Consumers acknowledged the value and usefulness of several types of communication from brands, but they also acknowledged their hesitancy to reveal too much, to avoid excessive disruption and intrusion. – Salesforce

JAKPAT conducted a survey to 1957 respondents from user of JAKPAT Mobile Apps randomly to 17-45 age ranges and all provinces in Indonesia. This survey is a replication survey from Salesforce survey continuing the previous post. Survey is done in around 5-6 hours in December 2014.

Mobile Brand Factor Survey purpose is to define which way best for brands to present itself to its costumer utilizing mobile features and characteristics. Although this survey is not covering whole aspect, but by figuring out trend based on basic mobile activity response hopefully brand can get new insights on Indonesian mobile consumer.

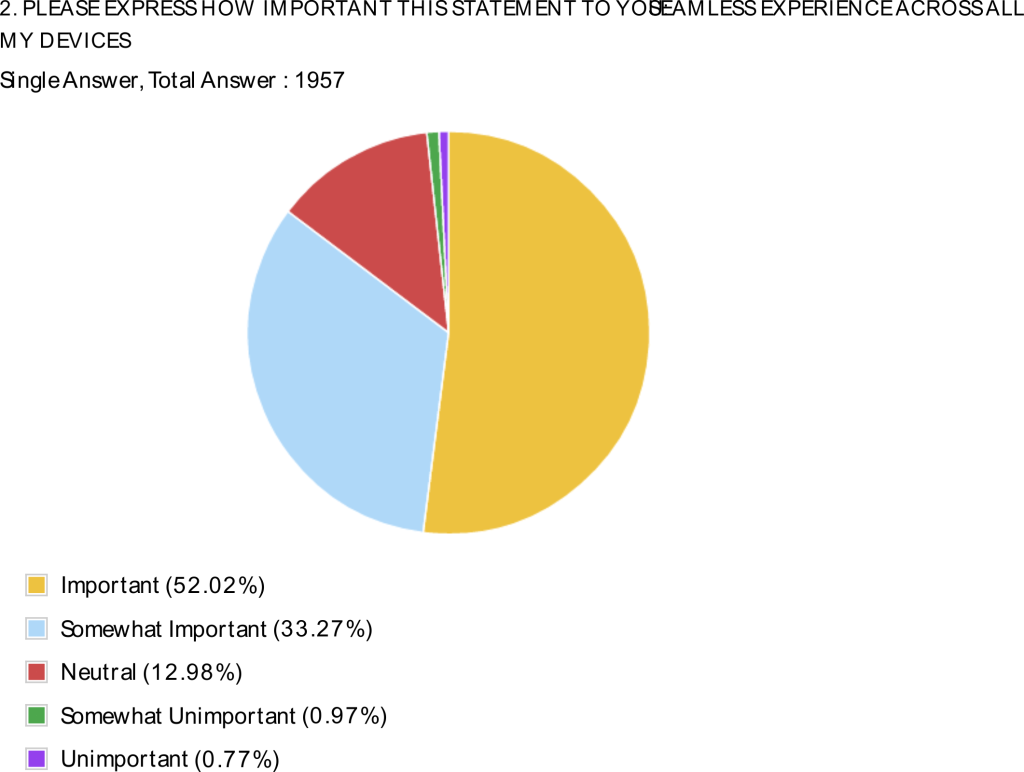

On Seamless Experience Across All Devices

More respondents felt important to have “seamless experience across all my devices” which is 52.02 percent. The rest chose somewhat important (33.27%) and neutral (12.98%). Only below 2% of respondents felt to have seamless experience is unimportant to them.

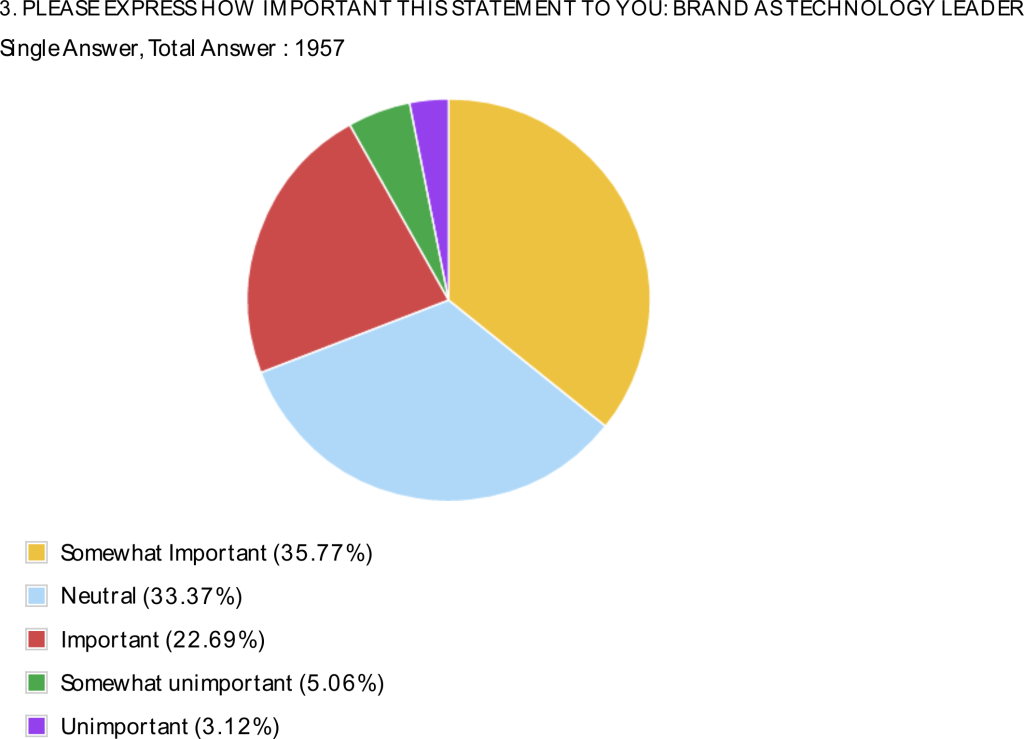

On Brand Being A Technology Leader

35.74% respondent stated that it is somewhat important for brand to be a technological leader, while 33.37% respondents stated neutral. Only 22.69% stated it is important for any brand to become technology leader.

This means that respondents expectation toward brand appearance in their mobile life does not have to have the no.1 technology.

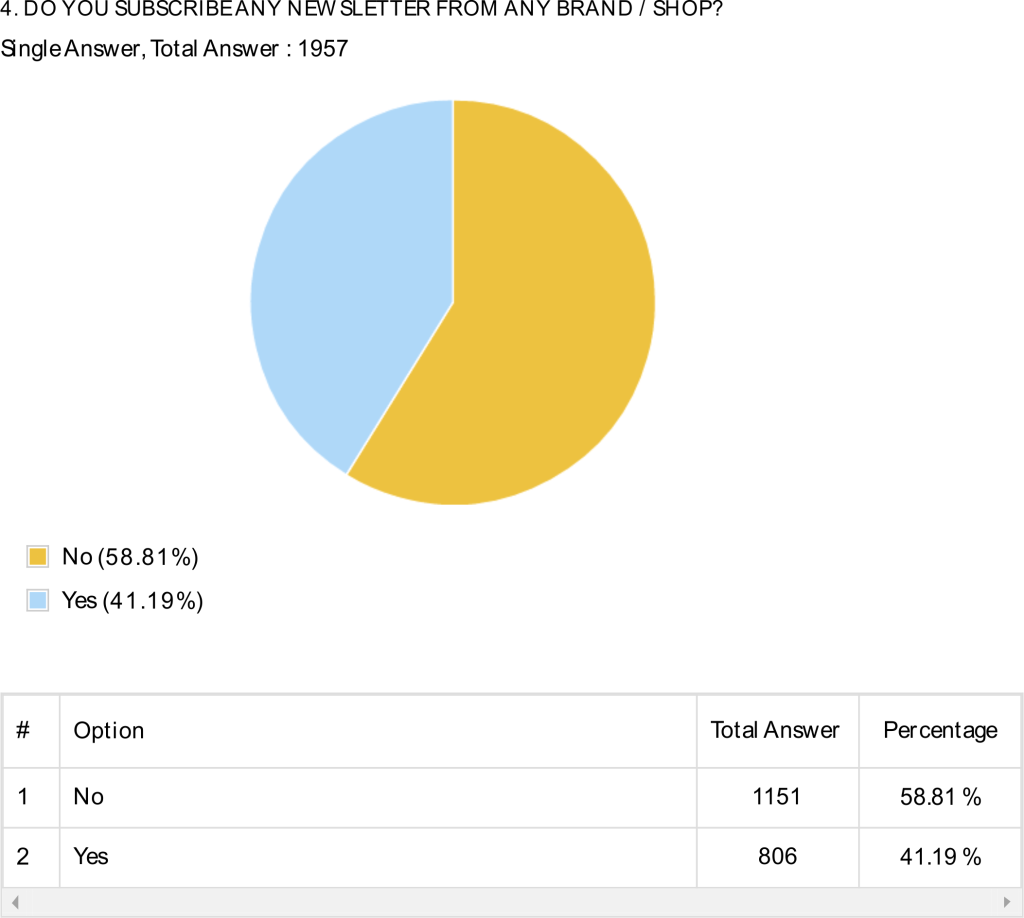

Subscribe to Any Brand’s Notice ( Email,SMS,etc)

Yes (58.81%)

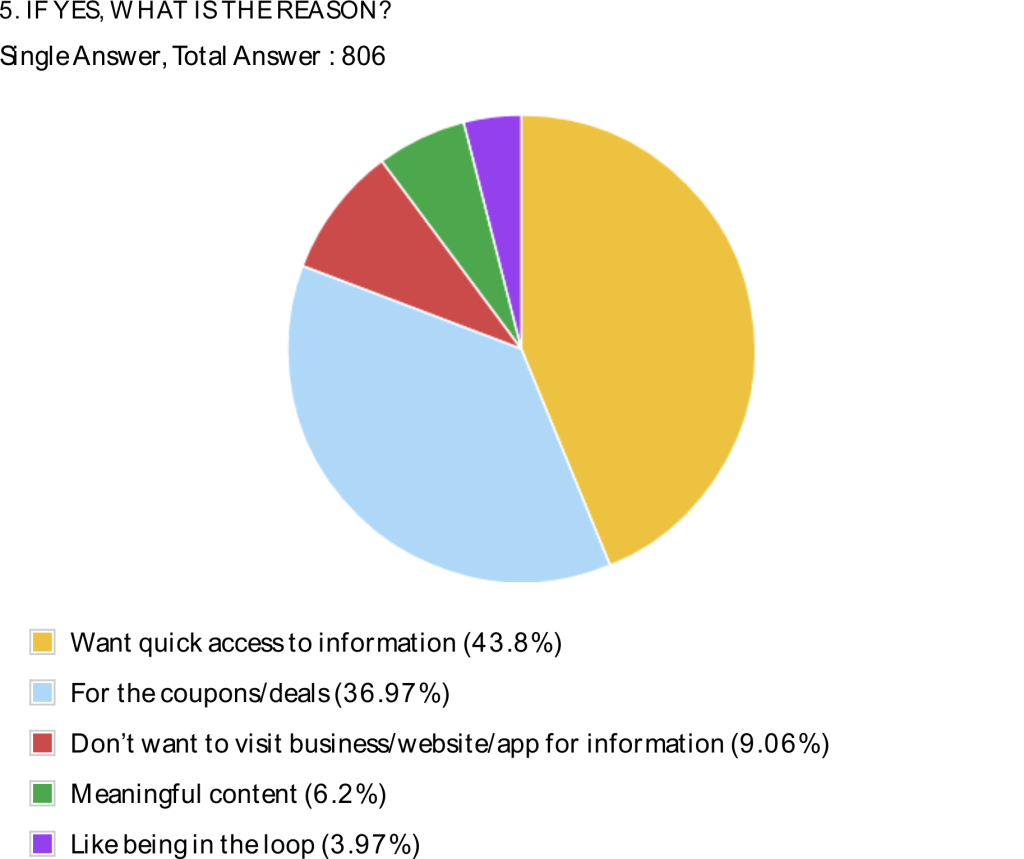

43.8% of those who subscribe to brand’s newsletter want quick access information about that brand. 37% want to get coupons or deals by subscribing. The other reason to subscribe is to avoid direct visit to business/website/application for information (9.04%), getting meaningful contents (5.99%), and the like being in the loop (3.95%).

No (58.81%)

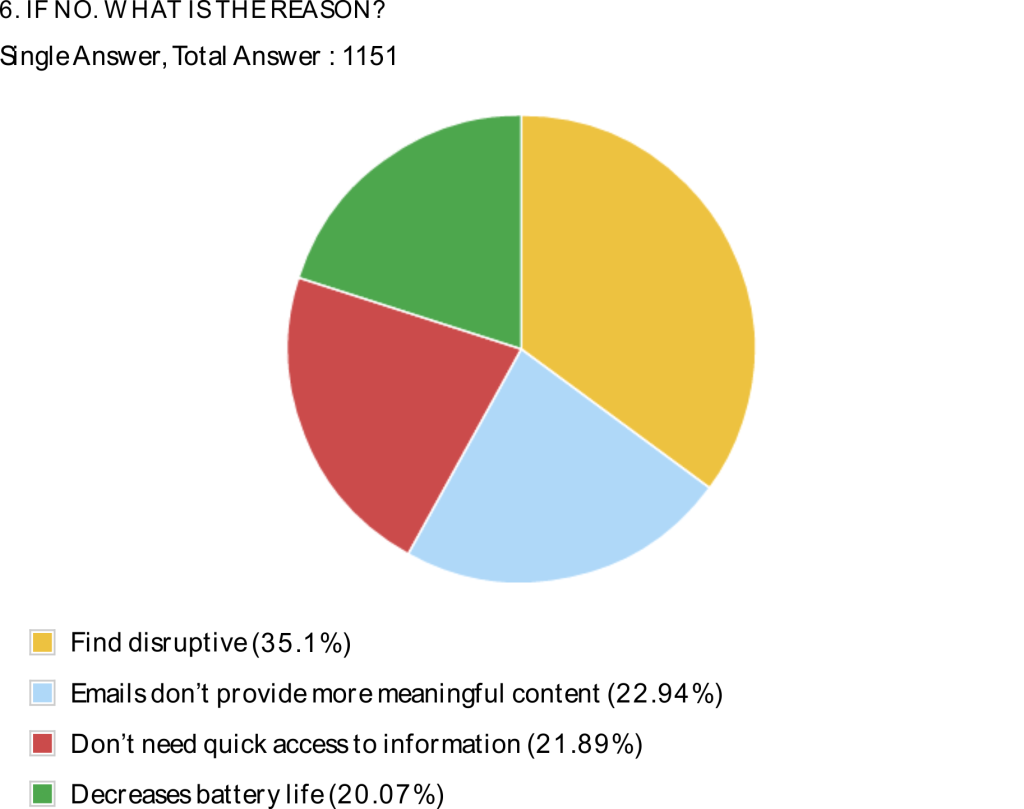

Meanwhile, 35.1% of respondents didn’t subscribe to emails from brands because it’s disruptive. Other reasons are because they find those emails doesn’t provide a meaningful content, they felt they don’t need quick access to brands information and also decreasing respondent’s battery life.

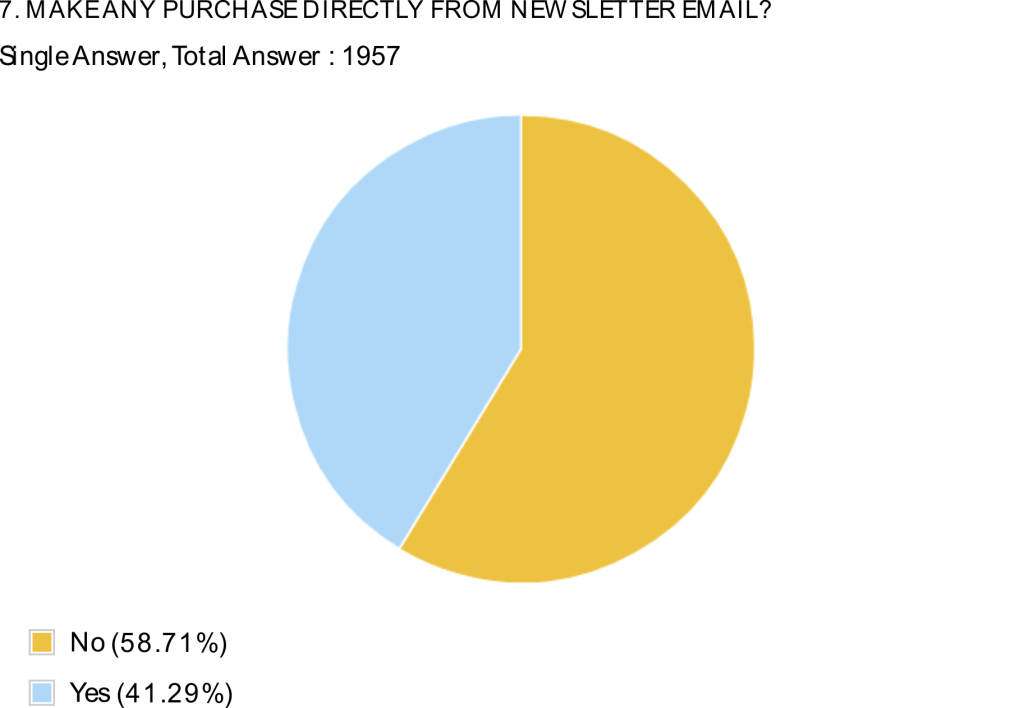

The effectiveness newsletter email as a way to reach costumer from a brand is positive when email contain relevant information or deals. We also checked how many of respondents that bought directly from newsletter

Buy Something Directly from Newsletter

Response to Push Notification

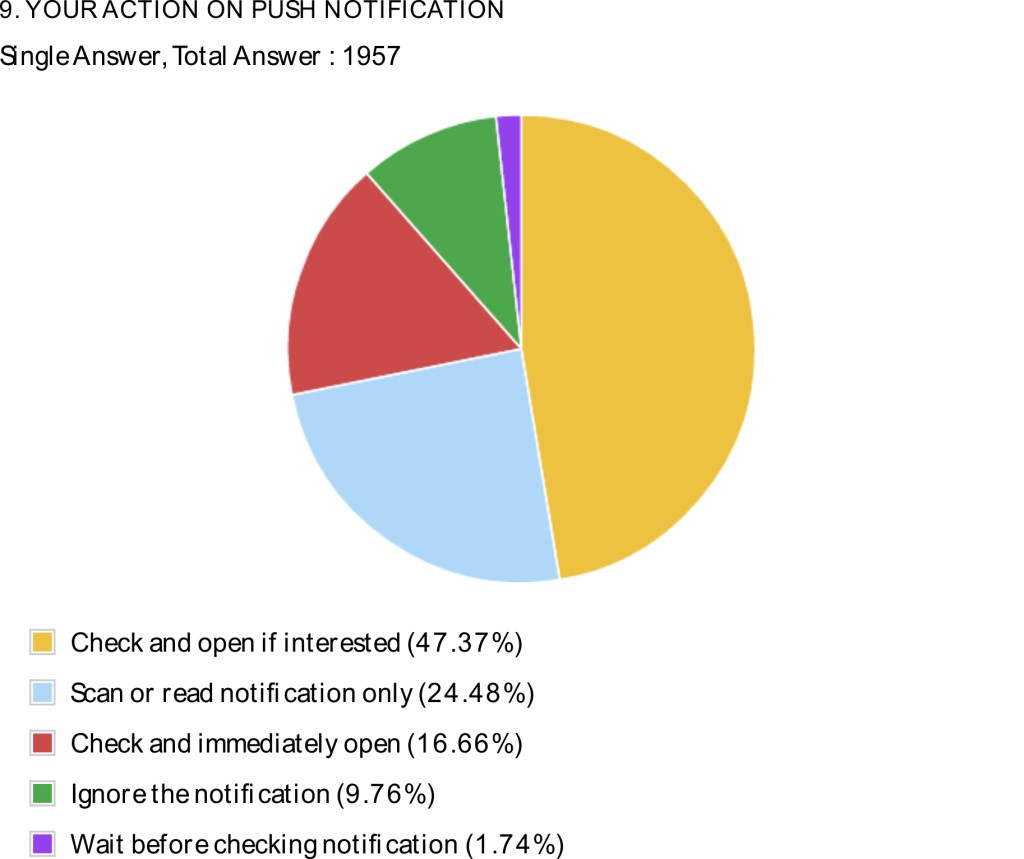

Push notifications (also called push messages, in-app messages, or in-app alerts) are messages that brands can send to consumers once they’ve downloaded their mobile app. These messages can take the form of alerts, reminders to resume shopping if a cart is abandoned, deals or offers (including location-based), and more. – Salesforce

Almost half of respondents (47.37%) reported to check and open their push notification if they are interested with the subject. Only 17% respondents always check and open it immediately. Meanwhile, 24.48% respondents just scanned and read the notification, 9.76% ignore the notification, and only slightly below 2% respondents wait before checking notifications.

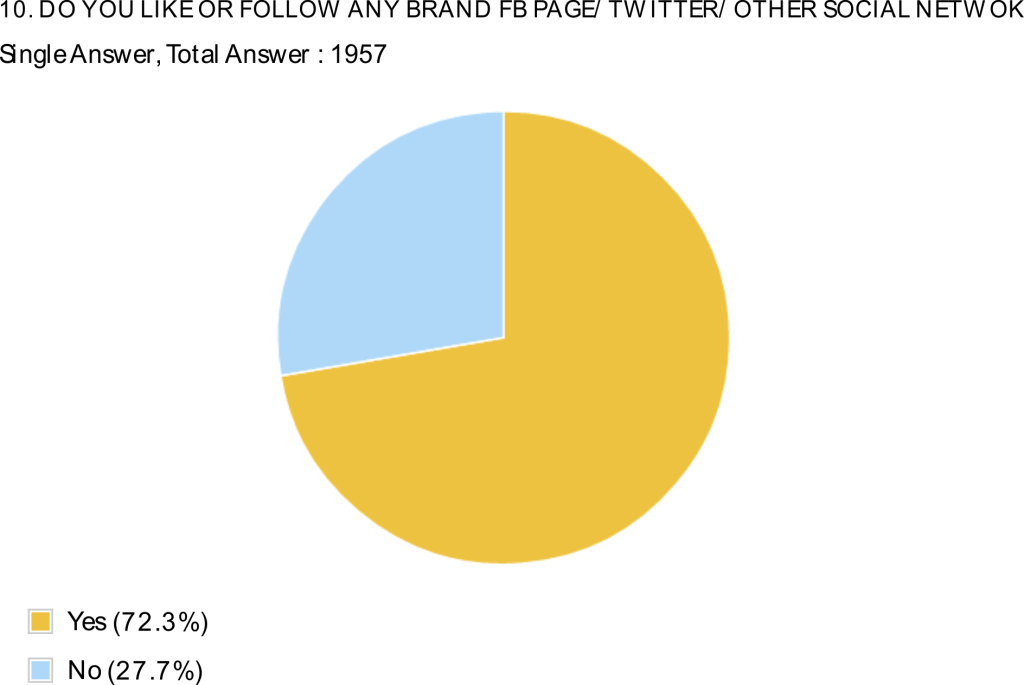

On Liking or Following Any Brand Social Media Channel

While social media is a common activity for the majority of mobile users, liking and following brands on social media is also reported to be common too. 72.3% of respondents said they’ve liked or followed a brand using a mobile device.

Yes

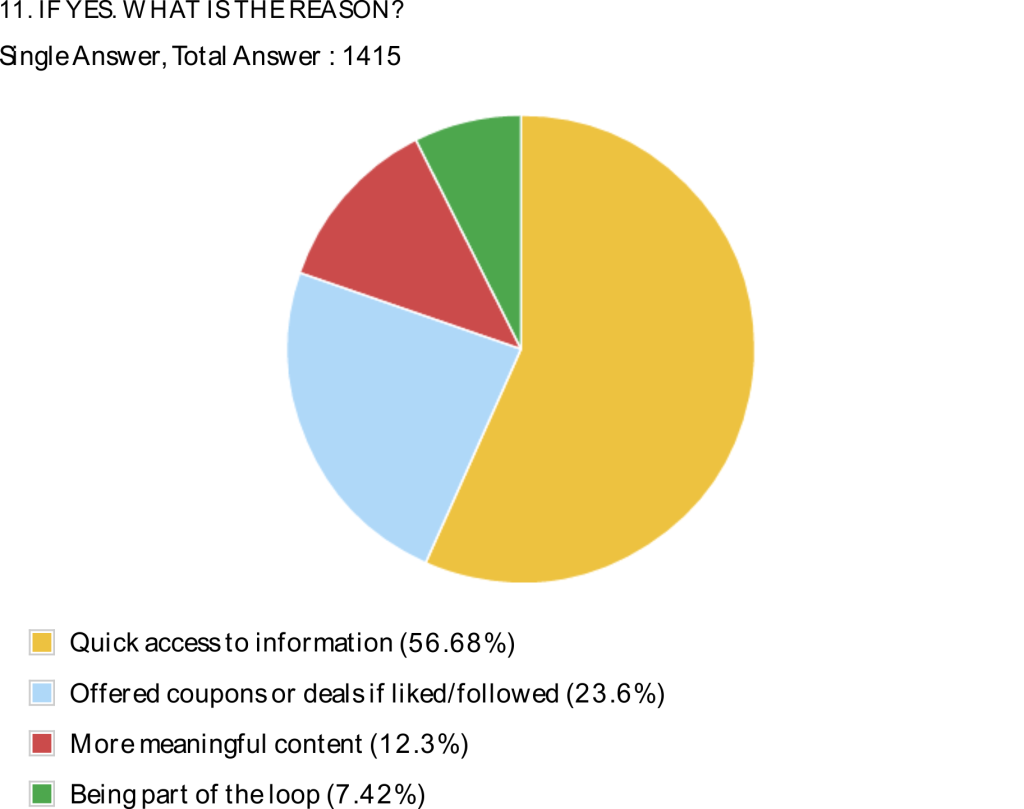

Toward those 72.3% respondent we also ask what is the reason they are following or liking brand’s social media channel.

Female respondent are significantly more likely to like or follow a brand on social media to receive coupons or deals (> 25% do so, compared to 23.90% of consumers overall); Male respondent are significantly more likely to read more meaningful content (> 13% like or follow for this reason, compared to 10.31% of female respondents).

But from overall respondent, the most reason is getting quicker access to information by liking or following brand social media (56.68%). Whereas needs of being part of the loop can attract only 7.42% attention from respondents.

No

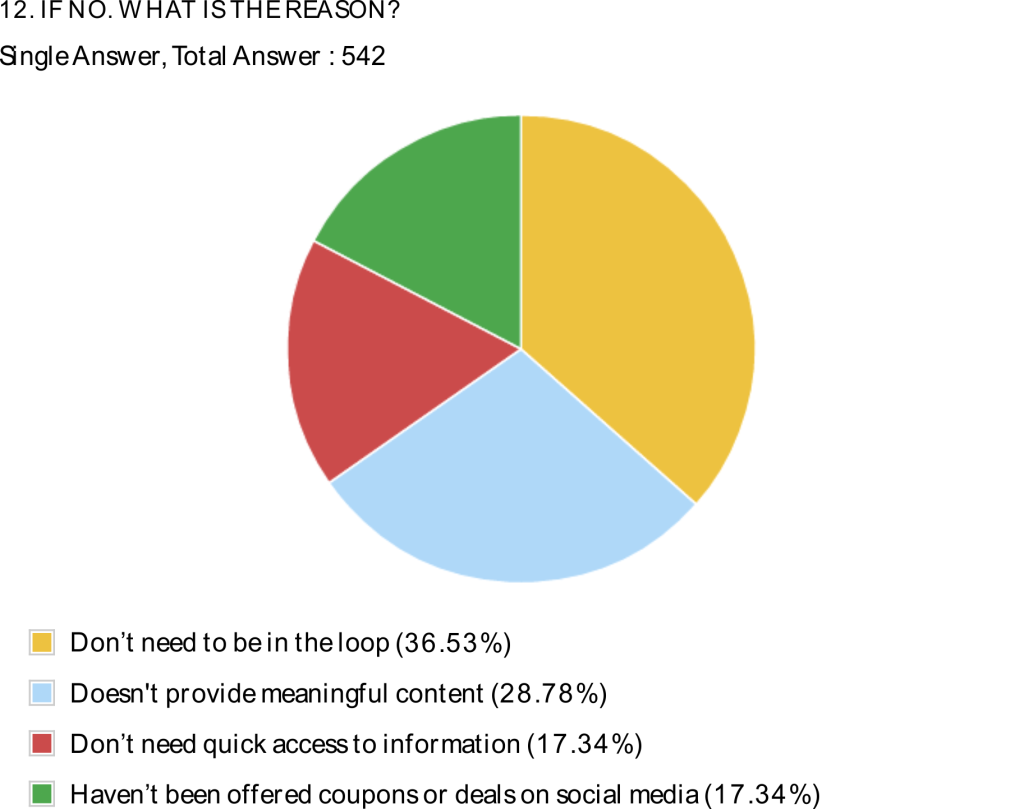

We also investigate to those respondents that stated not following or liking any of brand’s social media channel. Top reasons are : 1. They don’t need to be part of the loop (36.53%), 2. They cannot find meaningful content by following or liking brand’s social media channel (28.78%)

Ever Scan Coupon or QR Codes While Shopping In-Store

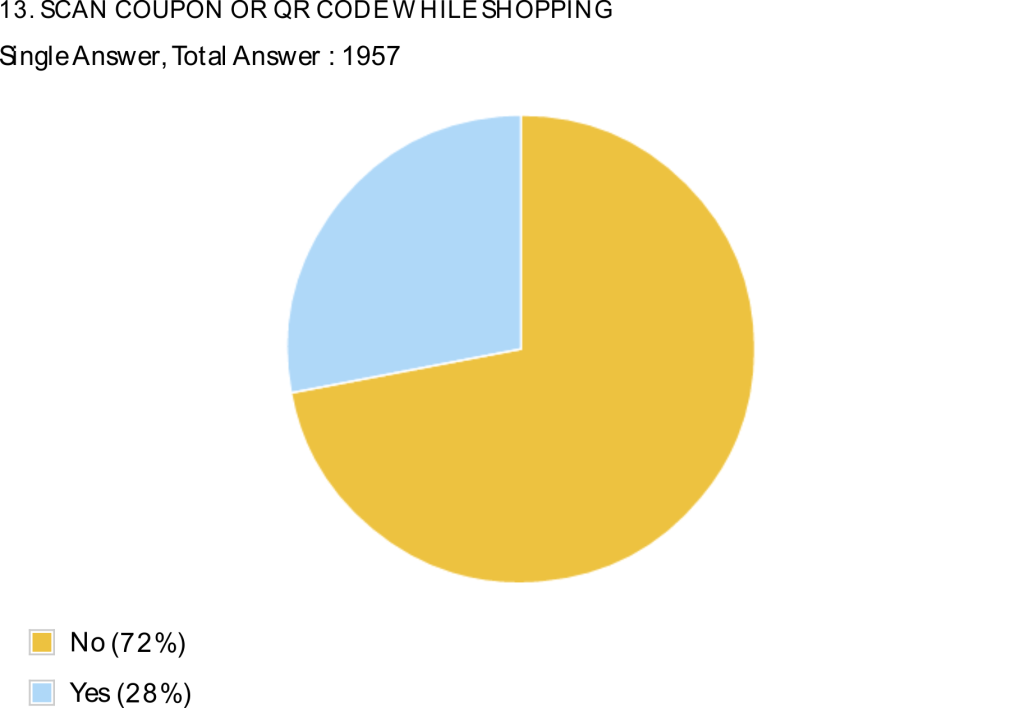

Only 28% respondent stated they have ever used them.

Yes

However, from those who have used them, 44%+ was interested because of the coupons and deals. And female respondent dominates this reason (>50%). 24.49% stated they use it to see whether it’s better to buy elsewhere.

No

Respondents are still deciding how much mobile shelf space they want brands to occupy. In some cases (like scanned coupons or QR codes), people may not know how to activate these mobile relationships. Almost half of respondents which is >45% said they either didn’t know how to use a scanned coupon or QR code or didn’t have the correct app. 38% of respondents didn’t find additional information helpful while 16% didn’t need quick access information. Brands must overtly explain how to opt in, the frequency of communications, and above all, why opting in will be beneficial.

If you want to download the report please click download XLS report below. JAKPAT report consists of 3 parts which are 1) Respondent Profile, 2) Crosstabulation for each question and 3) Raw Data. Respondent profile shows you demographic profiles ( gendr,age range, location by province, and monthly spending). Cross tabulation enables you to define different demographic segment preference on each answer.

Click the icon to download XLS report

Slideshare PDF can be downloaded here:

If you’re interested to do survey on retail and consumer goods field toward our respondents, we have over 23,000 mobile respondents ranged from age 17-50 years old, smartphone active users, and located in all regions of Indonesia that has installed our app and readily answering your survey.

Those 23,000 respondents has been verified, profiled, and continuously tracked to make sure you get the updated profiles of them. Our respondents has been profiled based on their demographic (age,gender,location, spending level, profession,religion), lifestyle habit (smoking/non, gamers/non, wearing glasses/non, frequent flyer/non, online shopper/non), and also brand consumption level ( brand A users, brand B users in FMCG, Retail, E-commerce,etc).

If you want to do research toward our respondent, please signup here and directly create your survey there. Or directly contact our Bizdev - Chrisprastika at +62-878-3908-9833. To non-Indonesian client, we offer free translation from foreign languages includes English, Chinese,Hindi,etc.

Source: