Fast food is the guilty pleasure among us all. Although we already know the controversy of fast food health issue, but it seems like most of us can never get enough of it. As the number of fast food chain in Indonesia is growing continuously, the competition among fast food chain become unavoidable. Offering the relatively similar menu and price, the competition among them happen in a fierce environment.

We conduct a survey toward 974 respondents in nationwide to understand their fast food consumption pattern. We would like to lay out their perceptual map regarding on their considered ideal menu, as well as comparing some fast food chains to measure their service performance.

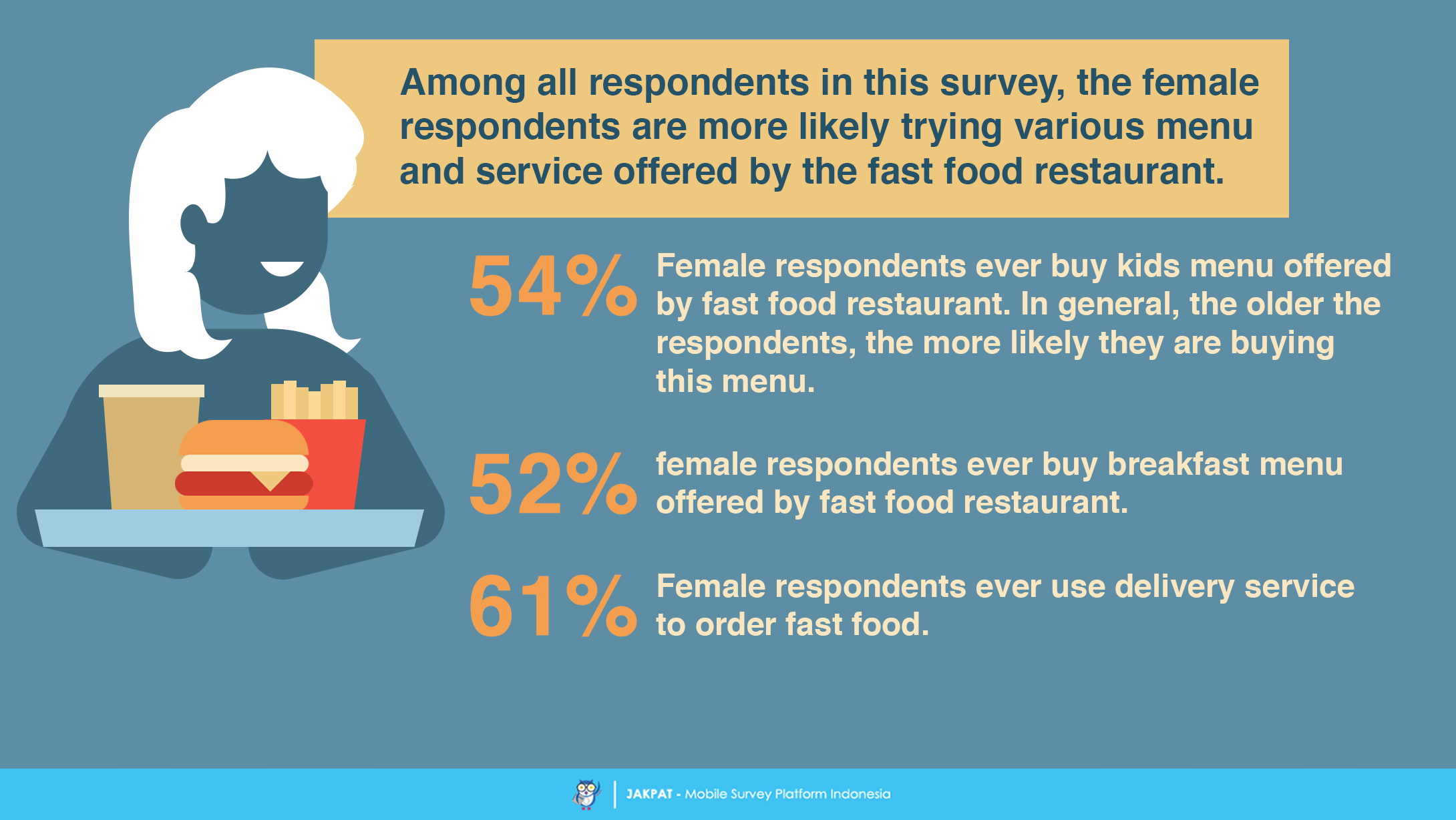

Notable highlight about this survey could be seen in many ways. First, we find out that among all segments of our respondent, the 20-25 year old seems to be the most potential market segment for fast food restaurant. To be precise, our female respondent are more likely buying various kind of package menu, and use delivery service more often than male. Second, discount program is seen as the most interesting promotion for most respondents. At last, we also find out that restaurants’ engagement with their consumer in digital media still relatively low.

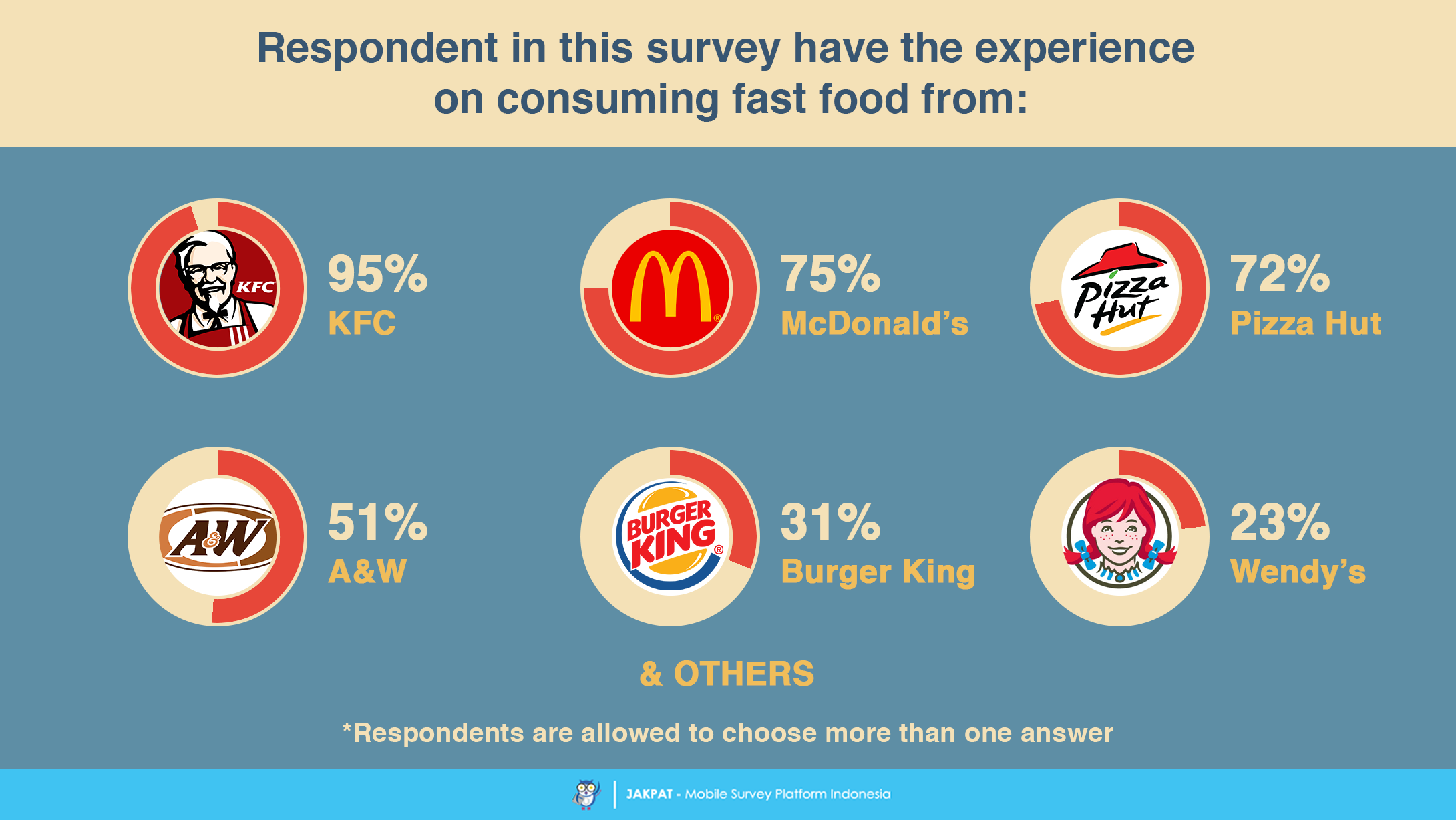

First of all, we ask about respondents’ experience on consuming fast food. We ask them to pick whichever fast food restaurant they ever consumed. Among all given answers KFC, McDonald’s, and Pizza Hut dominates the answer.

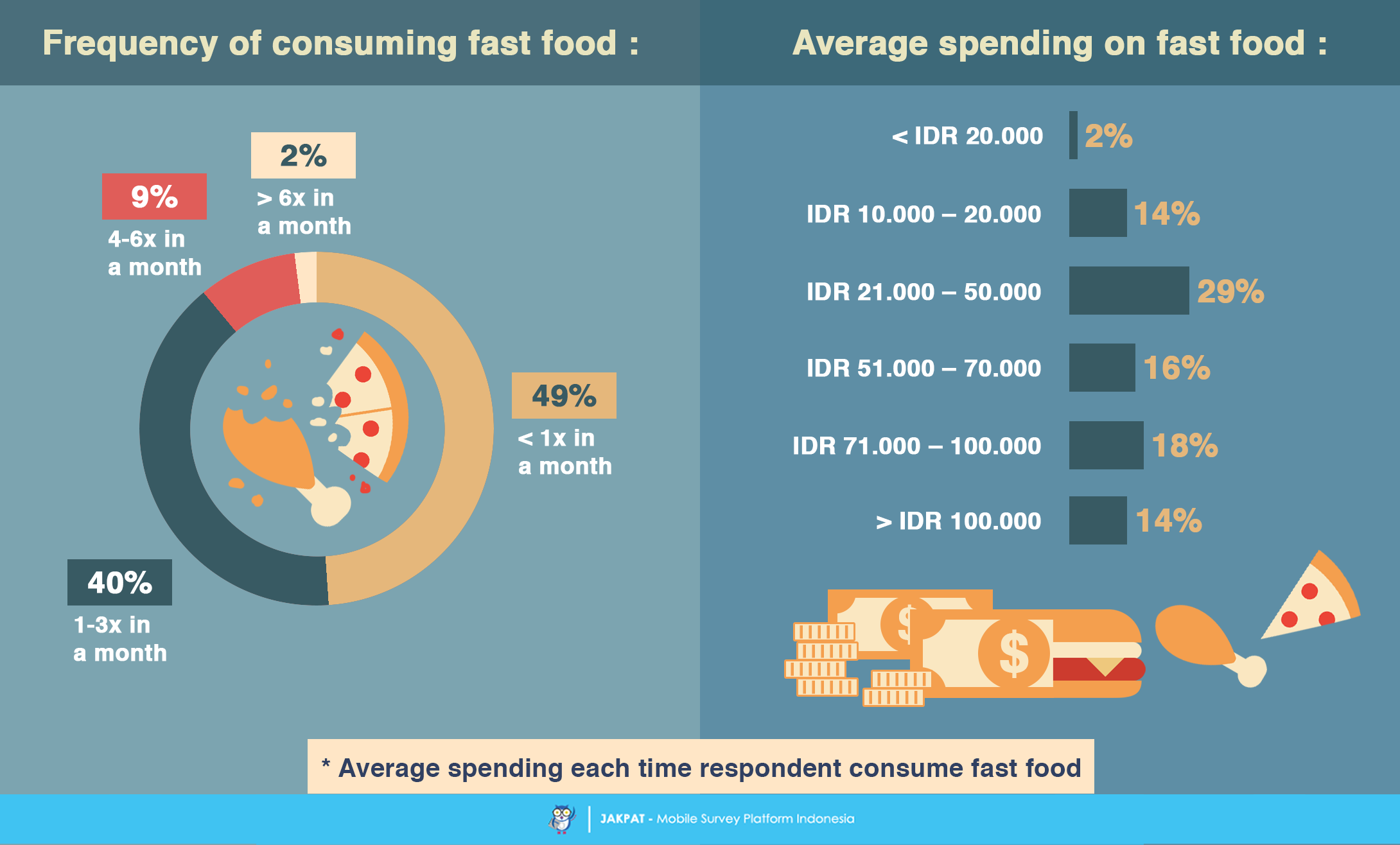

We further ask about their frequency of consuming fast food in a month. According to our result, most respondents are consuming from less than once a month up to three times in a month. Moreover, their average spending on consuming fast food per purchase is about IDR 21.000 up to 70.000.

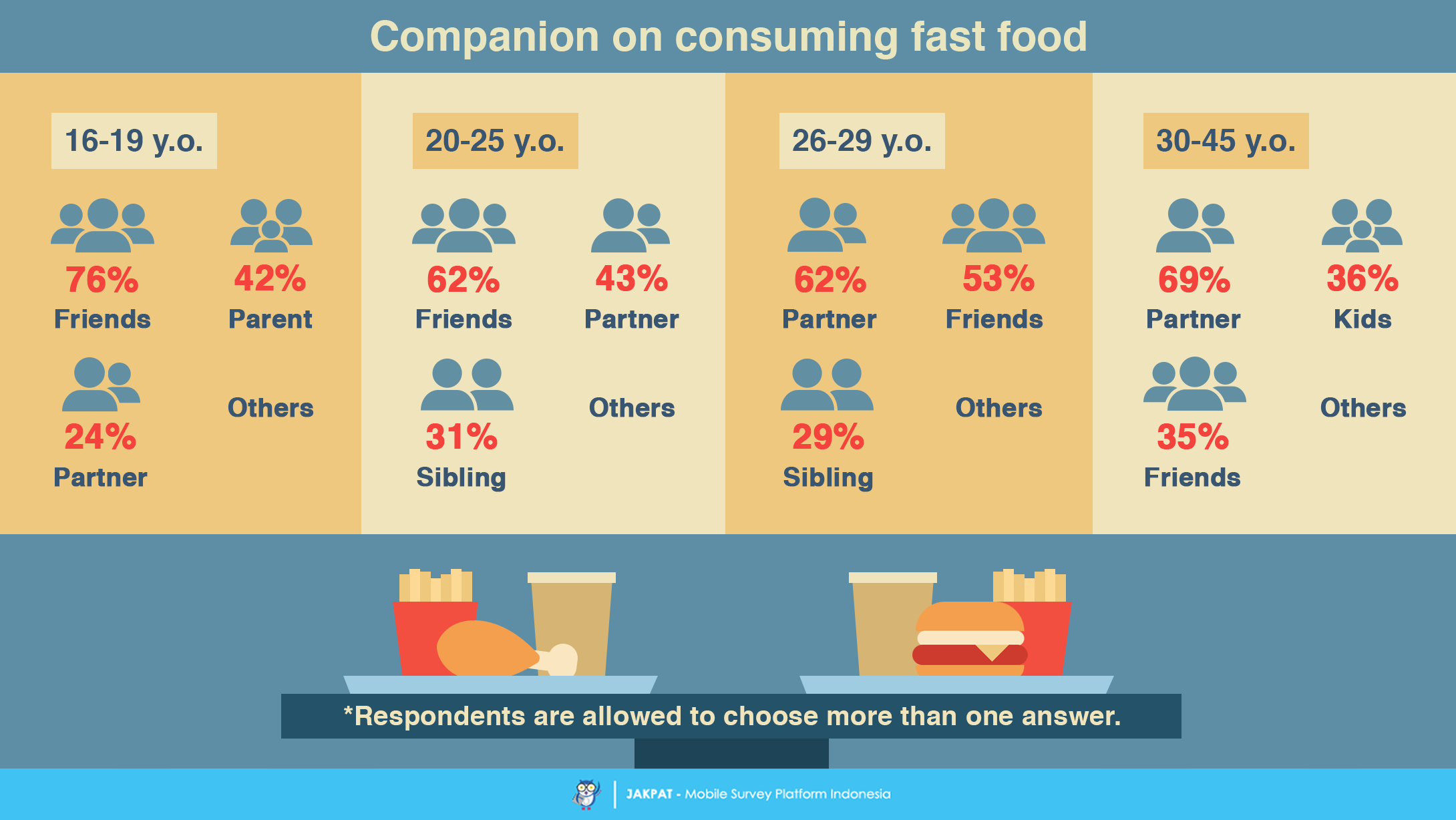

Most respondents in this survey seem to have a companion when they consume fast food. However, we find interesting finding regarding the companionship based on respondents’ age segment.

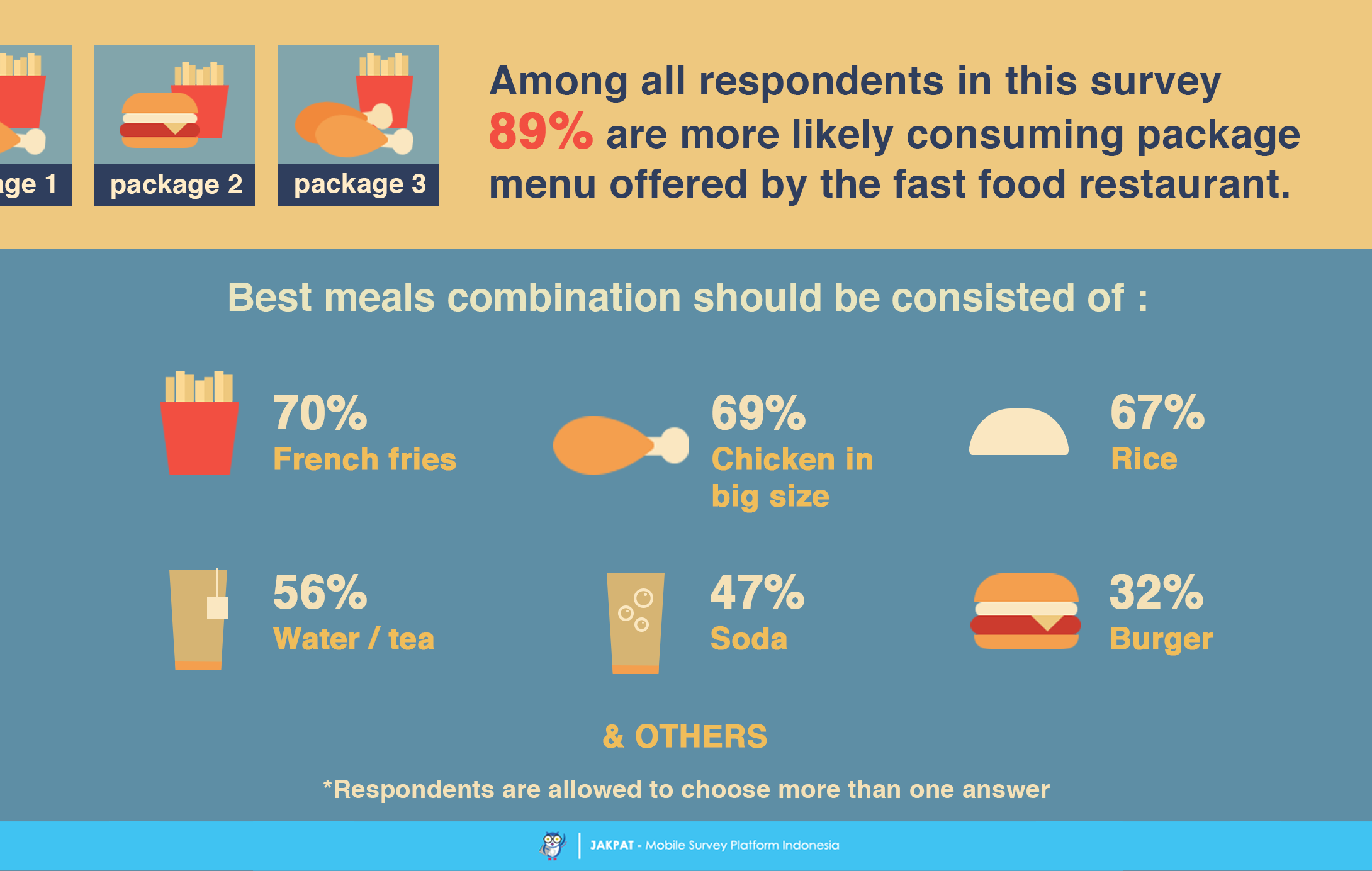

In our survey finding, we find that 89% respondents in this survey are more likely consuming package menu instead of the ala carte. We further ask them to arrange their most ideal meals combination to be put in one menu package. Apparently, fries and chicken are more popular among the under 40 year old respondent, otherwise the 40-45 year old respondents prefer rice and chicken.

Comparing the male and female respondent in this survey, we find that the female respondent is more welcome on trying any menu and service offered by the fast food restaurant. According to our data, more than half of our female respondent in this survey ever buy kids menu, breakfast menu, and even try to use delivery service.

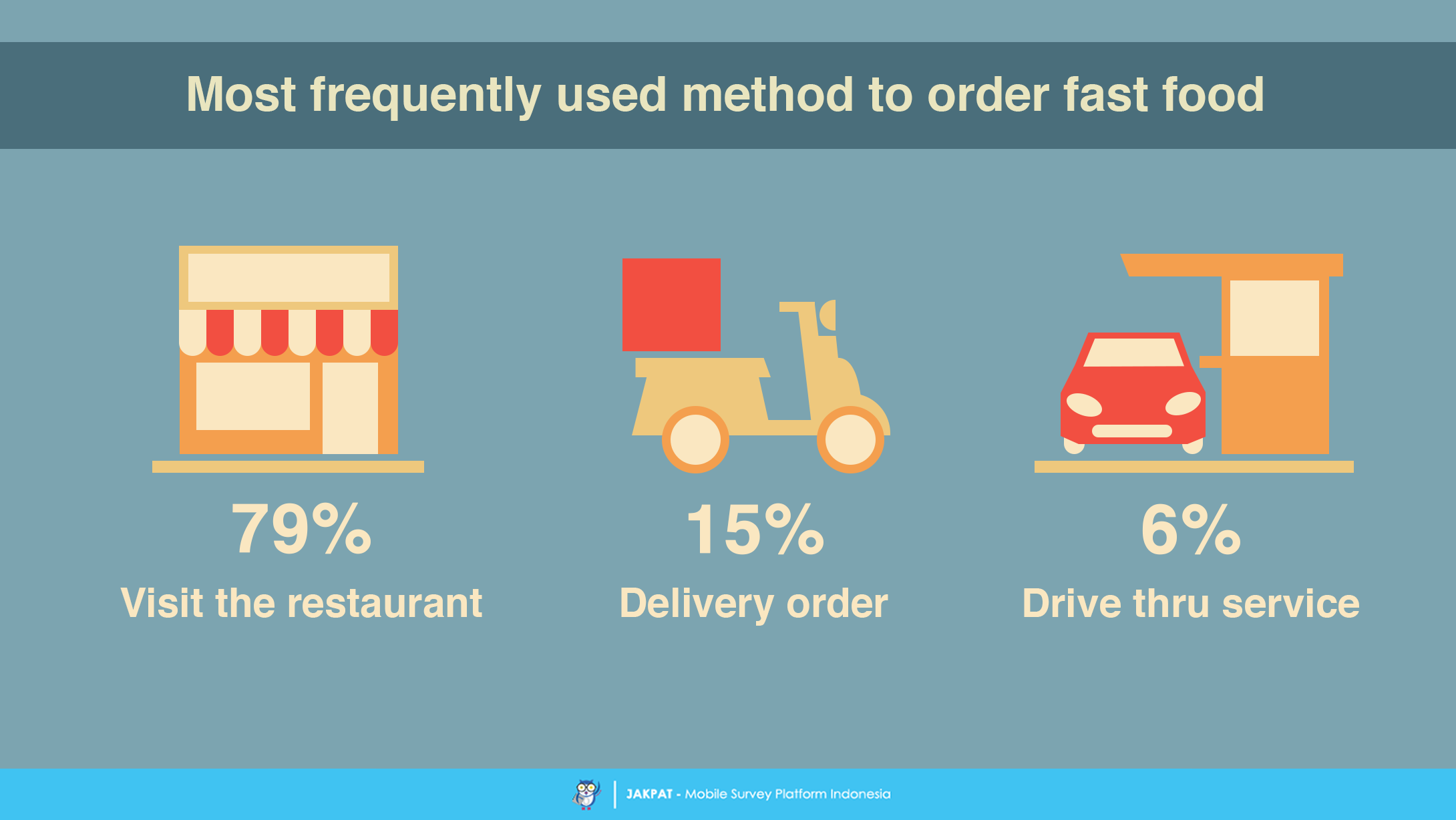

Comparing the method to order fast food, most respondents in this survey prefer to visit the restaurant at the first place. Only 15% of respondent frequently use delivery order service, and only 6% often use drive thru.

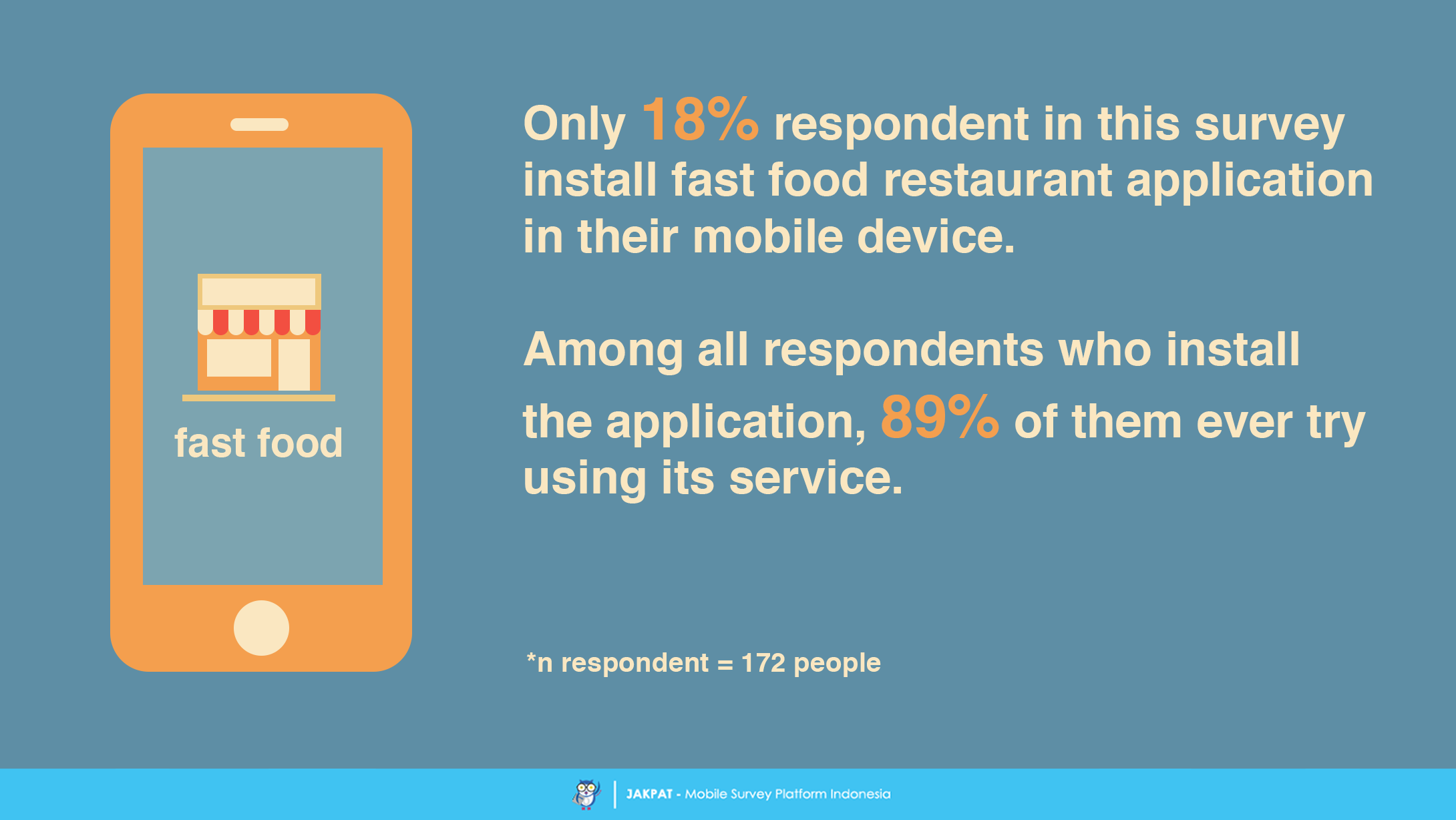

Today, many fast food restaurants create mobile application to better engage with their consumer. However, only 18% of respondent in this survey install the application, and only 89% of them ever try to order fast food from the app.

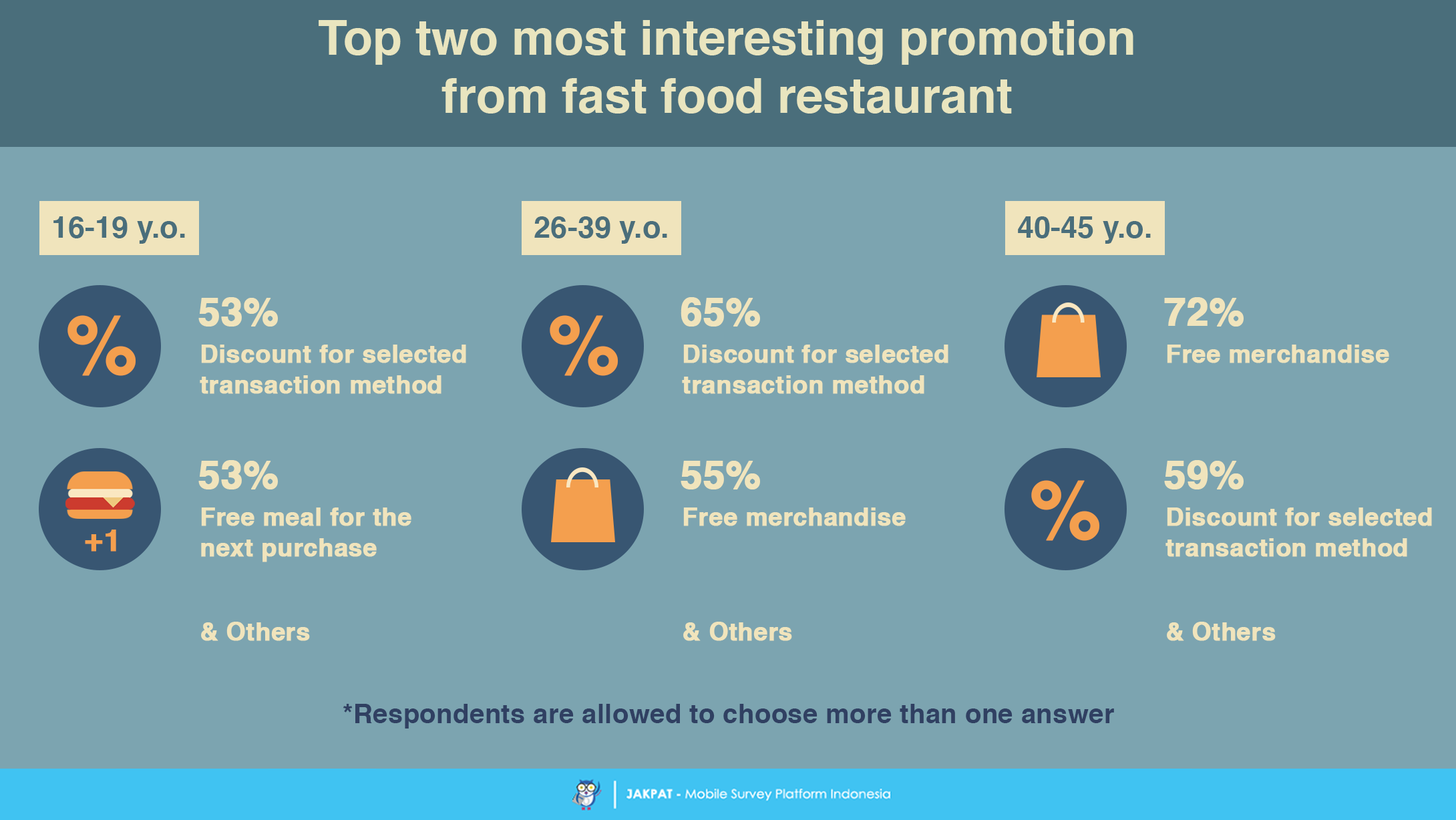

We further try to illustrate their insight by asking the most interesting promotion from fast food restaurant. In general, most respondents in this survey prefer discount price as the most favourite promotional program. Besides that, we also find that the respondent in less than 26 year old also likes to have a free meal on their next purchase. In other hand, respondent in above 26 year old are more attracted to have free merchandise.

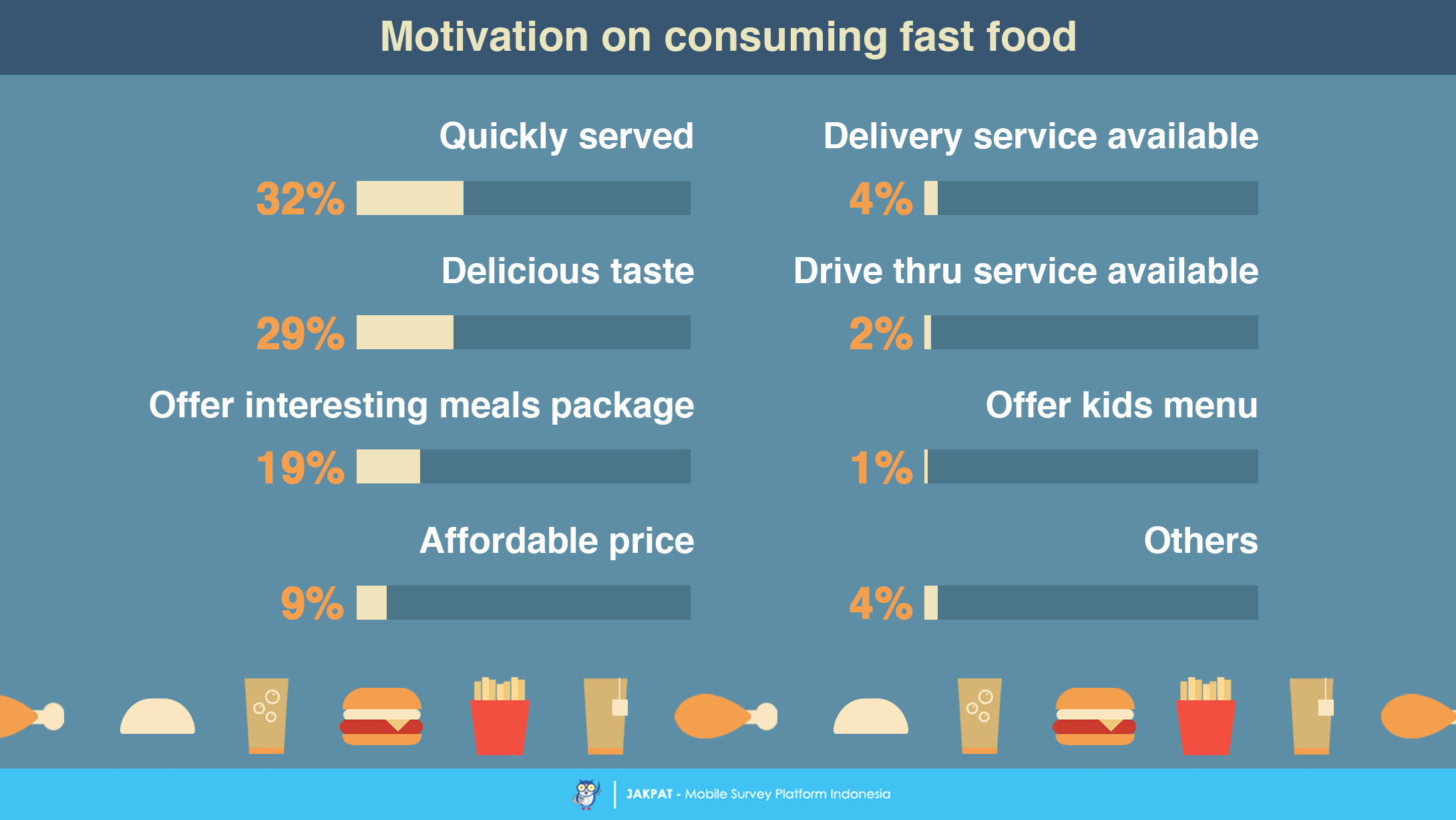

Despite all controversies about fast food industry, we would like to understand respondents’ motivation on consuming fast food. Among all given answers, respondents’ top motivations to consume fast food are because it is quickly served and have delicious taste.

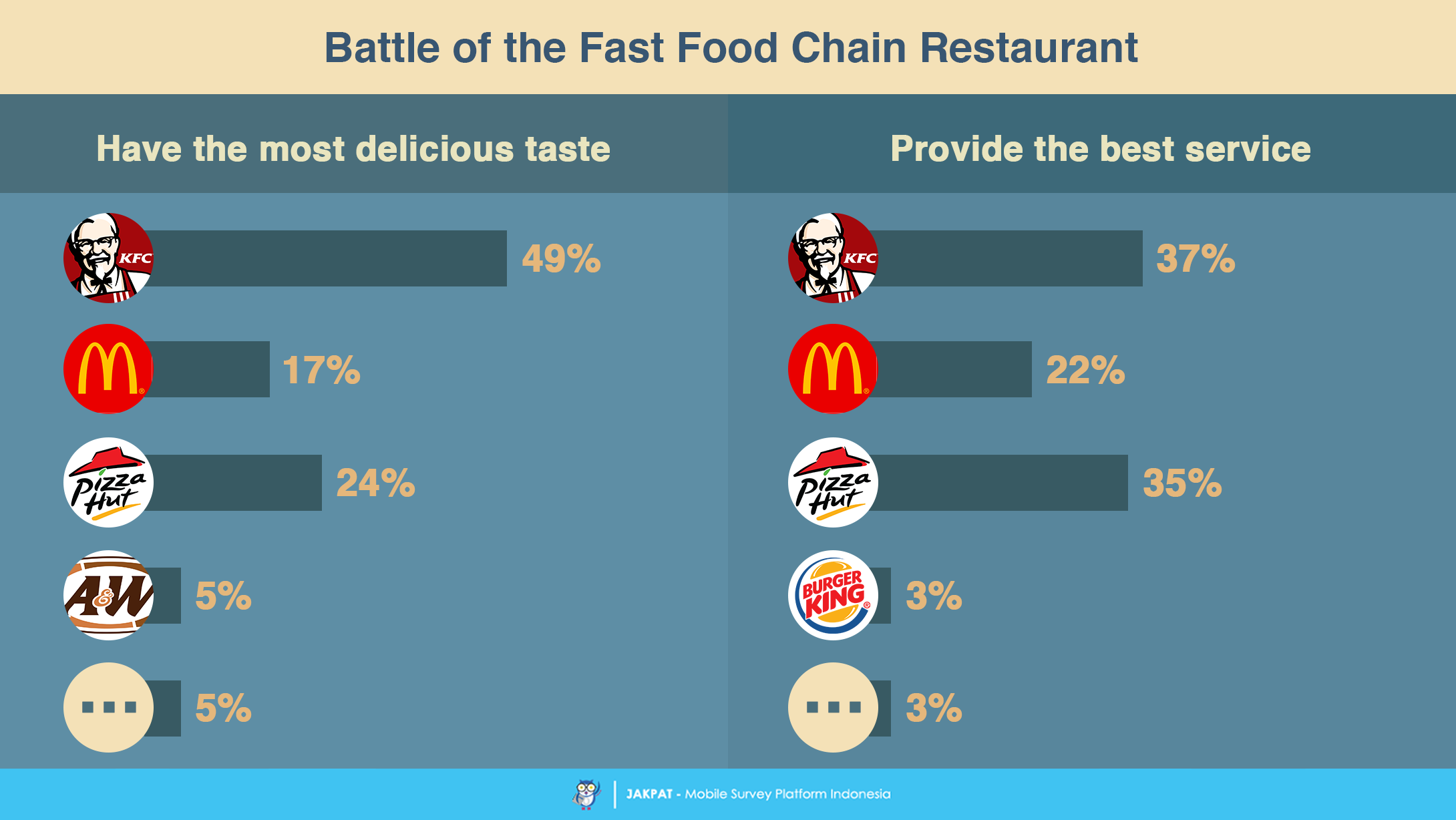

We continue our survey by making a battle among popular fast food chain restaurants in Indonesia. We ask our respondent to pick only one fast food restaurant they considered as the best. In general, KFC seems to be in the highest position for overall segment. As shown in the image below, KFC is considered as the number one fast food restaurant that provide best service and delicious taste foods.

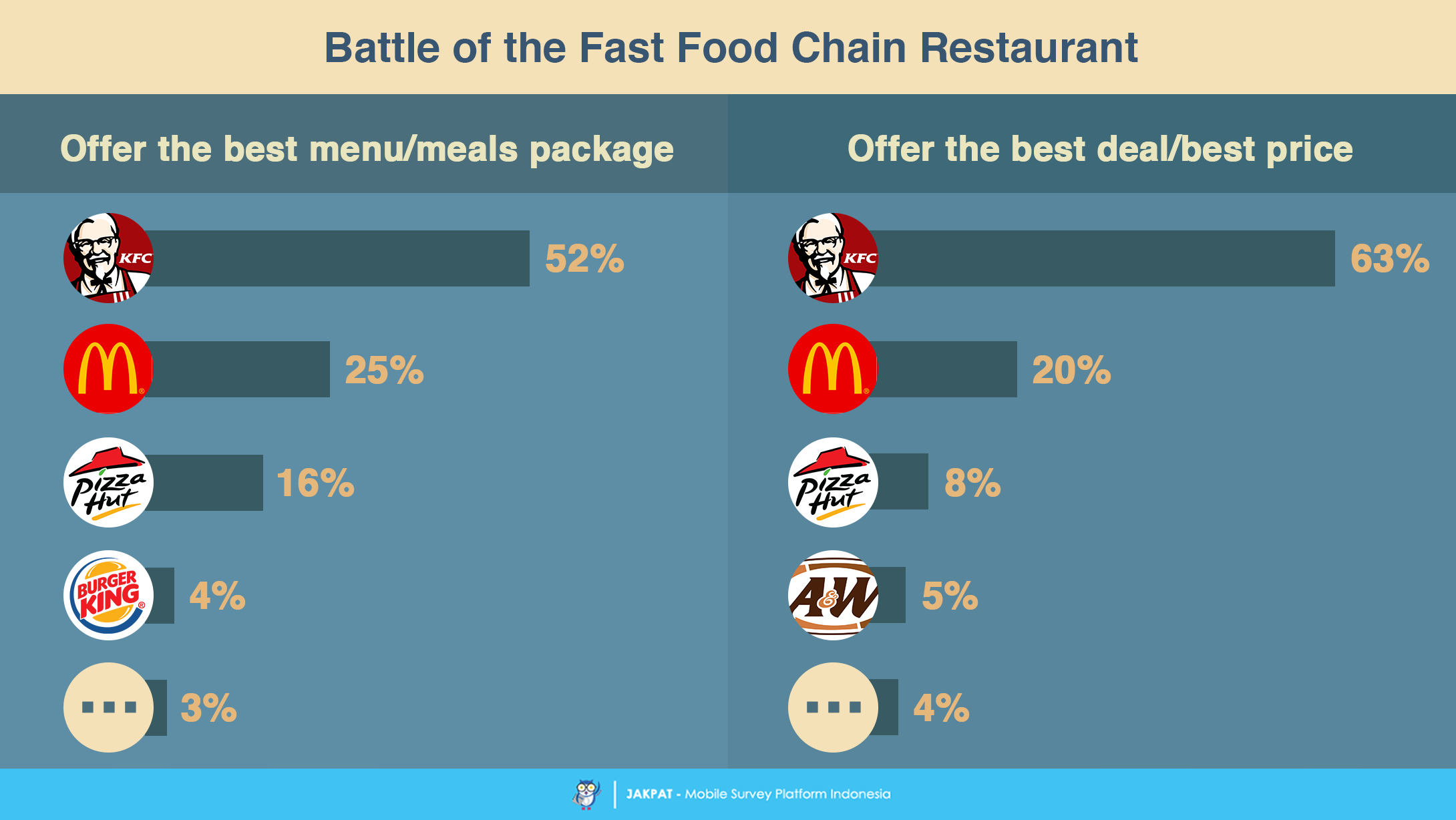

Similar finding is also be found regarding the menu and price aspect. KFC is in the forefront position, while McDonald’s and Pizza Hut follow behind.

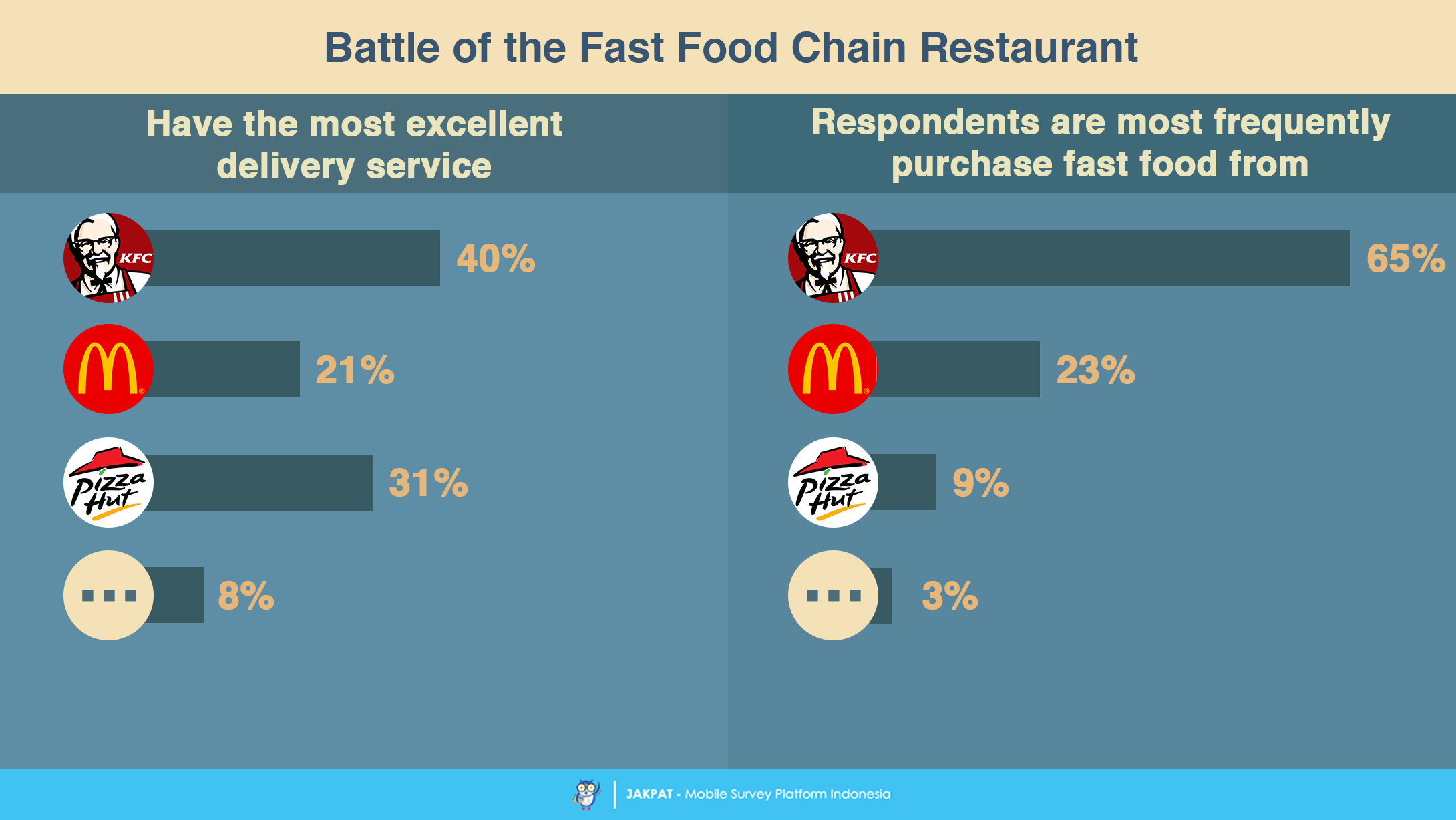

At last, we focus on respondents’ experience on their purchasing frequency and delivery service. Among all fast food chain restaurants, most respondents are frequently buy fast food from KFC. Besides that, our respondent also consider KFC as the fast food restaurant with the most excellent performance of delivery service.

As KFC seems to lead in the forefront position, the finding is in line as well with our respondents’ choice of the best fast food restaurant in overall aspect. Based on the choice of our respondent in this survey, KFC is considered as the best restaurant in its overall service and offered product.

For more detail you can download XLS report at the button below (Bahasa Indonesia). JAKPAT report consists of 3 parts which are 1) Respondent Profile, 2) Crosstabulation for each question and 3) Raw Data. Respondent profile shows you demographic profiles ( gender,age range, location by province, and monthly spending). Cross tabulation enables you to define different demographic segment preference on each answer.

You can also download PDF here: