Living in the digital modern world has been transforming the way we live like never before. Before money, the older society use to do barter for transaction. After stuff trading era we come to the monetary era that uses money as a legal transaction payment method. However, the concept of money is not exactly the same as the money we currently know. Before coin and paper money, there was commodity money that comes from different form in various countries. For example, in ancient China, Afrika, and India cowry shell was considered as the commodity money; while Japan uses koku as their commodity money. A long time after the era, the coin and paper money as we know today become available.

As the world becomes global and digital technology cannot be separated from our daily lives, the invention of new kind of money is necessary. Today, we recognize any kind of digital cash as a legal payment method. Digital cash is simply known as electronically transferrable money from one party to another during transaction. As the cashless lifestyle is in the rise, we conduct a survey to predict the trend of 2017 digital cash usage among our panel.

Notable highlight about digital cash trend usage in 2017 is that most respondents in this survey plan to use digital cash more often or at least just the same as this year. Moreover, their interest toward cashless lifestyle is shown as well in their future plan to use this method to fulfill their actual daily needs, and not only digital needs only.

In general, most respondents in this survey already have digital cash in many forms. According to our data finding, several types of popular digital cash are already owned by respondents. Among all types of digital cash available; e-Money, Flazz, and T-Cash becomes the top three most currently owned by our respondents.

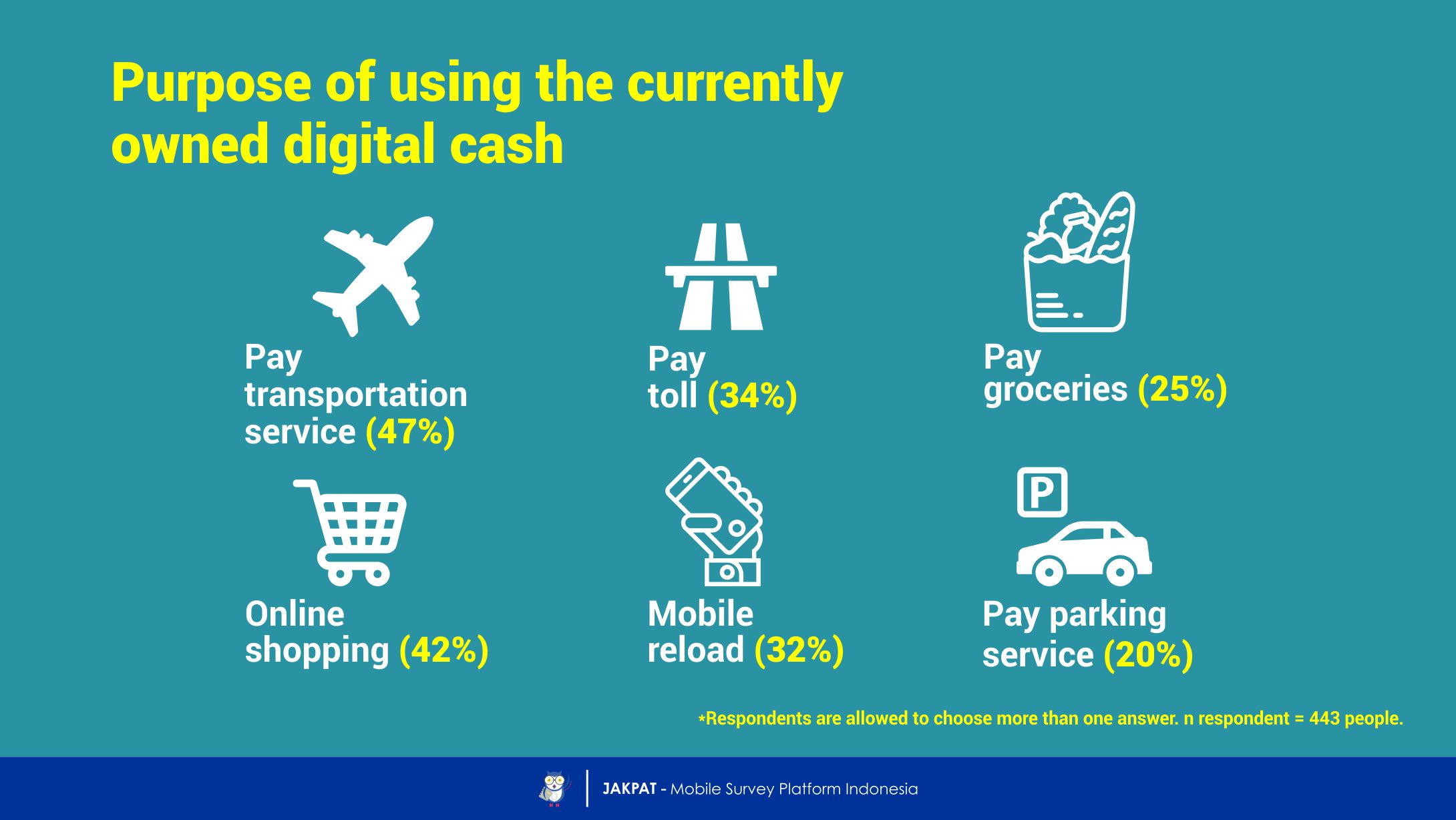

We further ask our respondents about their owned digital cash usage in this year. According to our data, most respondents tend to use digital cash to support their mobility. Most of them use digital cash to pay transportation service such as online ojek and busway. They also use it to pay toll and parking service. Besides that, most respondents also use digital cash to support their digital activities such as online shopping and mobile reload.

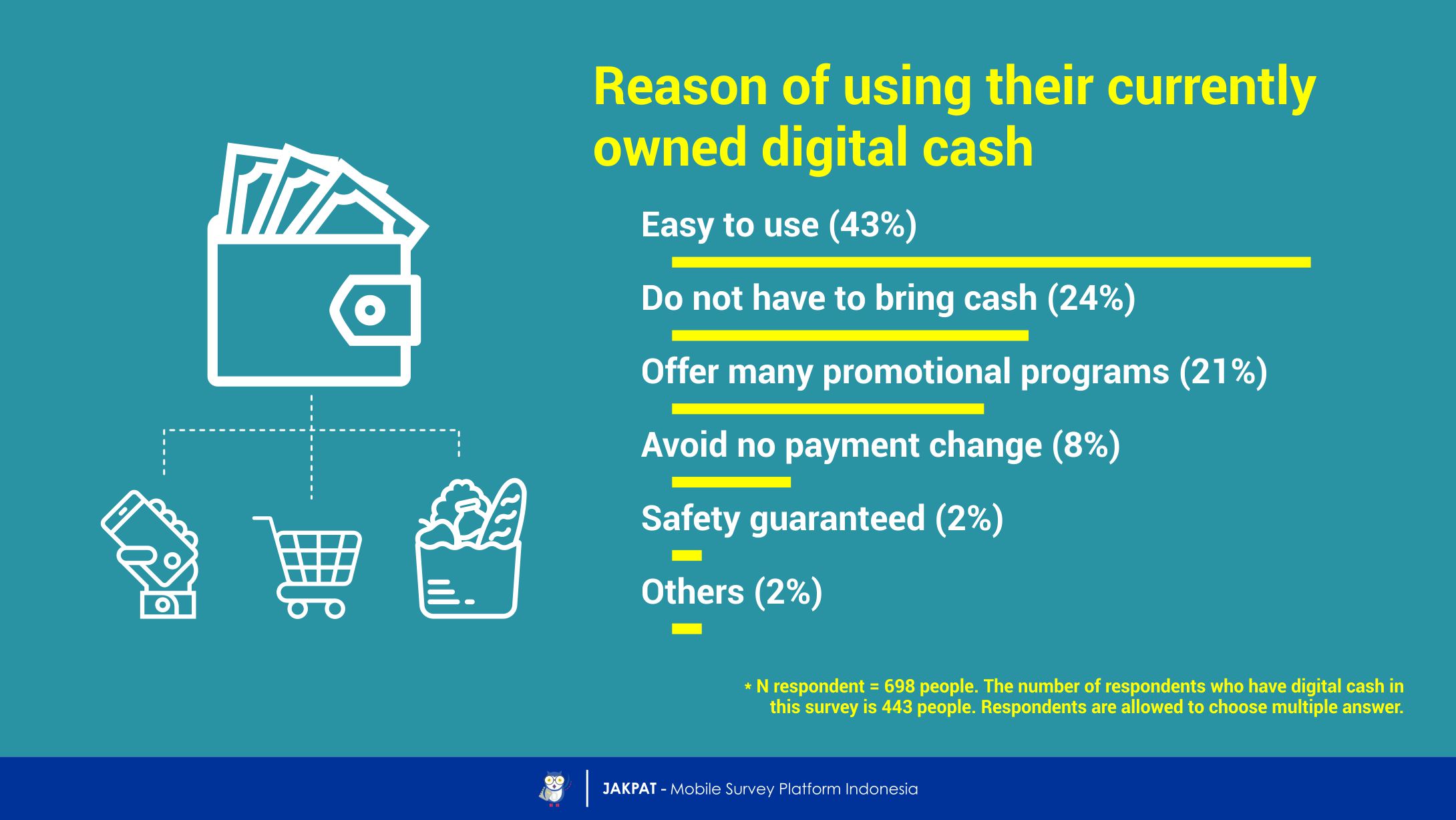

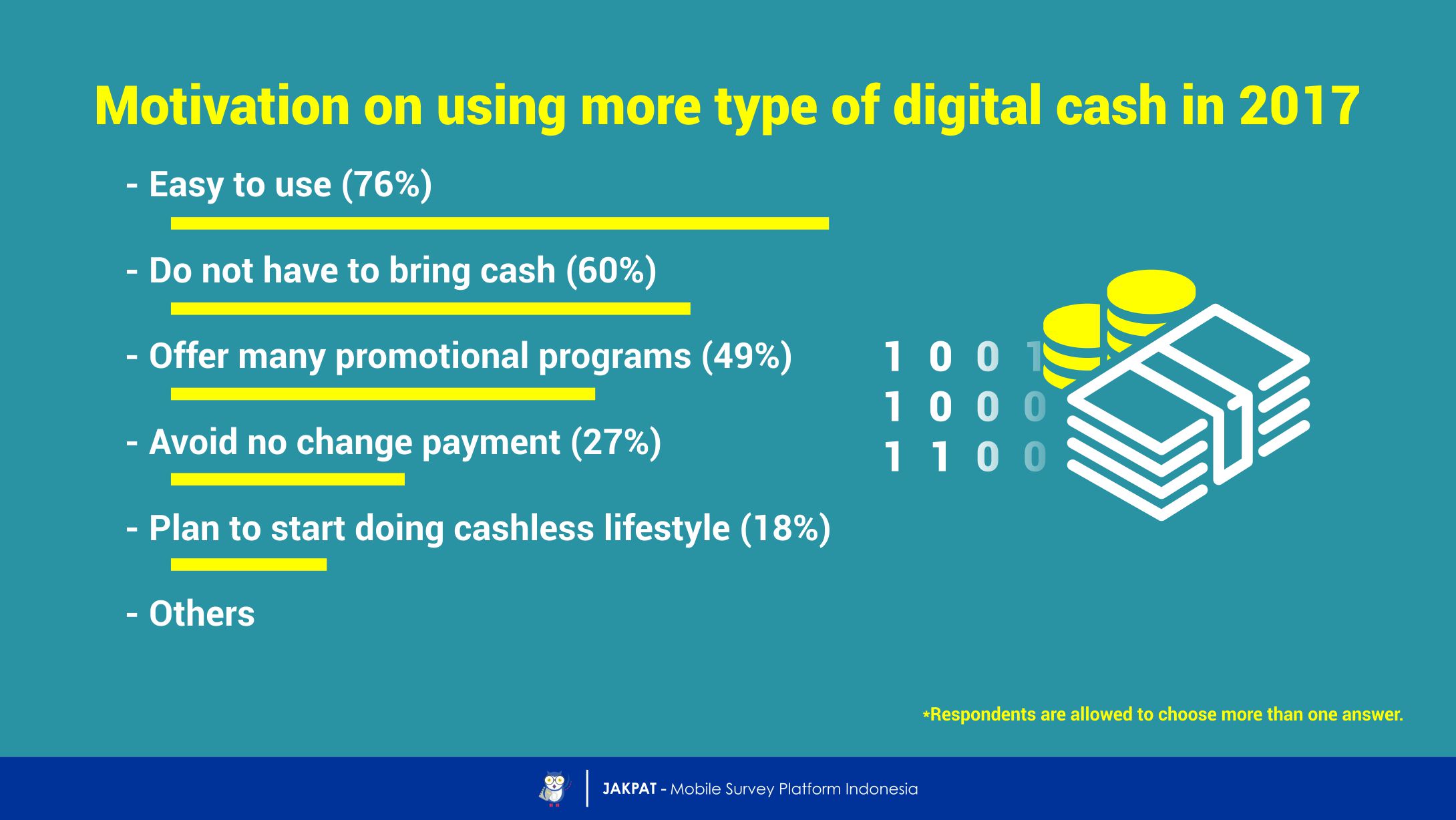

In general, the simplicity of using digital cash becomes the main reason of our panel to use theirs. Most respondents in this survey consider digital cash is easy to use and makes it possible for them for not bringing cash all the times. Moreover, our respondents also like to use digital cash because the digital cash provider likes to offer many promotional programs for them.

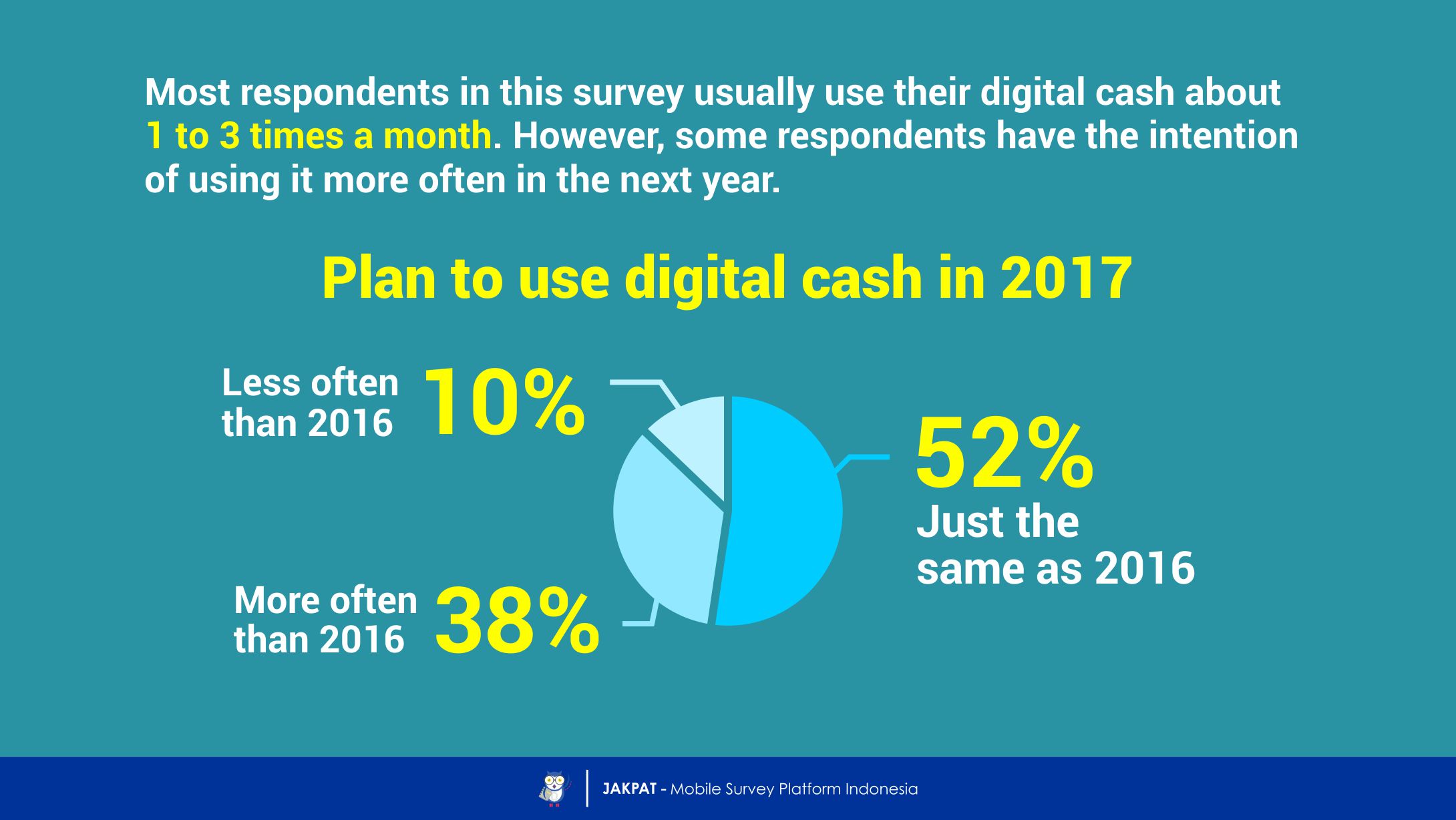

The trend of digital cash seems to rise in the near future. According to our data finding, only 10% respondents in this survey tend to use digital cash less often than this year. This means, 90% respondents in this survey are about to use digital cash more often or at least in just the same frequency as they use it this year.

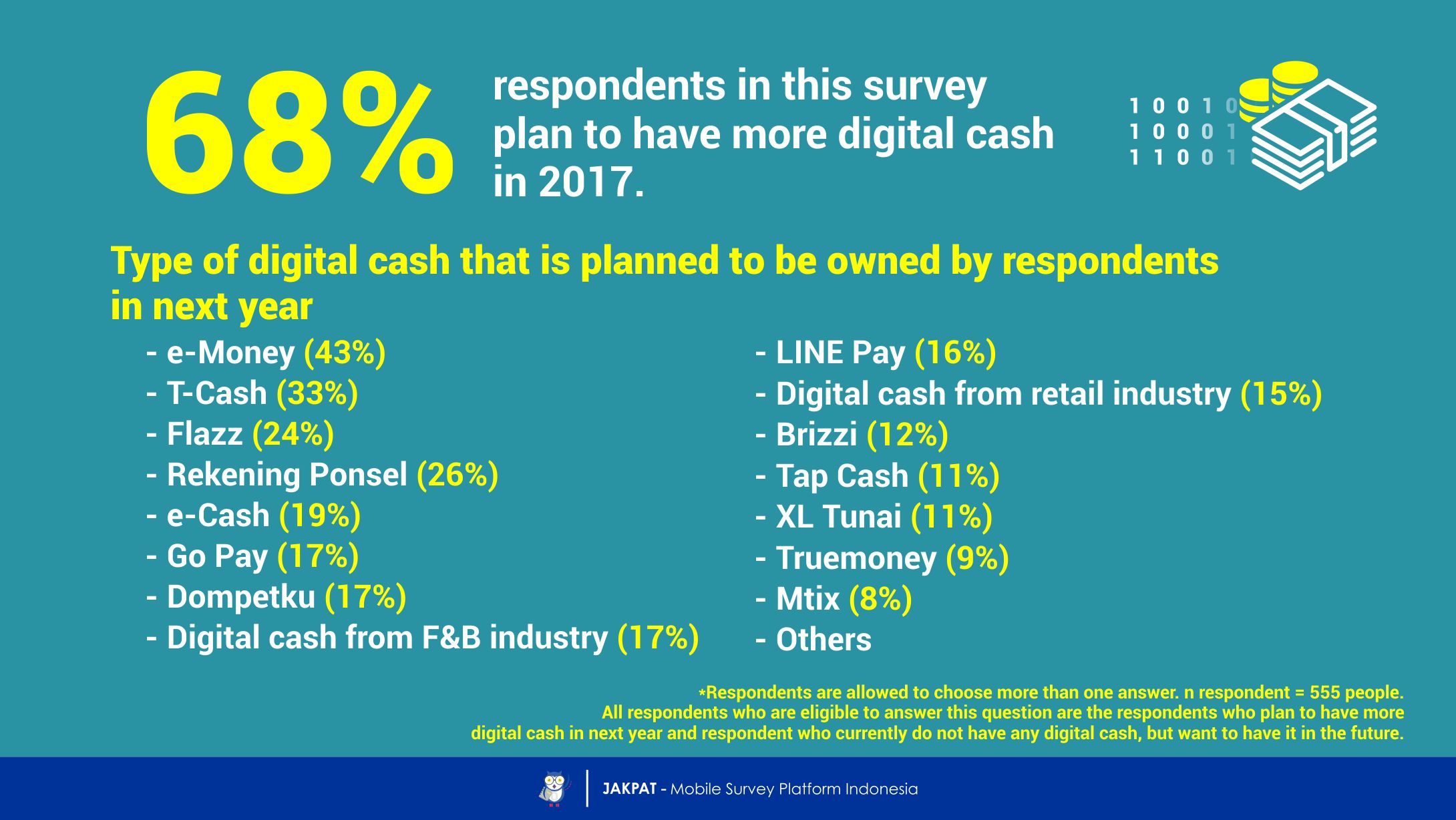

Apparently, it is not only the interest of using digital cash that seems to rise in the next year. 68% respondents in this survey even plan to have more type of digital cash in next year. Although most of them wants to have any popular digital cash such as e-Money, T-Cash, and Flazz at the first place; but their interest to have other types of digital cash is higher than the previous year. For example, there are respondents who plan to have e-Cash, Brizzi, Truemoney, also digital cash from food and beverage merchants in 2017.

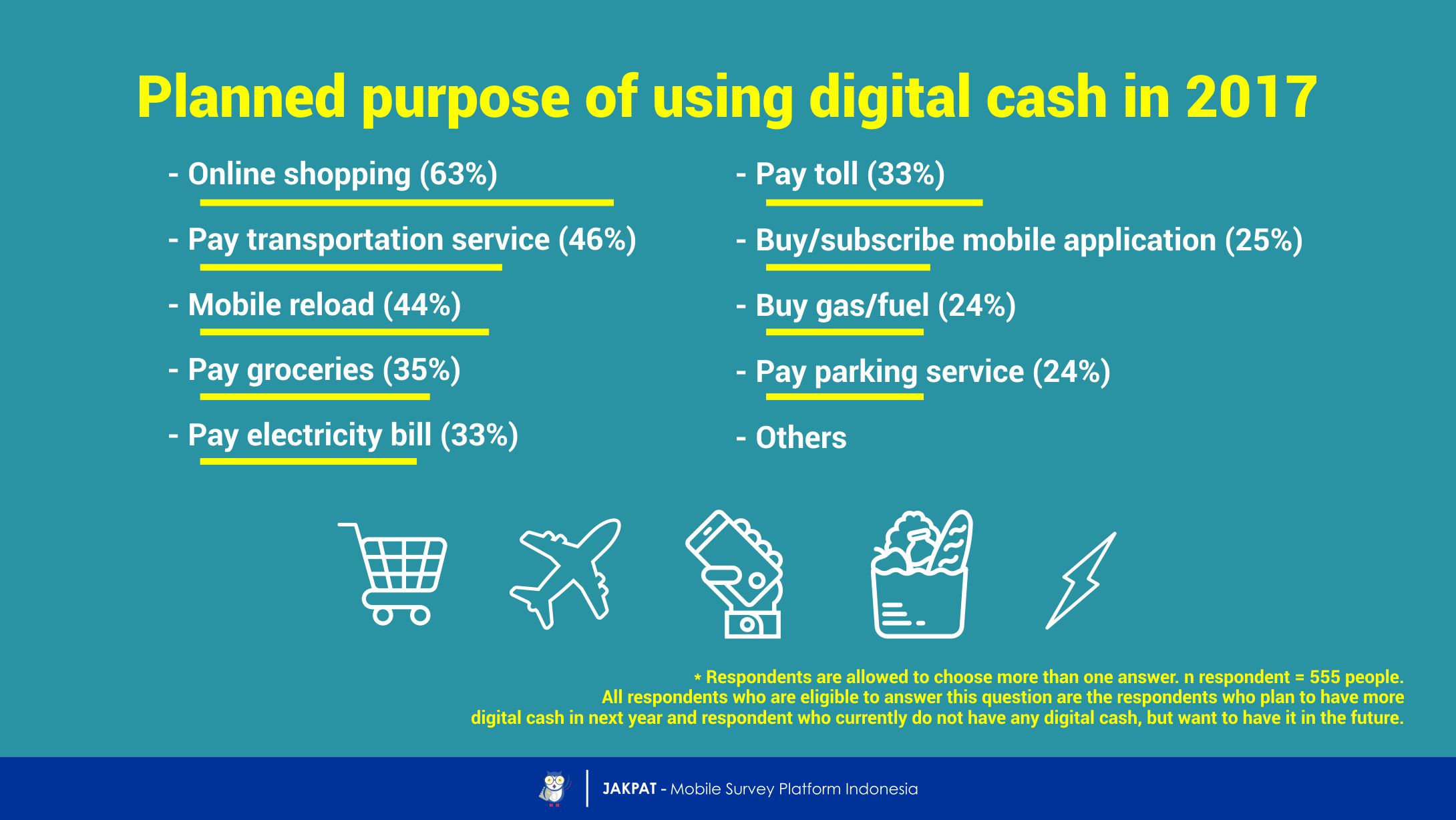

The optimism of digital cash trend usage in 2017 is shown as well in the respondents’ planned purpose of using digital cash. Apparently, the trend usage is not very much different as how they use digital cash in this year. The transportation and digital purpose still become two main purpose of using digital cash. However, some of them also plan to start using digital cash to afford their daily needs such as pay electricity bill, buy groceries, and buy fuel.

We also find no significant different about respondents’ motivation on using more type of digital cash in 2017 than this year. The simplicity of using digital cash and promotional program become two most important motivations. However, we also find some respondents in this survey have the motivation of start doing cashless lifestyle in the next year.

In order to understand respondents’ interest of using digital cash in the next year, we ask them about their expected service from digital service provider. Apparently, 64% respondents expect more merchants will accept digital cash as a valid payment method.

Another expectation from most respondents is that digital cash provider will offer more promotional program in the next year. Furthermore, among any kind of the expected promotional program offered by digital cash provider; most respondents expect to receive a discounted price when they make digital cash transaction.

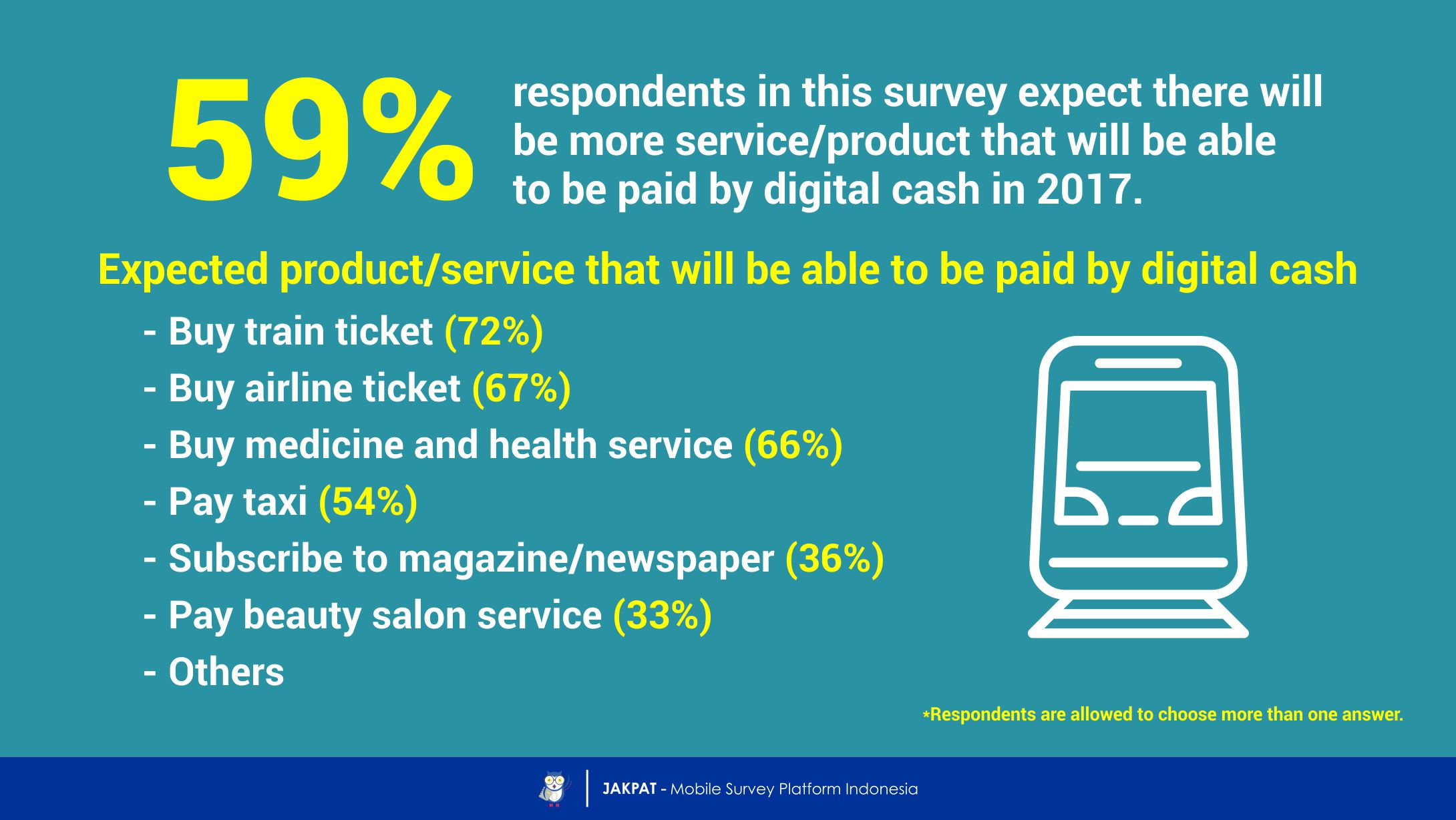

Some other respondents in this survey also expect that there will be more service/product that will be able to be paid with digital cash in the next year. Regarding the expected product/service that they want to accept digital cash; most of them expect transportation vehicle as well as beauty and health care service at the most.

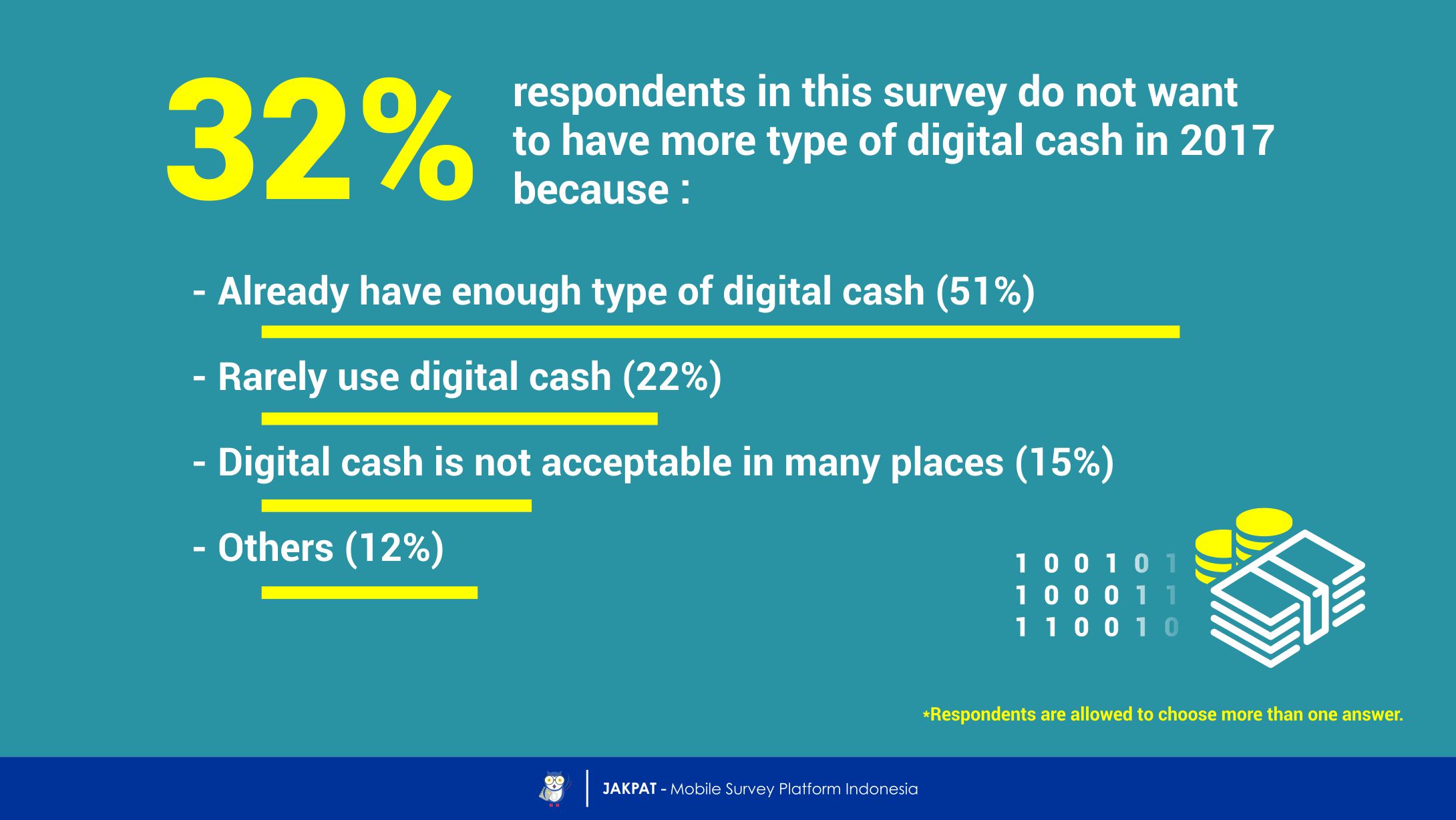

At last, we ask the 32% respondents in this survey who currently have digital cash, but do not want to have many more in the next year about their motivation of doing so. Apparently, we find two extreme opposite answers from our respondents. At first, most respondents in this survey do not want to have many more type of digital cash because they currently have enough type of it that already suitable for their transaction needs. In other hand, the other respondents do not want to have more type of digital cash because they rarely using it. Up to this point, we can summarize that respondents’ interest of using more type of digital cash in the future is determined either by their fulfilled needs of their current digital cash, or their lack of frequency of using it.

For more detail you can download XLS report at the button below (Bahasa Indonesia). JAKPAT report consists of 3 parts which are 1) Respondent Profile, 2) Crosstabulation for each question and 3) Raw Data. Respondent profile shows you demographic profiles ( gender,age range, location by province, and monthly spending). Cross tabulation enables you to define different demographic segment preference on each answer.

You can also download PDF here: