As we know that Millennials currently at the peak of their productive age. Therefore, all things related to the Millennials interesting to study. In this survey, I tried to figure out how Millenials view of the state of their finances. The survey involved 415 respondents, 24-35 years old, female and male, single and married in 7 major cities in Indonesia.

68.67% of respondents declared financially independent. Both respondents who are married or single, both showed a tendency to be financially independent.

When we asked respondents to compare their financial situation with friends of their generation, the majority of respondents feel they are at the same level (51.57%).

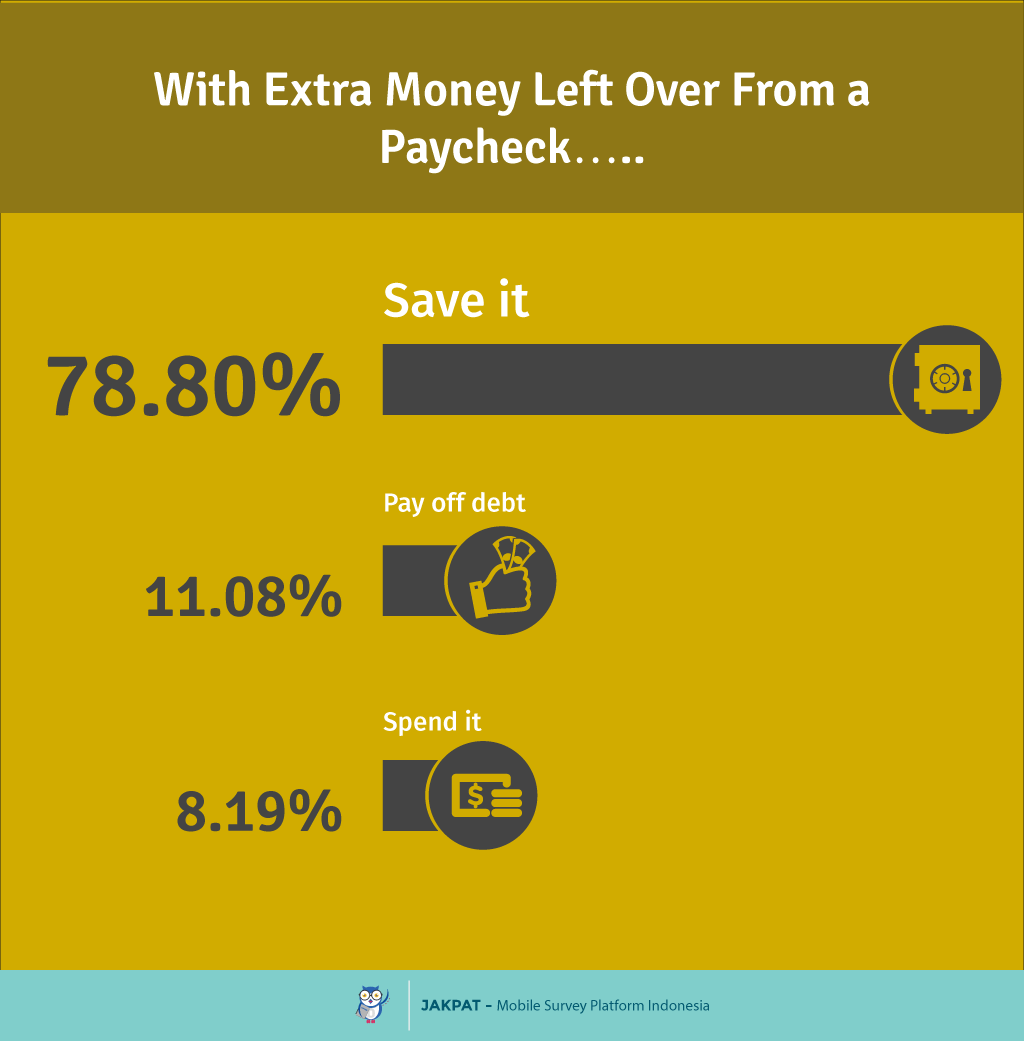

Our millennial respondents said they will save money if there is money left on the payroll. While respondents who will spend it only 8.19% of them.

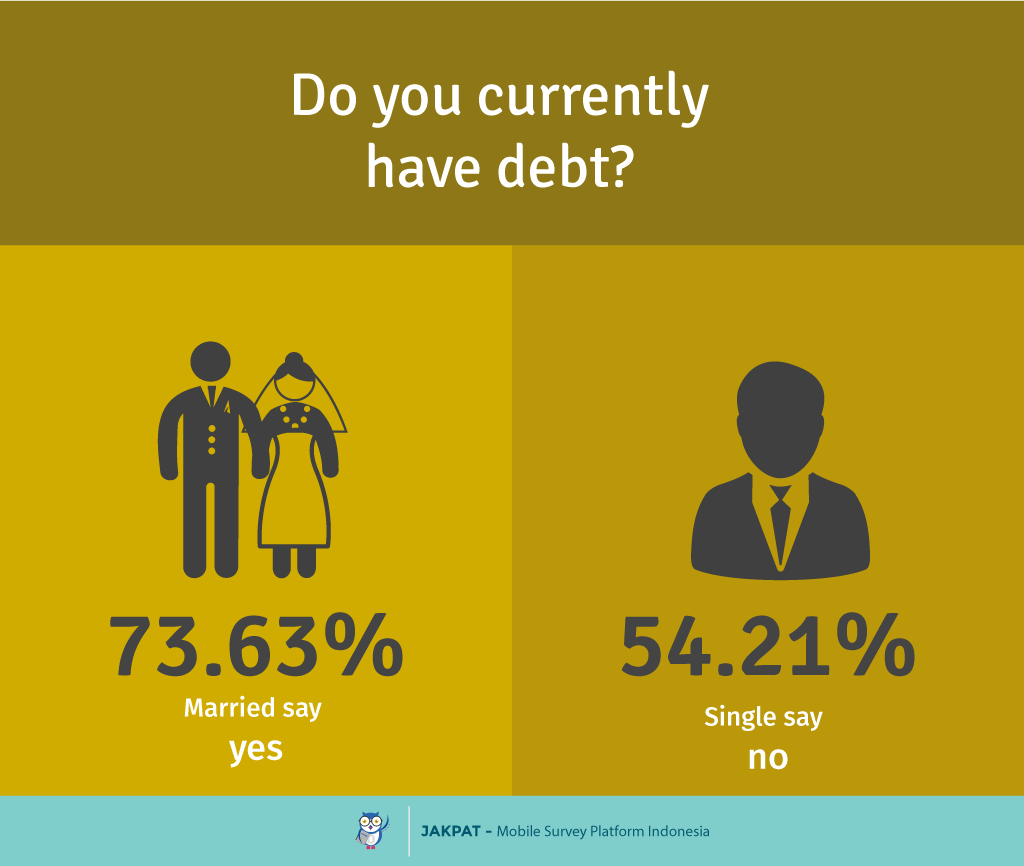

In this survey, marital status indicate different tendecy in financial situation. One difference is the debt ownership. The majority of respondents who are married, whether they have children or don’t claimed to have a debt that must be paid regularly. While respondents were still single, the majority said they had no debt. This clearly shows that changes in the status of domestic demand much greater needs, so many things that need to be purchased or held by way of debt.

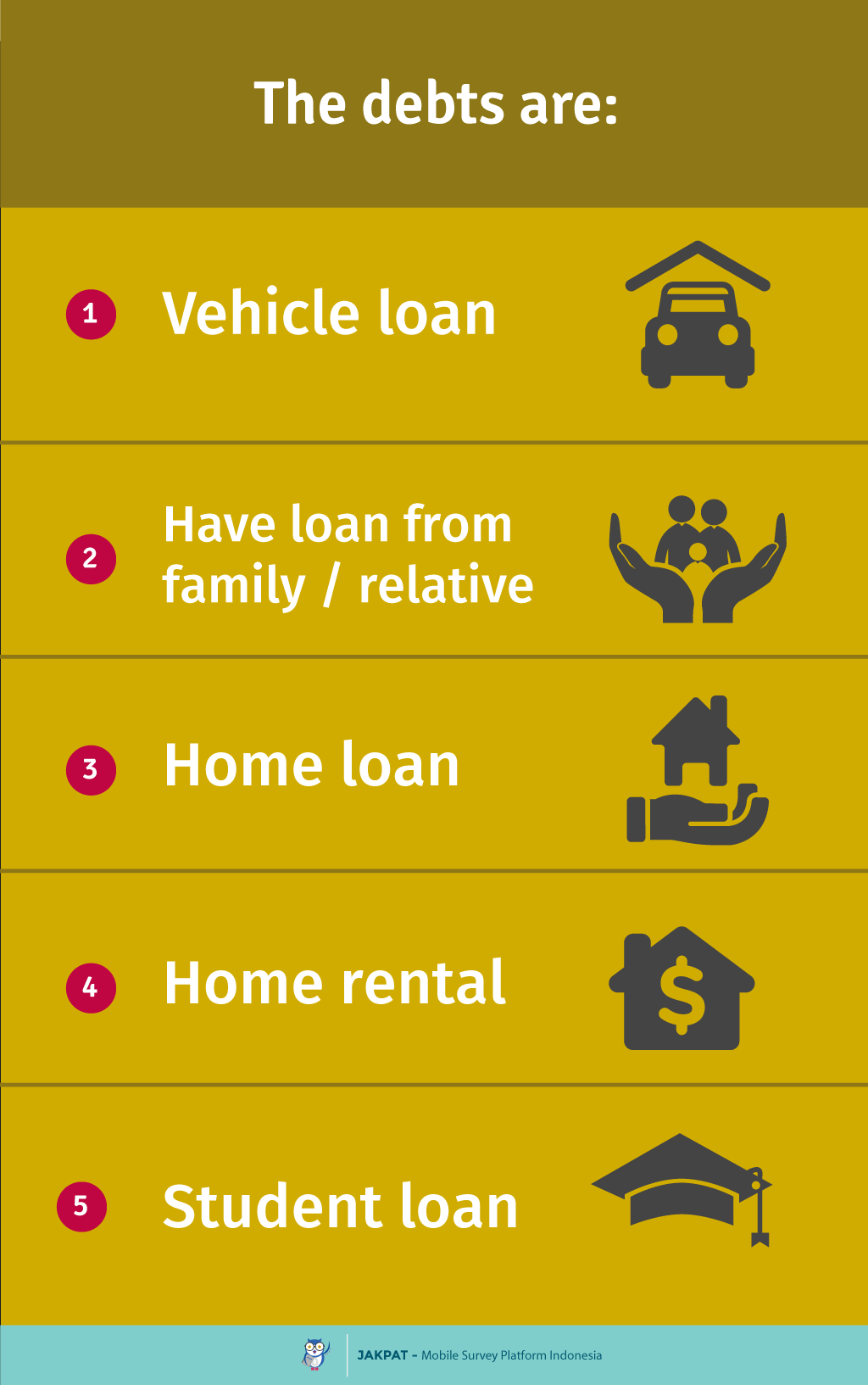

Then we asked further what debt owned by the respondent. The top chosen answer is a vehicle loan. There was also a loan from family and home loans.

To cover the needs, sometimes someone needs to borrow money. These loans can be obtained from various parties, one of which is the family / relatives. We also asked respondents whether they had ever borrowed money from parents / family / relatives to cover expenses, the majority of respondents also said they had borrowed (67.47%).

Saving was considered important by the majority of respondents. This is indicated by the approval of a majority of the respondents, that they regularly save (73.73%). But more than half of respondents admitted to never do an evaluation of the expenditure of every end of the month. Two things are equally well stated by respondents who are single or married.

When we asked respondents to choose, which one is more important to them, having a home or nice vehicle. Almost all respondents said the home is more important than a great vehicle. It is also equally expressed by the respondents are single or married.

Different trends between single and married is shown in terms of investment. When we asked whether respondents do certain investments. The majority of respondents who are married either already had children or not yet admitted to invest, while most of respondents who still single admitted to not do any investment. This shows that when a person has a family, long-term financial plan thoughtful, unlike the single. We also asked respondents who have made investments, what kind of investment they choose. Apparently, gold has been chosen to be an investment. Gold may have been because the price is relatively stable and not complicated to do.

For more detail you can download XLS report at the button below. JAKPAT report consists of 3 parts which are 1) Respondent Profile, 2) Crosstabulation for each question and 3) Raw Data. Respondent profile shows you demographic profiles ( gender,age range, location by province, and monthly spending). Cross tabulation enables you to define different demographic segment preference on each answer.

Click the icon to download XLS report (Bahasa)

Ready to Send A Survey?

or Get A Sales Quote by filling this form or Call to +622745015293