After having a long day doing whatever our activities, spending the times under a refreshing shower is definitely a pleasant moment. To make it better, some others even soaking themselves in the bubble bath as the remedy after being busy at work. However, no matter how refreshing the feeling, it will not be completed without the presence of body soap. The refreshing scent of our favourite body soap will make our bath time become more enjoyable. Not only having a fair clean skin, the refreshing feeling and lingering scent of our body soap make the bath time become a pleasant activity that we look forward just before and after the day.

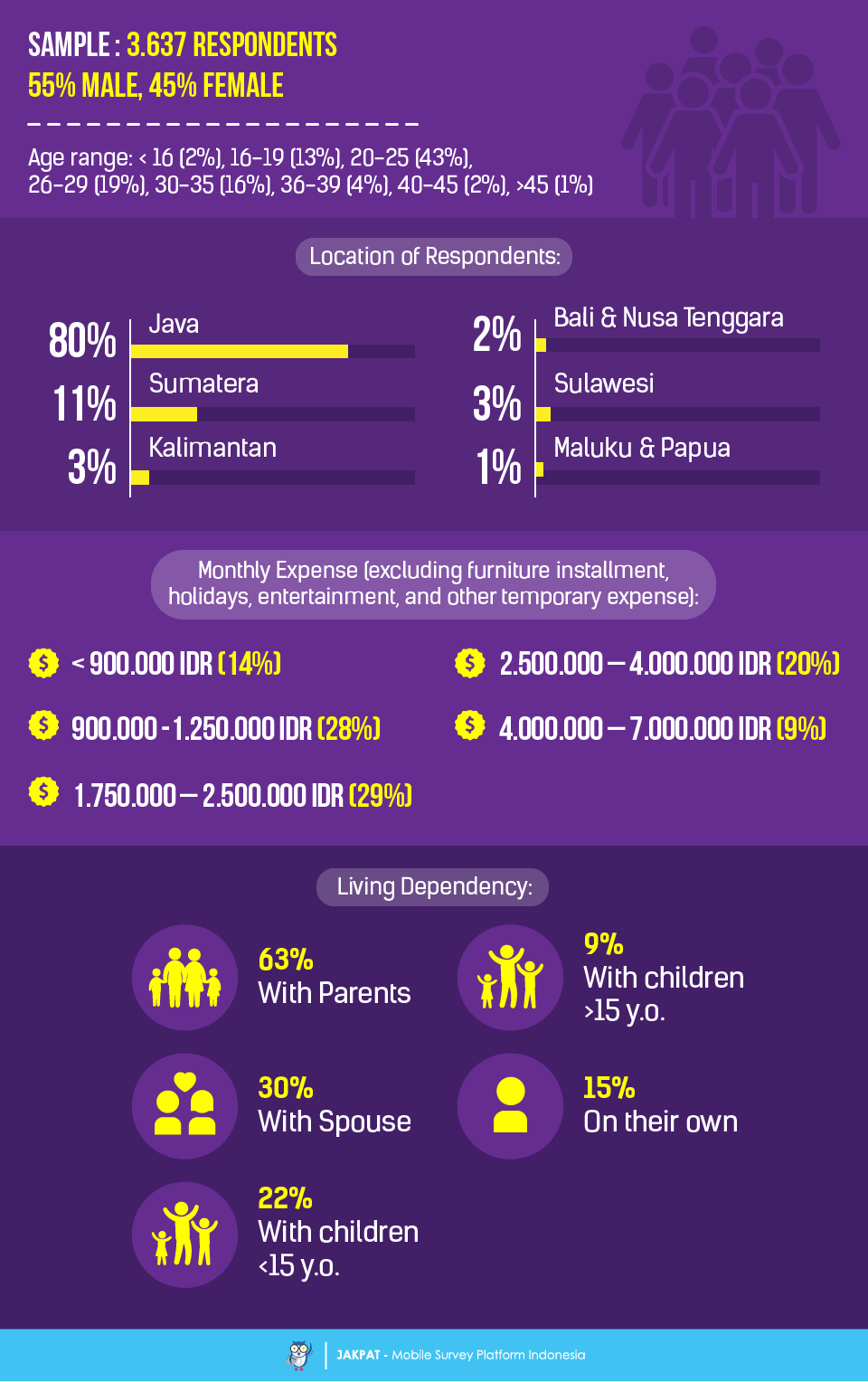

Understanding the need of body soap in the daily bathing ritual, we send a survey to our 3.637 respondents in nationwide to understand their body soap consumption pattern. The demographic composition of our respondents is consisted 55% male and 45% female in various age ranges. The geographical composition is mostly concentrated on Java, but proportionally sends as well to the other islands. Furthermore, the detail profile of our respondents who participate in the survey is shown in the image below.

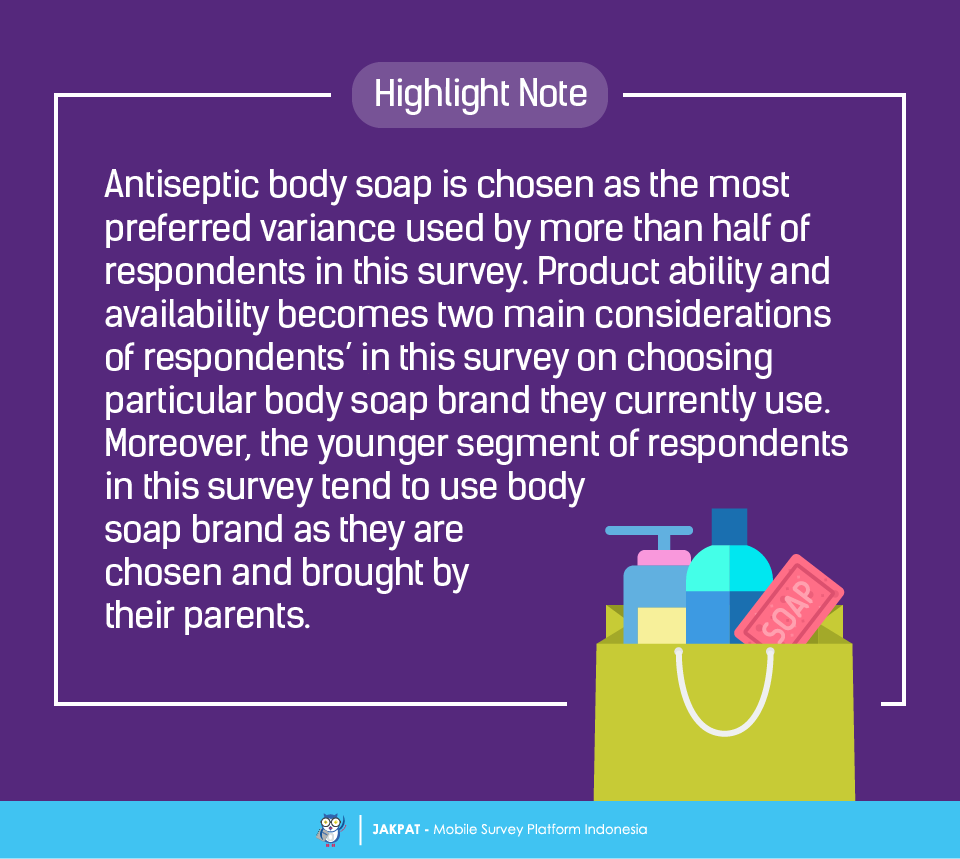

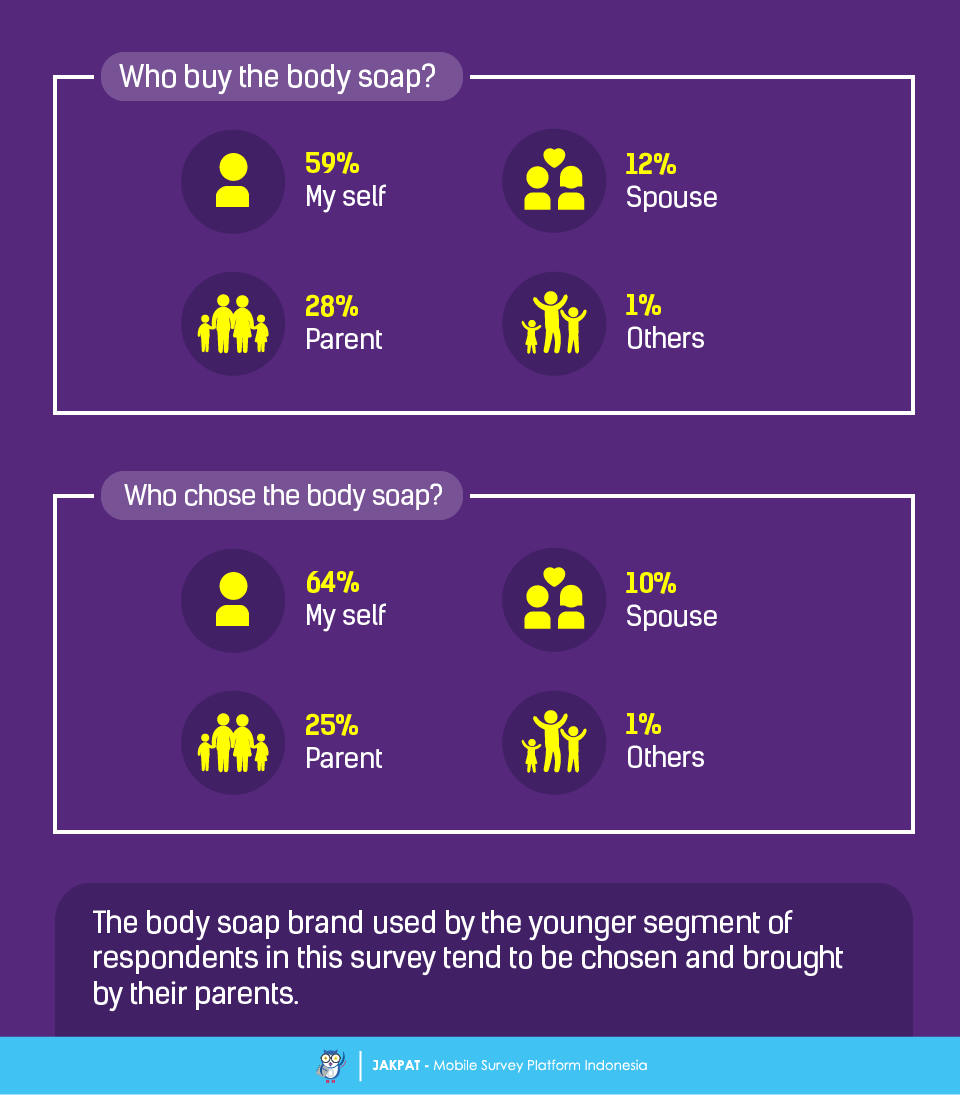

The highlight of our survey mostly reveal about the most preferable variance of body soap and the main consideration of respondent body soap preference. Among all variances of body soap, the antiseptic body soap is chosen as the most preferred variance by more than half of respondents in the survey. Product ability and availability become two important considerations of respondents’ preference on choosing particular body soap brand. Moreover, when it comes to toiletries product, the brand used by respondents under 19 years old are more likely to be chosen and brought by their parents.

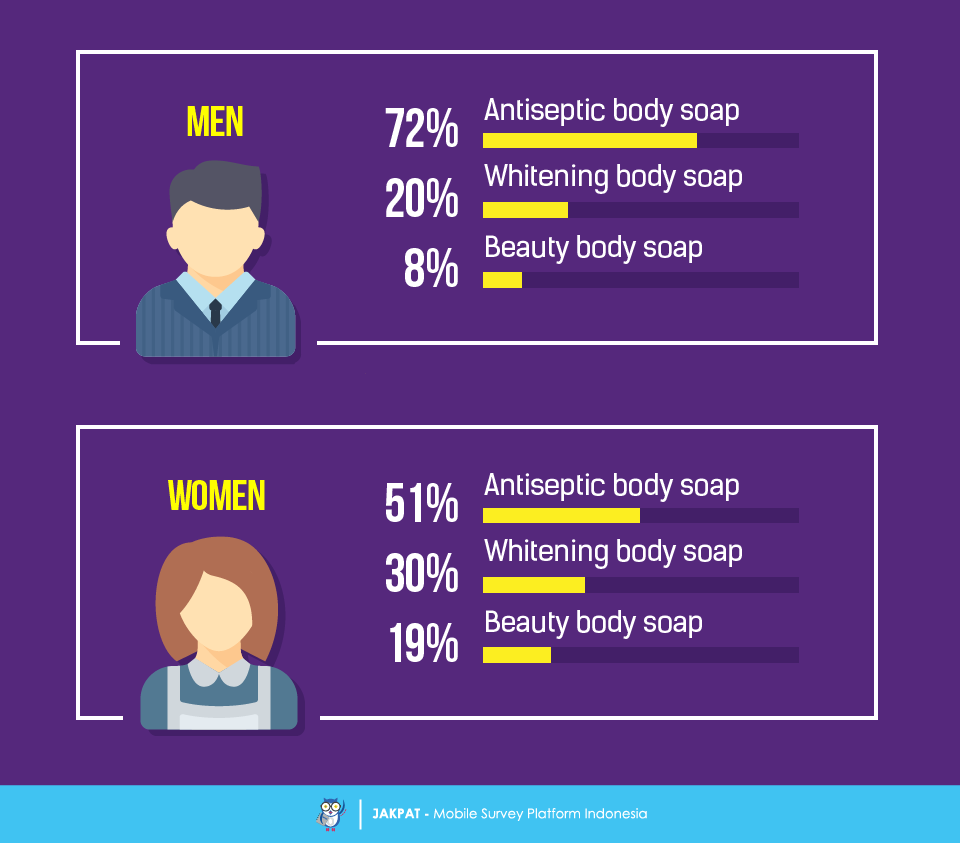

Both our male and female respondents in this survey are more likely using antiseptic body soap for their everyday bath time. However, we find different answer between them regarding their second most preferred variance. Our male respondents are more likely using whitening body soap, while in the other hand our female respondents are more likely using beauty body soap.

We ask our respondents in this survey to mention their currently use body soap brand for their daily routine. Many brands are mentioned and the competition of body soap market is relatively fierce. Lifebuoy, Lux, and Dettol become the top three most mentioned body soap brand by our respondents in this survey.

Regarding the decision maker and the buyer of body soap brand used by respondents, we find different pattern of consumption between the respondents under 19 years old, the selection of body soap brand depends on their parents’ preference. In other hand, the respondents above 19 years old tend to choose and buy the body soap by themselves.

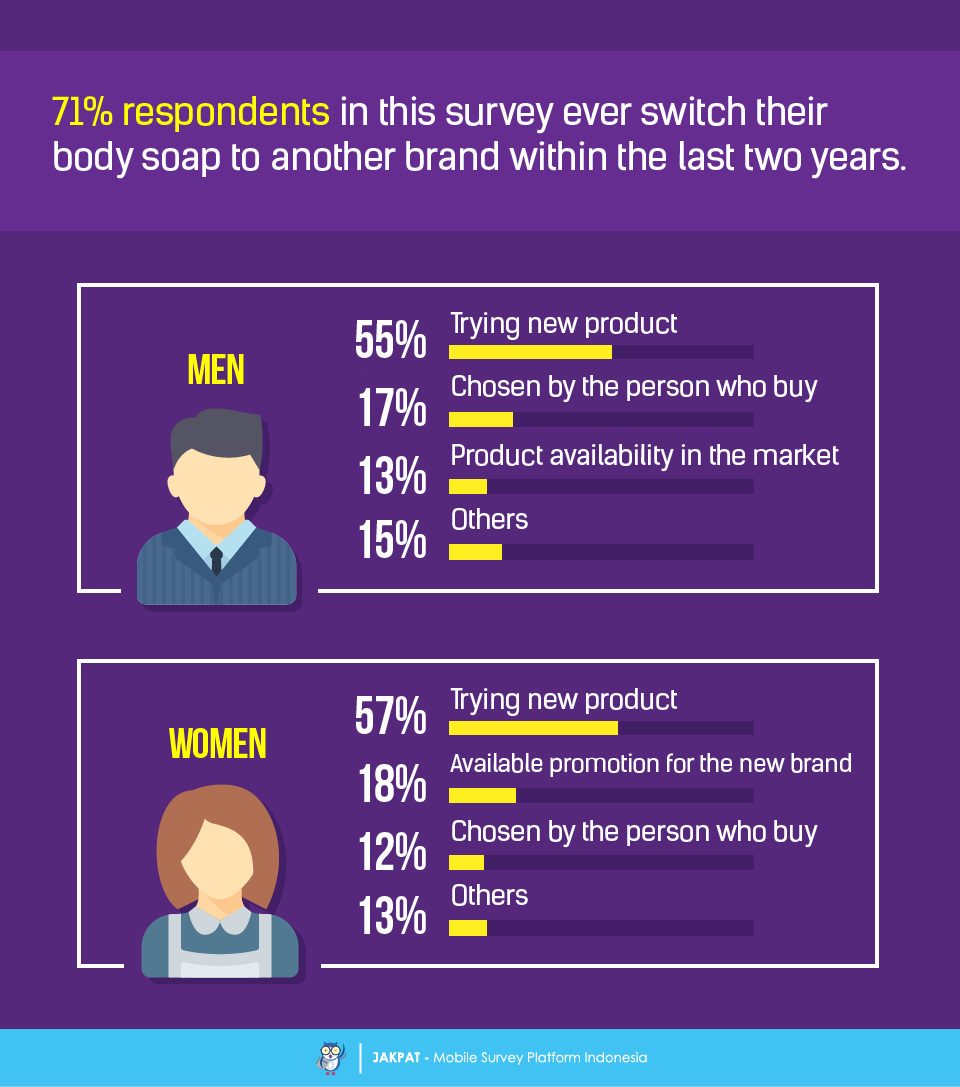

To check on the loyalty of respondents in this survey toward their preferred body soap brand, we ask whether they ever switch the body soap brand within the last two years. Interestingly, the switching rate is quite high. 71% respondents in this survey said that they ever switch their body soap brand. However, from 2.527 respondents who said so, we find that their curiosity on trying on the new product becomes the main reason of their switching behaviour.

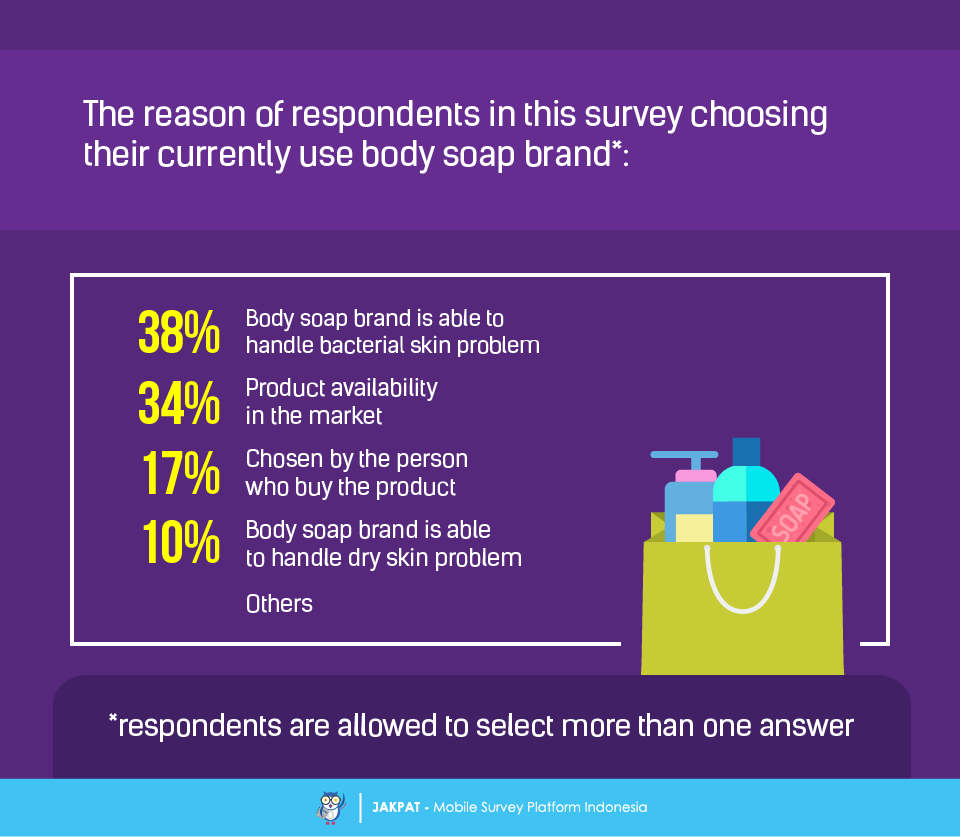

We further ask our respondents about their reason on choosing their currently use body soap brand. In this question, we allow our respondents who participate in this survey to pick more than one answer. From all given answers, product ability and availability in the market tend to be the most considerable factors on their decision in choosing particular body soap brand.

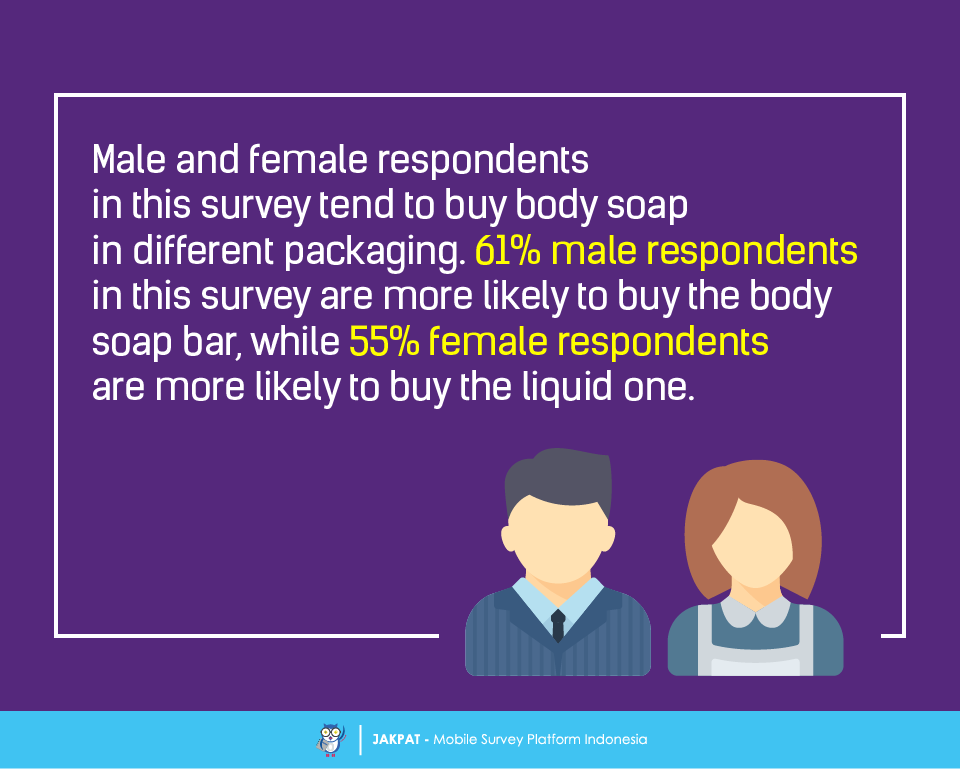

Regarding the type of body soap packaging, our male and female respondents tend to have different preferences. More than half of male respondents in this survey are more likely buying the body soap in bar package. In other hand, more than half of our female respondents in this survey are more likely buying the liquid package.

At last, we find several fun facts of our respondents who participated in the survey. From their latest purchase on body soap, we find that mini market is chosen as the most preferable place to buy the product. Moreover, most of our respondents in this survey tend to buy only one unit of body soap and spending about IDR 5.000 to 20.000 for body soap on their last purchase.

For more detail you can download XLS report at the button below (bahasa). JAKPAT report consists of 3 parts which are 1) Respondent Profile, 2) Crosstabulation for each question and 3) Raw Data. Respondent profile shows you demographic profiles ( gender,age range, location by province, and monthly spending). Cross tabulation enables you to define different demographic segment preference on each answer.

You can also download PDF here:

or Get A Sales Quote by filling this form or Call to +622745015293