Menjelang Pemilu 2024, masyarakat Indonesia banyak terpapar konten politik di media sosial. Mulai dari visi dan misi capres-cawapres, isu-isu politik, kampanye, hasil debat, opini public figure, hingga meme politik. Hal ini bisa menjadi tambahan referensi masyarakat dalam menilai dan mengevaluasi dari berbagai sudut pandang untuk menyakinkan pilihannya saat pemilu nanti.

Jakpat melakukan survei untuk mengetahui pandangan responden terhadap kampanye politik saat ini, khususnya mengenai konten politik di media sosial, mengidentifikasi konten hoaks, visi dan misi kandidat, hingga keputusan memilih. Survei yang melibatkan 1099 responden ini juga bertujuan untuk mengetahui preferensi politik responden secara netral tanpa memiliki asosiasi atau mendukung partai politik tertentu.

Hasil survei menunjukkan 58% responden mengutarakan pendapatnya mengenai pilihan capres dan cawapres secara langsung atau offline, seperti diskusi dengan teman sebaya, rekan kerja, atau keluarga. Selain itu, 27% responden juga menyampaikan pendapat melalui media daring, terutama bagi Gen Z (29%).

Sedangkan, 30% yang tidak mengutarakan pendapatnya baik secara online maupun offline berpendapat jika masalah privasi (72%) menjadi alasan utama mereka tidak mau membahas mengenai capres dan cawapres pilihannya.

Mengidentifikasi Konten Hoaks

Konten hoaks merupakan informasi palsu atau bohong dalam upaya memutarbalikkan fakta yang dibuat dengan sengaja, dalam hal ini mengarah pada berita negatif. Jika dilihat dari frekuensinya, 37% responden jarang menjumpai konten hoaks. Meskipun begitu, 19% responden lainnya merasa sangat sering mendapatkan konten tersebut.

Tiktok menjadi platform yang paling banyak ditemukannya konten hoaks menurut Gen Z (75%) dan Milenial (58%), sedangkan bagi Gen X biasanya menemukan konten tersebut di Facebook (57%).

Kemampuan dalam mengidentifikasi konten hoaks, membuat responden tidak terpengaruh dalam menentukan pilihannya.Karena itu, 57% memilih tidak menghiraukannya atau skip konten/akun yang dianggap hoaks.

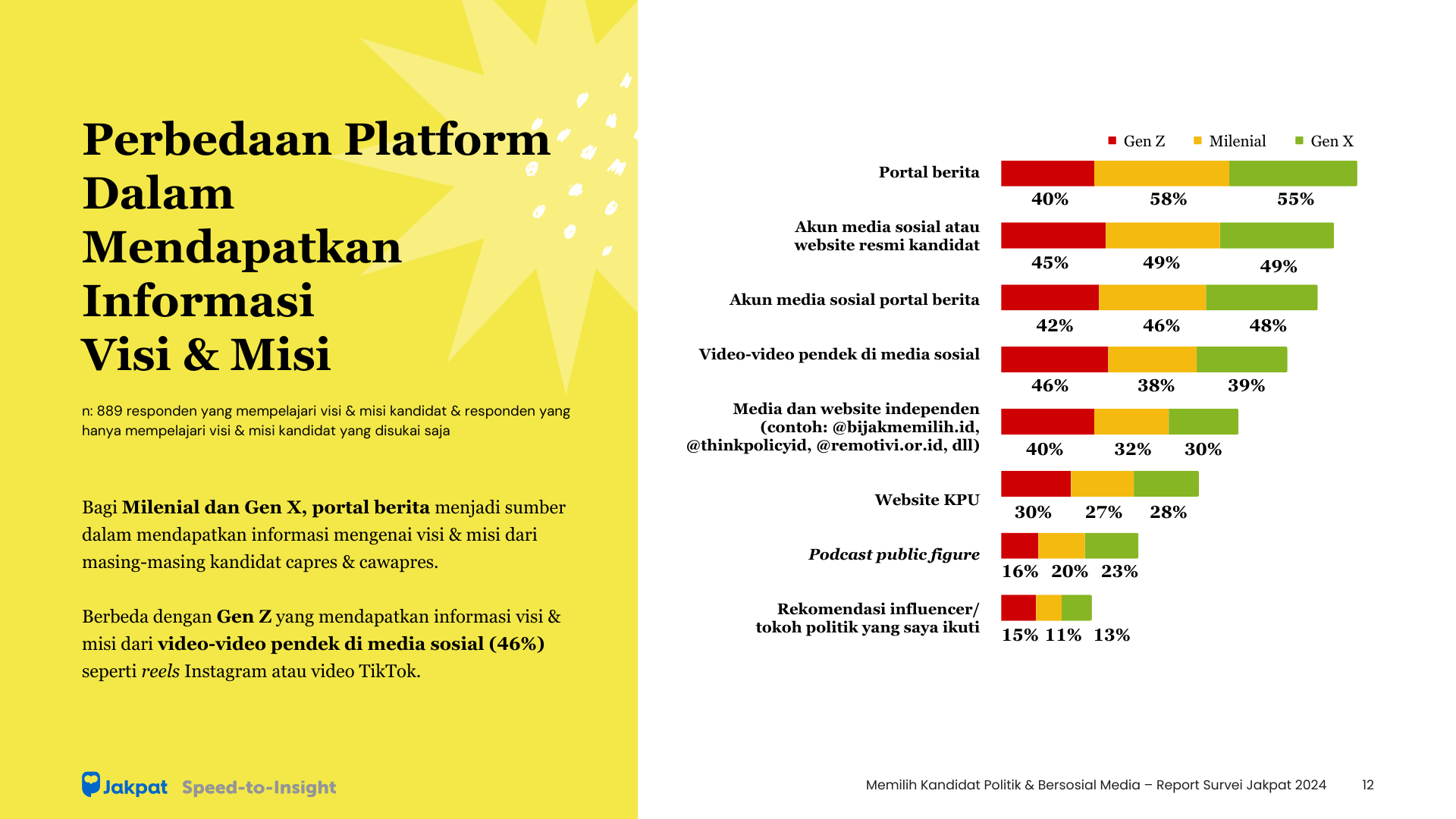

Mempelajari Visi & Misi Kandidat

Visi dan misi yang diusung kandidat (71%) menjadi faktor utama yang memengaruhi penilaian responden dalam menentukan pilihan capres dan cawapres. Selain itu, kualitas diri juga menjadi faktor teratas penilaian, seperti rekam jejak positif (61%), latar belakang kandidat (58%), dan mampu dalam memimpin (51%).

Tampaknya visi dan misi kandidat capres-cawapres lebih menarik perhatian responden daripada visi dan misi yang dibawa oleh calon legislatif. Hal ini ditunjukkan dengan hanya 44% yang mempelajari visi dan misi caleg, dibandingkan dengan mempelajari visi dan misi capres-cawapres (63%).

“Awareness untuk menggunakan hak pilih dalam pemilu sebenarnya tetap tinggi, hanya saja terlihat masih ada ketimpangan awareness antara pemilu presiden dan pemilu legislatif. Untuk pemilu presiden memang masih ada 19% yang tidak mempelajari visi misi capres, tetapi untuk pemilu legislatif, justru ada 56% yang tidak mempelajari visi misi caleg. Jadi sepertinya perhatian masyarakat lebih banyak terpusat pada capres,” jelas Head of Research Jakpat, Aska Primardi.

Aska melanjutkan padahal nantinya saat pemilu, masyarakat juga diminta memilih caleg mulai dari DPR, DPRD tingkat 1, DPRD tingkat 2, dan DPD. Selain itu opsi pilihan di surat suara legislatif akan jauh lebih banyak dan rumit dibandingkan surat suara capres. Edukasi tentang pemilu legislatif ini yang perlu ditingkatkan, supaya masyarakat bisa lebih mengenal caleg dan visi misinya.

Keputusan Memilih

Mayoritas responden sudah menentukan pilihan capres-cawapresnya. Terlebih 84% responden juga mengakui jika mereka sudah mantap dan tidak ada rencana untuk mengganti pilihannya.

Partisipasi yang tinggi pada pemilu mendatang ini terlihat dari setiap generasi, status ekonomi sosial, dan wilayah, seperti 97% dari Jabodetabek, 95% dari Jawa, dan 97% dari luar Jawa yang akan berkontribusi.

Dapatkan informasi lengkapnya pada report kami di sini

![[FREE] E-Commerce Trends 2nd Semester 2023-Jakpat Premium Report_241223_10](https://blog.jakpat.net/wp-content/uploads/2023/12/FREE-E-Commerce-Trends-2nd-Semester-2023-Jakpat-Premium-Report_241223_10.jpg)