Among all kind of beverages available, tea has been long known as one of the most favourite for almost everyone from different culture and region. Drinking tea even has been a part of special rite in several cultures. From English afternoon tea to Chinese tea pai shows that drinking tea is not only the practice of sipping on a cup of tea, but also a special moment for family to enjoy their quality time. As the time goes by, drinking tea also becomes part of our daily habit. We don’t have to drink tea only in specific moment, but we can drink it every time in a bottled pack. Despite the sacred meaning of drinking tea with the family as a part of rites of culture, drinking the ready-to-drink tea has been a trend and already succeed in captivating huge market segment. According to this trend, we would like to explore the profile of ready to drink tea consumer regarding their consumption habit.

Download the Infographic Report PDF here

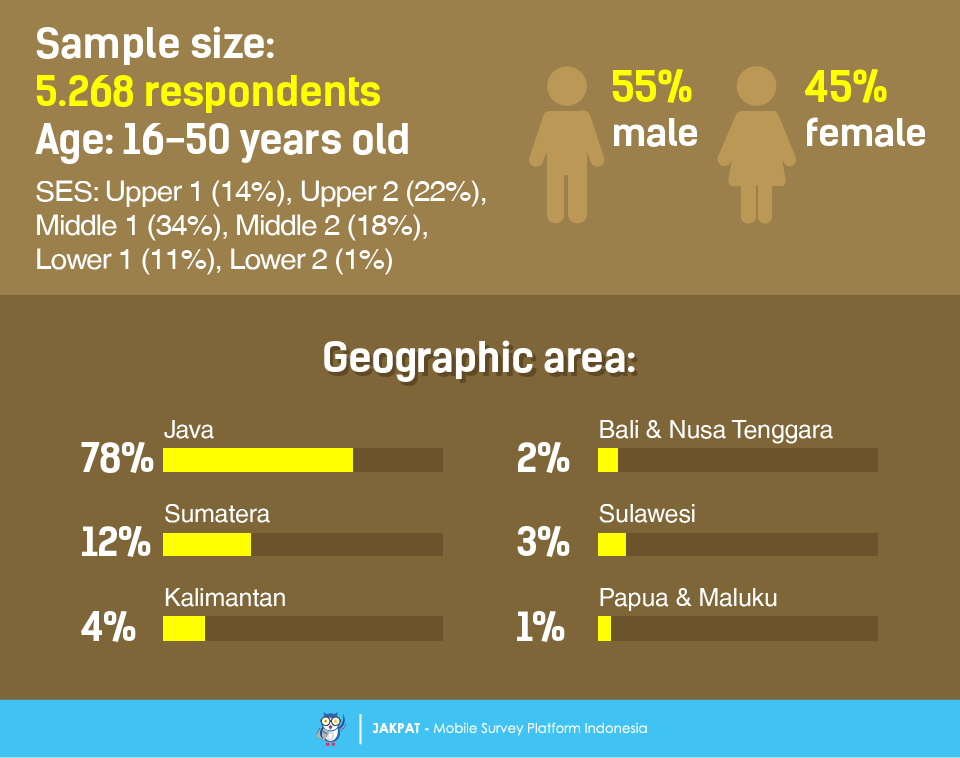

Ready to drink (RTD) is a term used to define any kind of beverages that was already been well-packaged, so that their consumer can easily grab a bottle/box and drink it at the moment. The consumers don’t have to take their times to blend all ingredients. The RTD beverages are usually packaged on bottle or box with various sizes. As RTD tea has been very popular to be consumed in every day, we asked our 5.268 panel of respondent to participate in our survey regarding their RTD tea product consumption habit.

Among all respondents who have participated in the survey, we can highlight several notes. First, we cannot find specific difference between the pattern of RTD tea consumption habit between our male and female respondents. They tend to act similarly regarding their consumption habit. Second, the brand of RTD tea available in public is quite various. However, the fierce competition is dominated only by few brands.

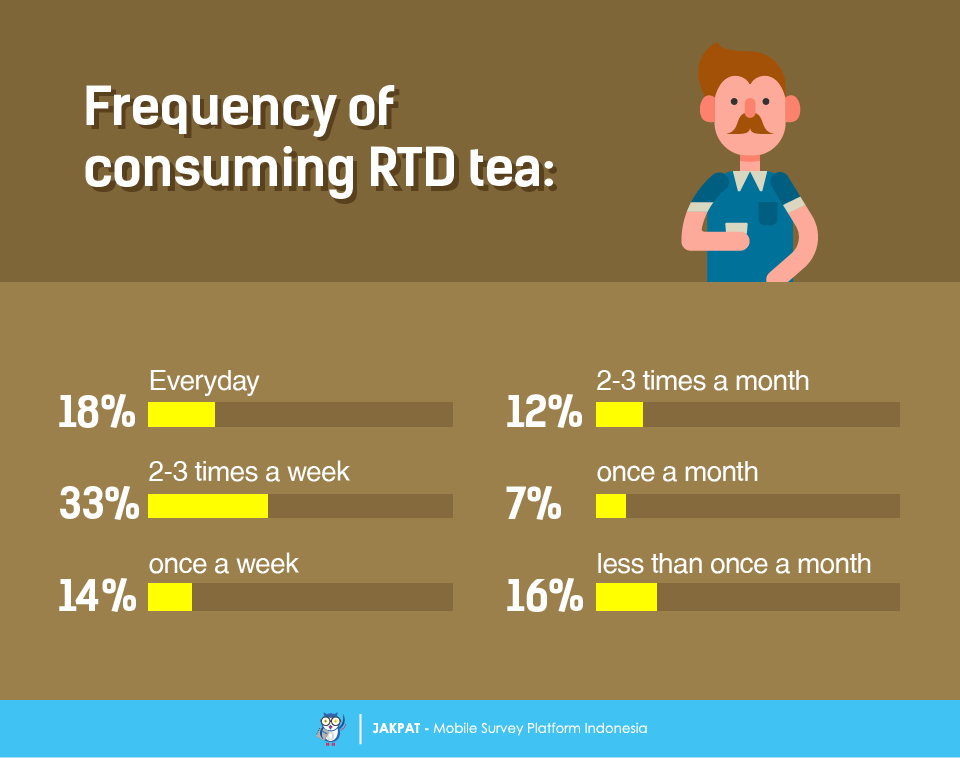

The first question we asked to our respondent was their frequency of consuming RTD tea product. Most respondents in this survey said that they were consuming about 2 to 3 products in a week. However, the “heavy consumer” also shown as a promising market as 18% of all respondents in this survey said that they regularly consume RTD tea in everyday.

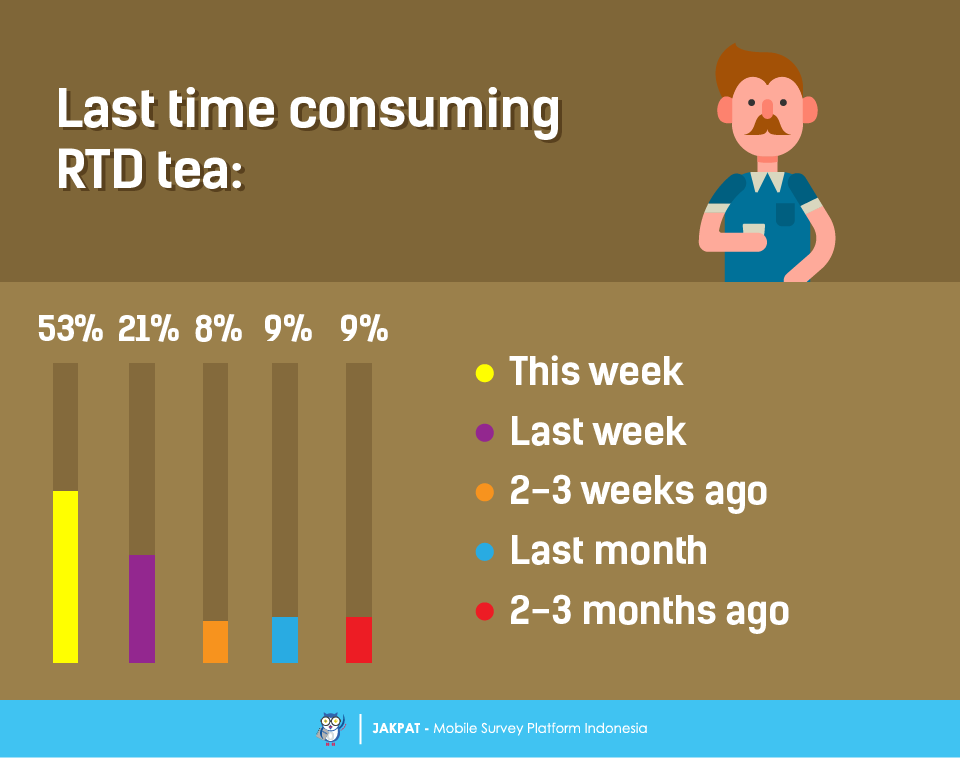

As we expect to gain a factual data from our respondent, we asked them to mention their last experience of consuming RTD tea. Surprisingly, 53% of them were consuming RTD tea product within this week, and 21% of them were consuming last week. Thus, we can expect that they can well recall their experience of consuming RTD tea product.

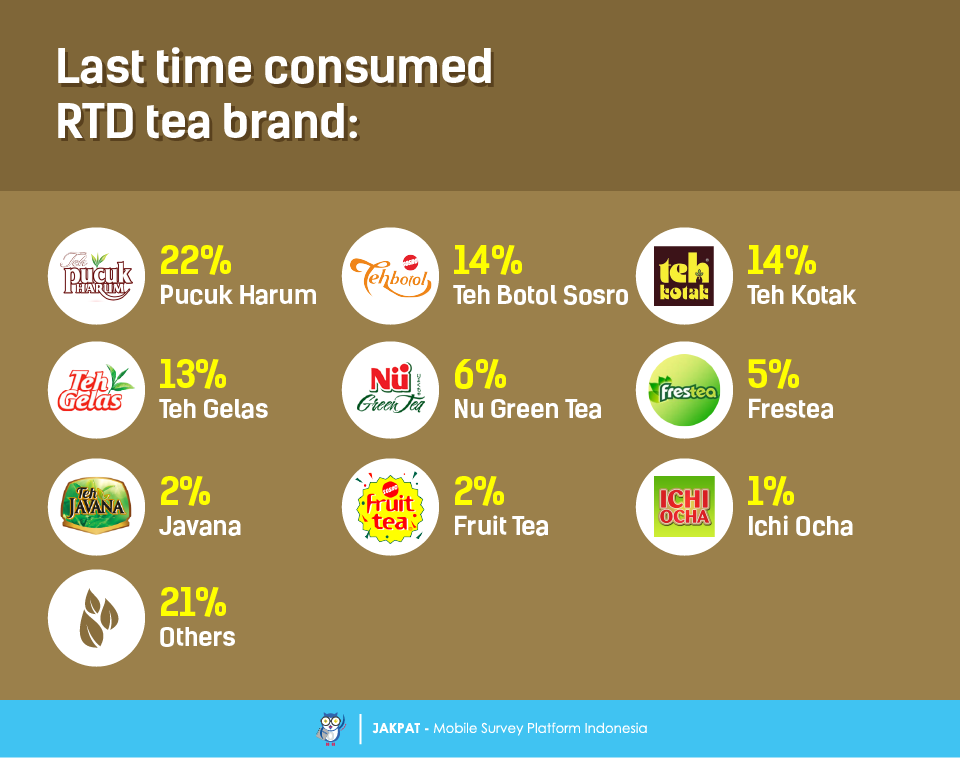

The competition of RTD tea market is very rough. Up to right now, there are more than 10 famous brands of RTD tea available in the marketplace. We try to map the market competition among RTD tea brand by asking the last RTD tea brand consumed by respondent in this survey. Teh Pucuk Harum was mentioned as the most consumed by our respondents in this survey. This finding was then followed by Teh Botol Sosro, Teh Kotak, and Teh Gelas.

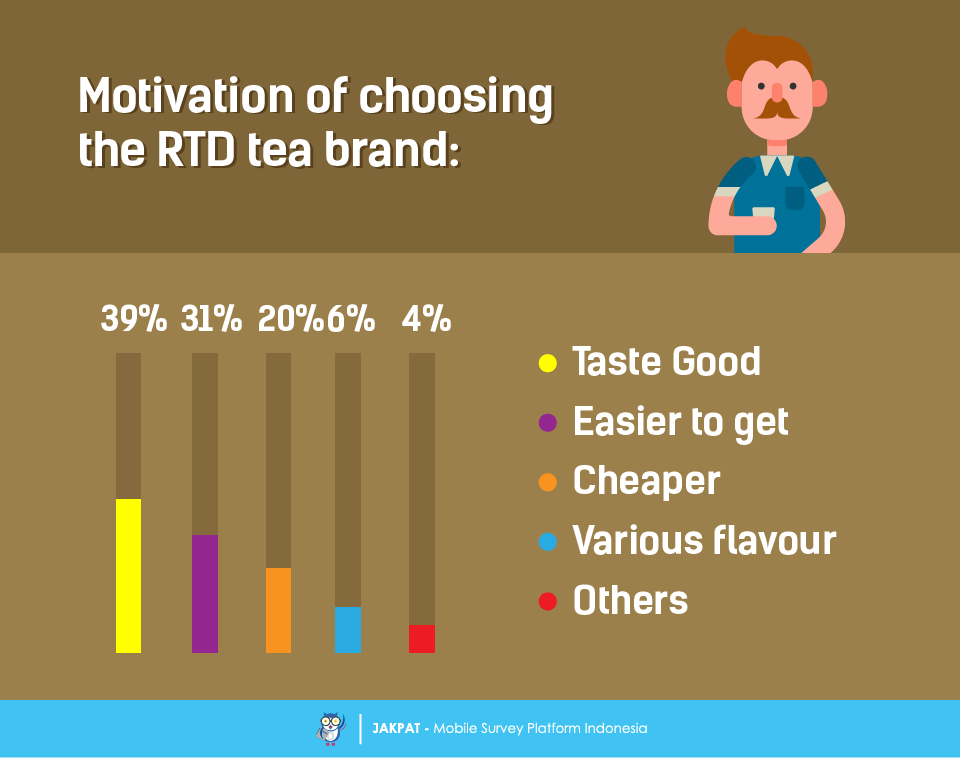

We further try to obtain respondents’ motivation on choosing particular RTD tea brand. We asked them about their reason on choosing the brand of RTD tea product they last consumed. The taste of the product becomes the main reason for respondents. Besides that, the availability of the product enables them to find it easily, so that they tend to buy the most available product. Price also becomes another factor affecting respondents’ decision on buying particular RTD tea brand.

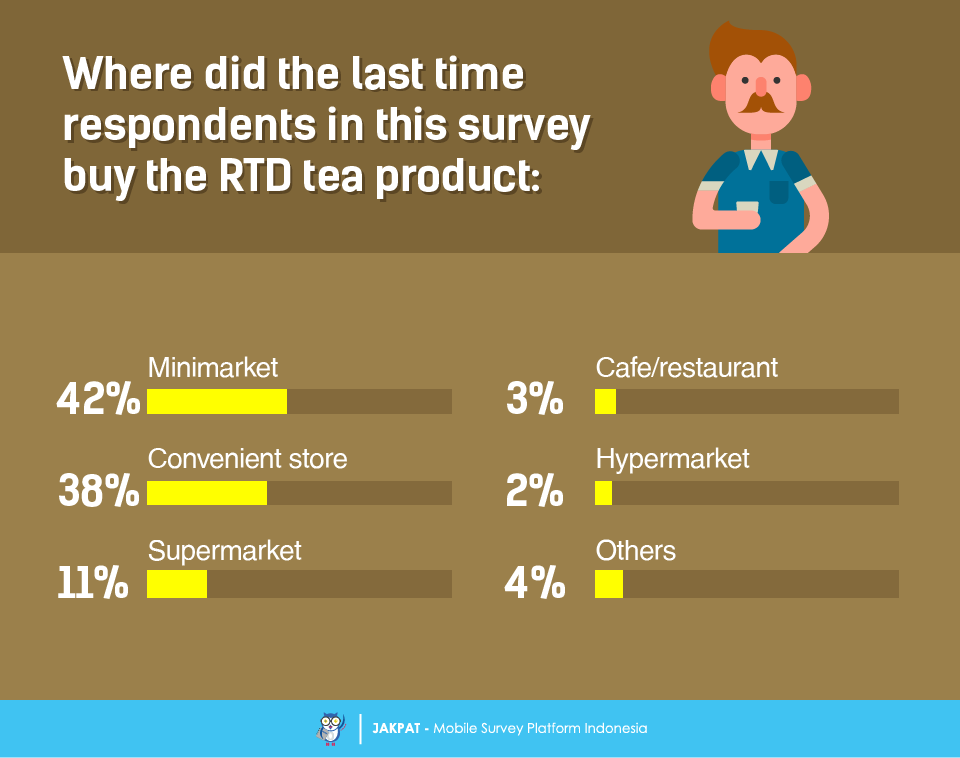

The place to buy RTD tea product became our following curiosity to be asked to respondent. We asked our respondent about where the last time they buy RTD tea product. Minimarket and nearby convenient store becomes the most popular channel for them to buy RTD tea product. This finding is then followed by supermarket, cafe/restaurant, as well as hypermarket, and other places.

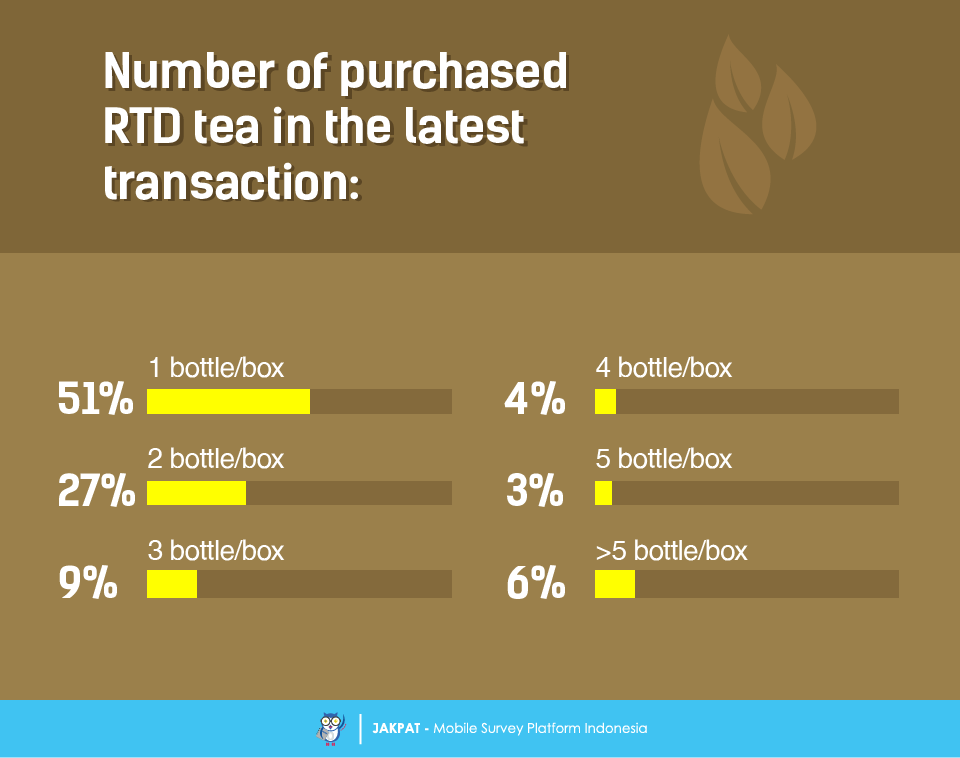

Regarding the number of purchased RTD tea in respondents’ latest transaction; most respondents were more likely to buy only a single bottle/box per transaction. Averagely, maximum bottle/box that respondent buy are only two bottles/boxes in each transaction. However, fewer respondents also buy more than two bottles/boxes.

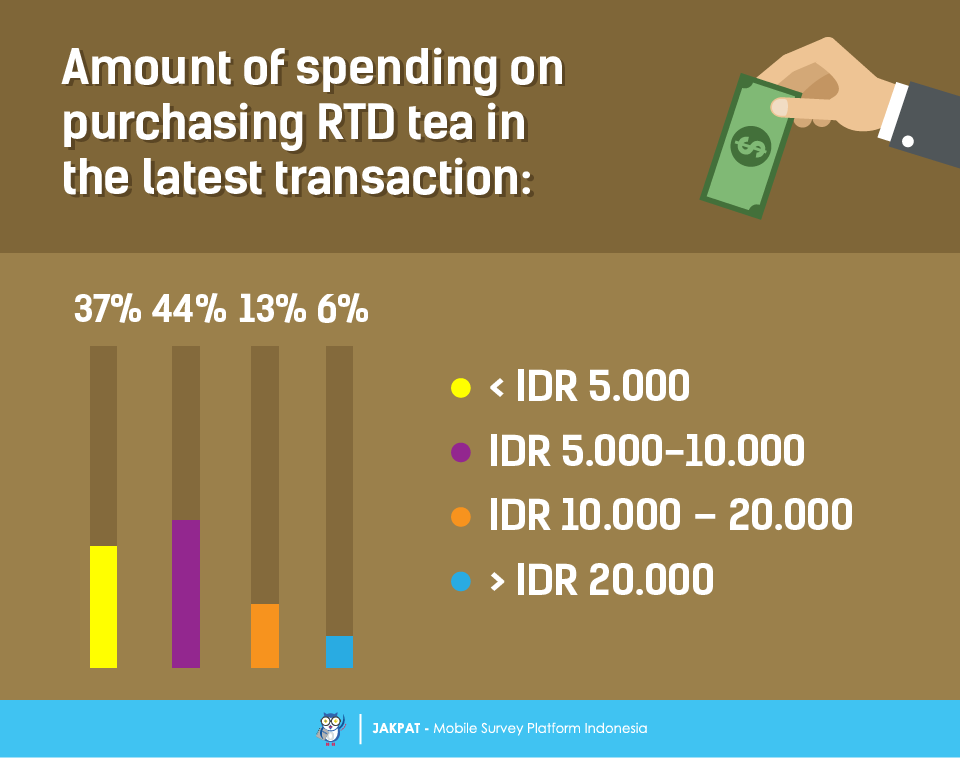

At last, we would like to discover the spending amount on purchasing RTD tea product in respondents’ latest transaction. Most respondent are spending about IDR 5.000 – 10.000 per transaction. To see the bigger picture of this finding, it seems that most respondents are more likely to spend maximum IDR 10.000 or even less than that to buy RTD tea product.

For more detail you can download XLS report at the button below (bahasa). JAKPAT report consists of 3 parts which are 1) Respondent Profile, 2) Crosstabulation for each question and 3) Raw Data. Respondent profile shows you demographic profiles ( gender,age range, location by province, and monthly spending). Cross tabulation enables you to define different demographic segment preference on each answer.

You can also download PDF here:

or Get A Sales Quote by filling this form or Call to +622745015293