The digital age has given rise to young generation, not only as followers, but also as pioneers. They shape and are shaped by world changes in various aspects, such as adopting and adjusting international trends, make innovation, to action on climate change issues.

Narasi together with Jakpat conducted a survey to find out the picture of Indonesia’s young generation in responding to changing their environment during the growing digital era. The report, which involved 2.482 respondents conducted during the period September-October 2023, shows how they interact, especially in pop culture, digital economy, environmental issues, and mental health issues.

This survey to understanding Indonesian youth is the result of collaboration with Narasi from the Bergerak, Bergerak, Berdampak movement which will take place on Sunday, November 19, 2023, at Graha Bhakti Budaya, Jakarta.

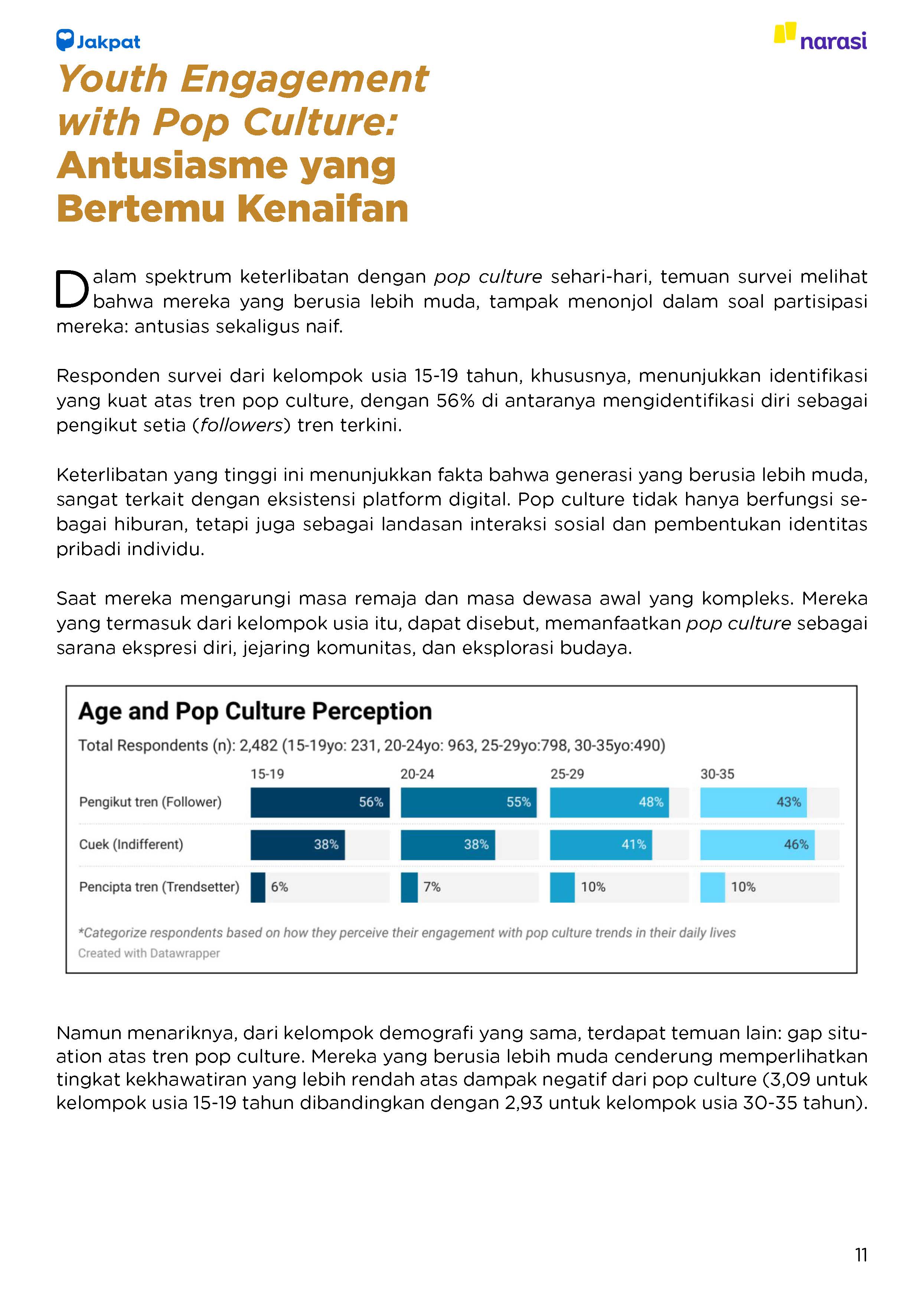

Youth and Pop Culture

The results of the survey to understanding Indonesian youth with a focus on the Millennials generation and generation Z showed that 56% of respondents, especially from the age group of 15-19 years, showed identification with pop culture as loyal followers or followers of the latest trends.

However, within the same age groups also showed lower levels of concern over the negative impact of pop culture, 3.09 for the 15-19 age group compared to 2.93 for the 30-35 age group.

“The majority of the younger generation are followers of pop culture, and only a small percentage are trendsetters. This fact is the basis for companies, brands, to political figures and parties to adapt the latest trending issues to embrace the young generation. On the other hand, this is a challenge for the young generation to be more critical and be able to identify the benefits of a product, or the commitment of legislative candidates or presidential candidates, which are often hidden behind these pop culture trends,” said Head of Research Jakpat, Aska Primardi.

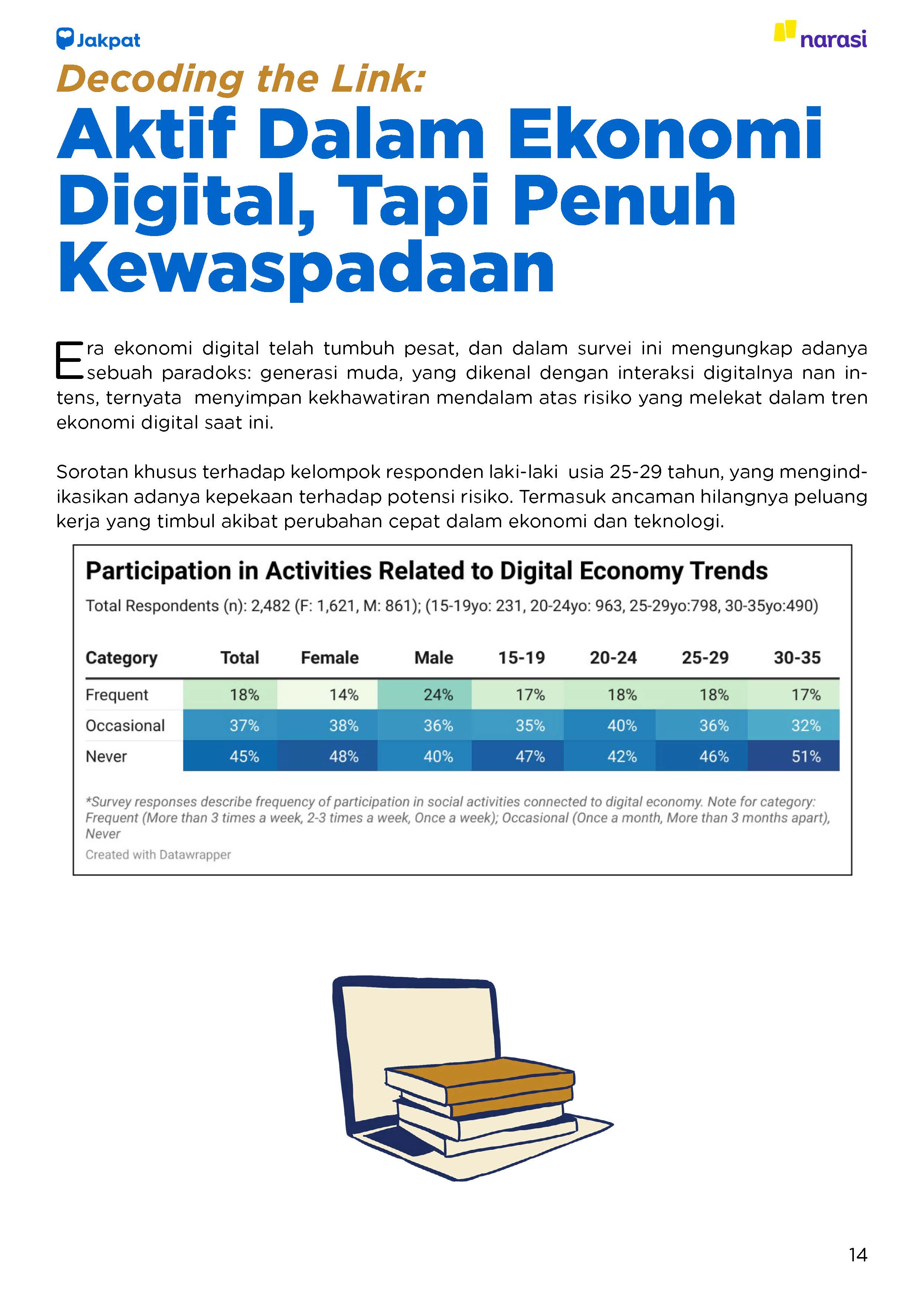

Digital Economy and Vigilance

18% of all respondents indicated frequent participation in activities related to digital economy trends, then 37% for occasional times, and 45% never. The young generation who are attached to digital interaction apparently show concern about risks in the current digital economy trend. Especially in the group of male respondents aged 25-29 years (35%) who are worried about the threat of losing job opportunities arising from rapid changes in the economy and technology.

The young generation who are attached to digital interaction apparently show concern about risks in the current digital economy trend. Especially in the group of male respondents aged 25-29 years (35%) who are worried about the threat of losing job opportunities arising from rapid changes in the economy and technology.

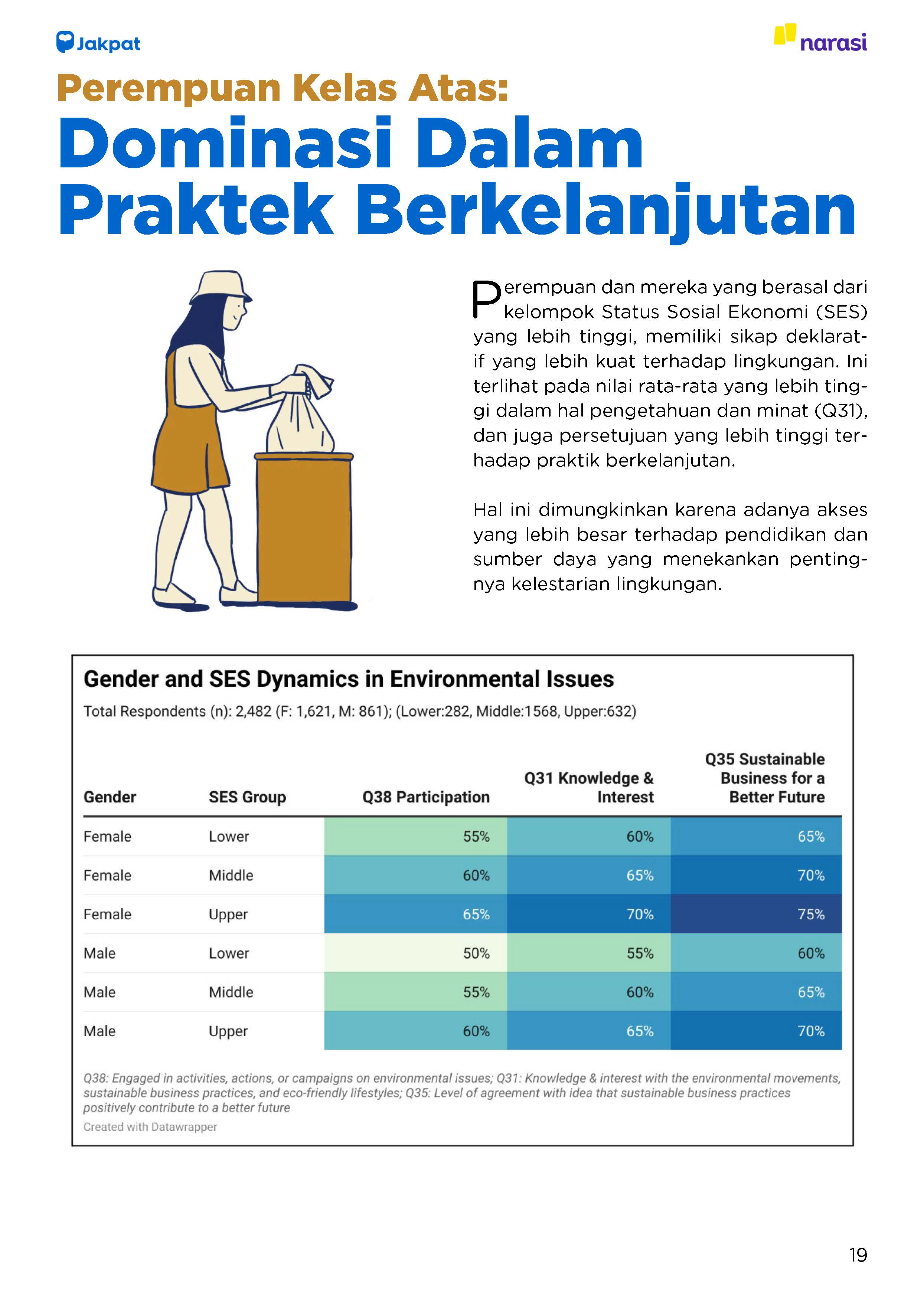

Environmental Sustainability

Women with higher Social Economic Status (SES) have a strong declarative attitude towards the environment with 70% scoring average in terms of knowledge and interest, 65% active in environmental activities and 75% supporting green businesses. In addition, middle-class women also showed 60% active in environmental activities and 70% supported green businesses.

In terms of sustainable practices shows such as energy conservation (55% for women, 48% for men); electric vehicles (40% for women, 35% for men); green investment (32% for women, 26% for men); and energy transition (33% for women, 25% for men).

Young People and Mental Health Issues

Understanding Indonesian youth in terms of mental health issues indicates all ages and genders showed high participation in mental health movements, ranging from 15-19 years old (73%), 20-24 year old (72%), 25-29 year old (76%), and 30-35 year old (79%)

In addition, 86% of all respondents indicated that social media is the main channel in accessing information regarding mental health.

“The majority of respondents at this young age are already aware of the importance of mental health aspects in daily life. They no longer feel ashamed to admit that they have mental problems, and begin to take the initiative to find solutions, either in the form of self-therapy or through psychologists or psychiatrists. This indication can also be seen from the growth of platforms, web, or applications that provide mental health services,” said Aska.

Get the details on our report here.