Beauty products are growing with the presence of various makeup and skincare. Especially now, local skincare brands are gaining popularity and attracting the attention of skincare users.

Jakpat was surveyed to understand people’s habits in using makeup and skincare products, and to identify the brands frequently used in 2023. The report, which involved more than 2000 respondents, covers three sections: makeup trends among female respondents, followed by skincare trends and beauty product purchases among both female and male respondents.

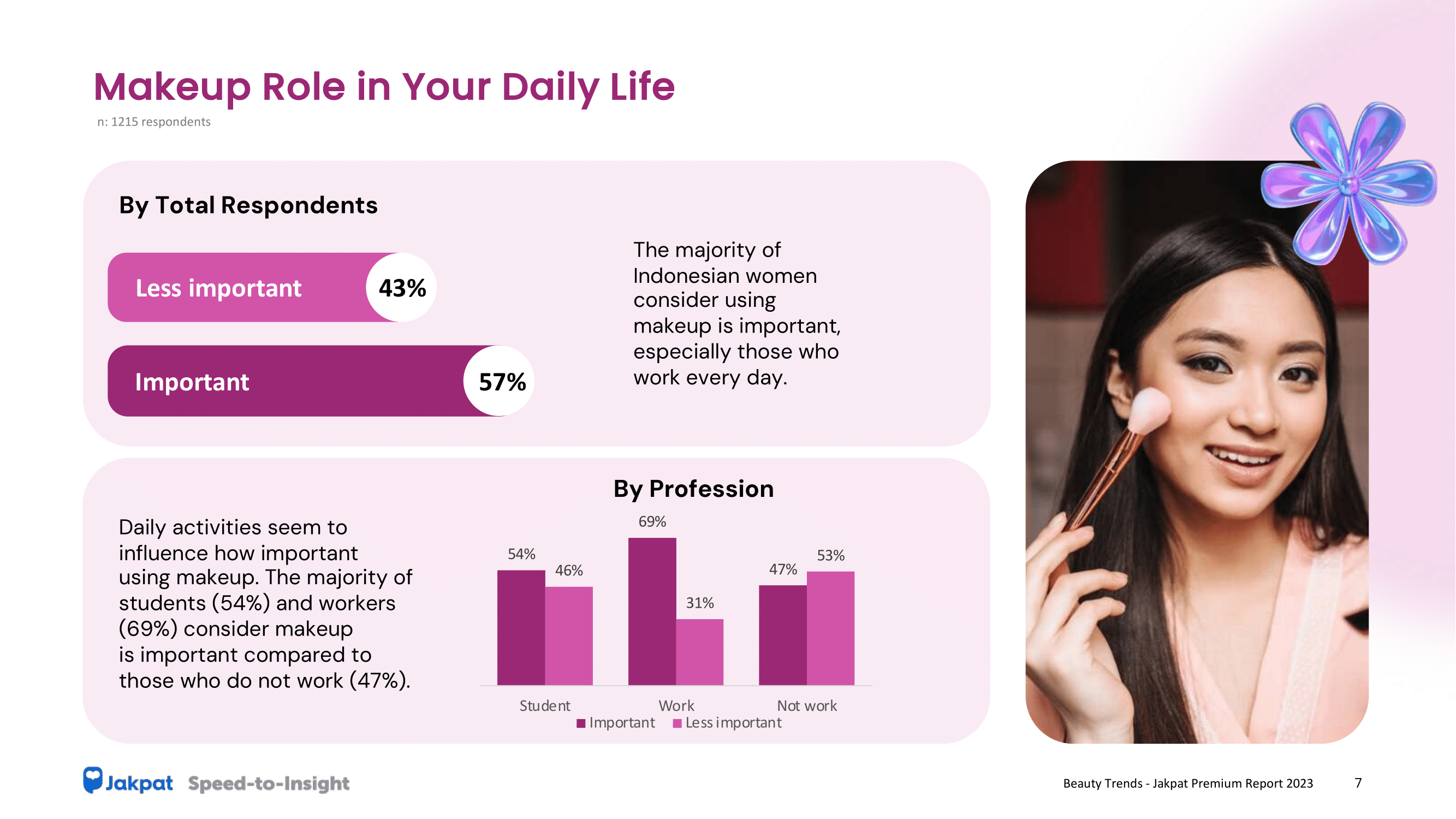

The survey results state that the majority of Indonesian women consider the use of makeup important, especially for those who work every day. Daily activities seem to influence how essential makeup is used. A majority of students (54%) and employed individuals (69%) consider makeup to be crucial compared to those who aren’t employed (47%).

Makeup Trends

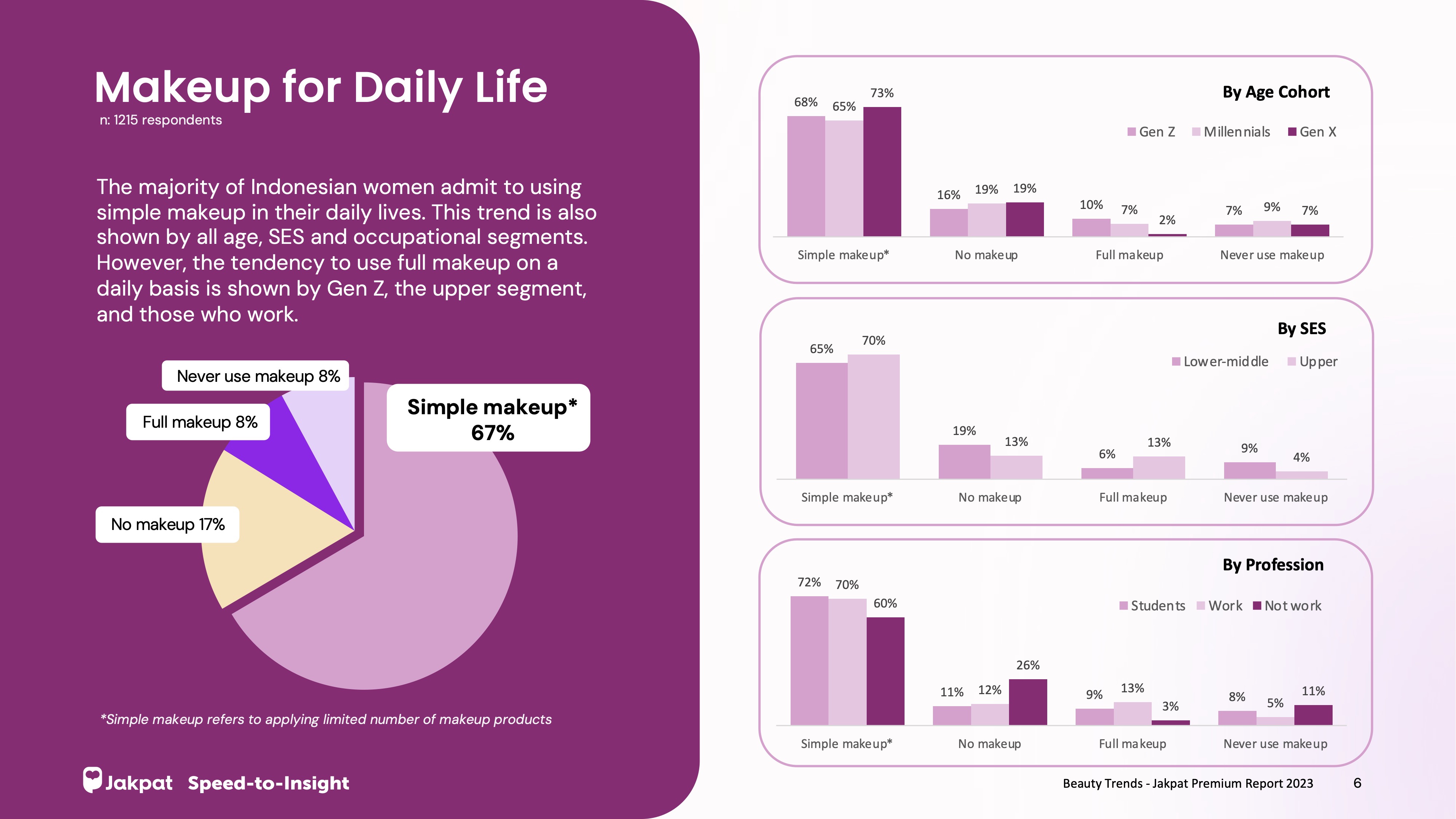

Most Indonesian women admit to wearing simple makeup for their daily activities. Simple makeup refers to the use of a limited number of makeup products, typically no more than 3. This trend is observed across all age groups, socioeconomic levels, and occupations. This trend is observed across all age groups, socioeconomic levels, and occupations.

In the use of lip products, lip balm leads with 44%, then lip cream 40%, lipstick 38%, liptint 39%, and lip gloss 20%. Meanwhile, in the use of brow products, many use brow pencil at 82%, followed by brow gel at 40%, and brow pomade at 7%.

Skincare Trends

74% of consumers said local brands still attracted their attention in the last 6 months. Compared to foreign brands, 73% admit that local skincare products are more suitable for their skin conditions.

Vitamin C is still the most popular skincare ingredient, with more than half of respondents claiming that their skincare products contain vitamin C. In addition, niacinamide and salicylic acid are the most popular top skincare ingredients.

“Most respondents consider halal, alcohol-free, and dermatologically tested skincare claims as the most important. Women tend to consider these skincare claims more than men.

Purchase Beauty Products

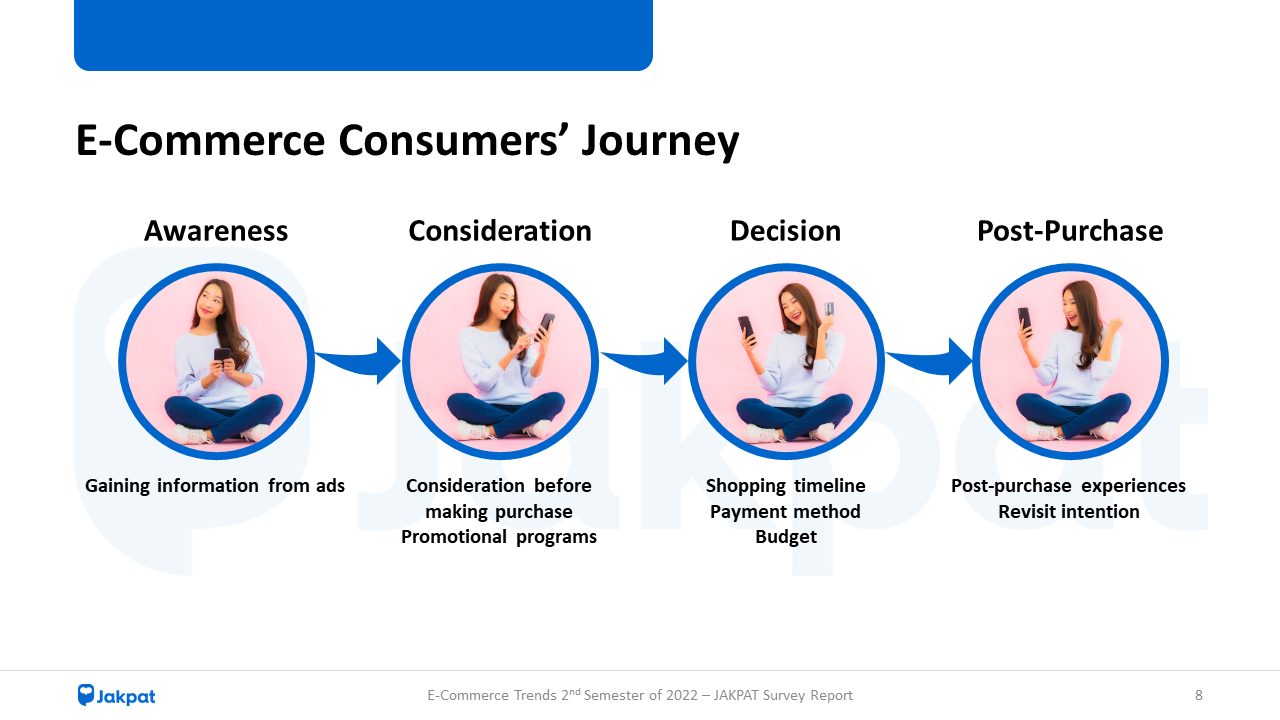

E-commerce is the top place to buy makeup and skincare online, in addition to social media and official websites. Meanwhile, offline makeup purchases from cosmetic stores lead with 51%, minimarkets/supermarkets with 37%, department stores 15%, and sales 10%.

Then, offline skincare purchases are more commonly made at minimarkets/supermarkets with 38%, cosmetic stores 32%, department stores 17%, and sales 8%.”

Looking at the 2023 retail data, makeup and cosmetics sales have increased compared to the previous year. Although the majority of purchases are made online via e-commerce, we still need to pay attention to offline purchases via cosmetic stores for makeup, and via minimarkets for skincare, because the experience of buying offline can help consumers to assess the product directly and try it on their skin/face before buying it. Only then at the repurchasing stage can it be done online, “said Head of Research Jakpat, Aska Primardi.

Regarding sources of makeup and skincare information, social media accounts and advertisements are the 2 main sources of information about beauty products. Moreover, most respondents rely on Instagram and TikTok when looking for beauty product references.

Get the details on our report here.

![Header-[Premium Report] E-Commerce 1st Sem 2023_V7](https://blog.jakpat.net/wp-content/uploads/2023/08/Header-Premium-Report-E-Commerce-1st-Sem-2023_V7-624x243.jpg)