We may quite familiar with a quote said that “diamond is women’s best friend”. This quote clearly shows that women tend to love any luxurious things, especially jewellery and fashion items. In fact, Indonesian women do not only love the products but also love to buy it. According to The Economist Intelligence Unit, Indonesia’s number of the new wealth builders (NWB) citizens will be tremendously growing and put us into the second position after India in 2020. This powerful market segment then leads the increasing spending level of luxury goods. As once mentioned by The New York Times, Indonesia has been the home of luxury brands in Asia. At this point, we may conclude that Indonesia is the next big thing for this industry and its potential of luxury consumers are undoubted. As the growth of Indonesian luxury market is quite enormous, we try to understand this phenomenon by asking our respondents about the potential of female luxury market in Indonesia. We asked to 215 people from our panel of respondents in nationwide. Random sampling was chosen as the main sampling technique. The validity of this study has been checked. The confidence level of the survey was 95%, with only 5% margin error level.

In order to obtain specific number of Indonesian potential of female luxury market, we asked our respondents about their possession of luxurious fashion products. According to our data, there was quite huge number of Indonesian who possesses the items. More than half of Indonesian women who were surveyed in this study said that they own original fashion products from luxurious brand. Furthermore, we asked about the number of fashion products they owned to deeper our understanding about their potential. We found that most of them owns about 1-5 luxurious fashion item products. Surprisingly, women in the age of 20-25 years old even tend to own more numbers.

To be able to capture their detailed insights, we asked about their collection of luxurious fashion products. Four fashion items were mentioned by most respondents. Bag, shoes, and clothes were found as the most mentioned. At the last position, accessories such as watch, jewellery, and perfume were also mentioned.

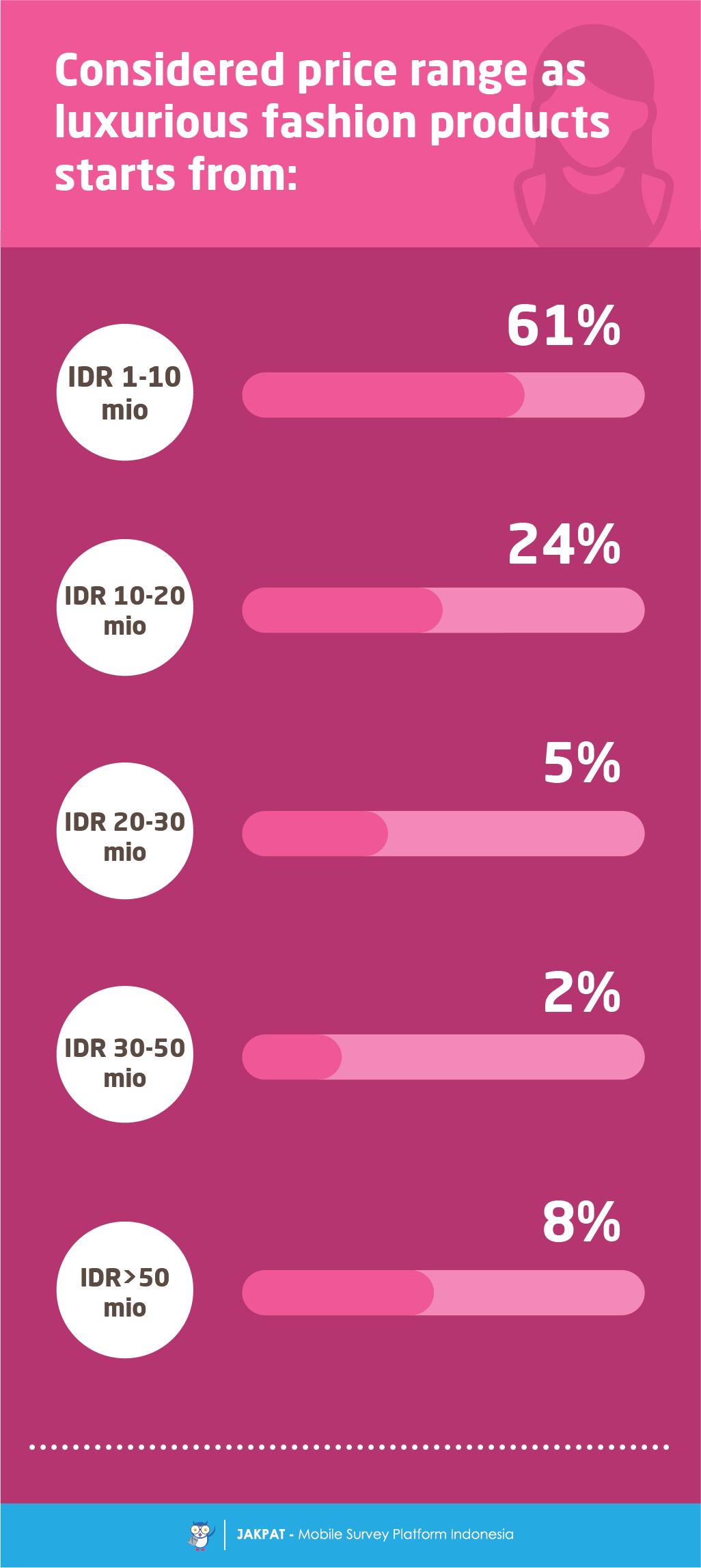

The high number of women who owns luxurious fashion products and their financial power then lead us to the question of their perception of price. We would like to explore their consideration of price range that was suitable to be categorized as luxurious. Interestingly, we found that although Indonesian women who own number of luxurious fashion products tend to have powerful financial resource, their considered price range as luxurious fashion products remain low. Most of them already considered any fashion products between IDR 1-10 million as luxurious already. Only less than 10% considered that fashion products in above IDR 50 million as luxurious.

Since luxurious fashion products was never cheap, we asked about respondents’ motivation of owning. In general, there were three main reasons found. At first, respondents consider that the product has an interesting model. At second, besides having interesting model, the product was also considered as trendy and fashionable. At third, they felt that the products were exclusive and elegance. Furthermore, there were other substantial motives of respondents in 30-39 years old who considered luxurious fashion products as reselling asset in the future.

The expensive price of products is considered as the biggest constraint of buying luxurious fashion products among Indonesian women. However, the potential of this industry remains high. More than half of them said that they have the intention to buy luxurious fashion products when they have financial resource.

As luxurious fashion products were only sold at certain places, we asked our panel of respondents about their shopping destination preferences. Most respondents said that they were more likely to buy the luxurious products in its official store or gallery. Besides that, online shop seems to be less preferable but chosen solution.

Purchasing luxurious fashion products were not as the same as buying massive products. With a relatively high price, these products were not accessible for all segments. Moreover, as we discussed in previous finding, Indonesian women among 20-25 years old tend to own more number of fashion items than the older segment. We then asked our respondents about who purchase their goods. Over all, most respondents said that they bought the luxurious products by themselves. However, the 20-29 years old respondents also said that they had their parents bought it for them, while the 30-39 said it was their boyfriend or husband.

The payment method also became our attention. We asked about the most preferable payment method for luxurious fashion products. Almost our respondents said that cash became their most preferred method. While less than 10% of them preferred credit card, seller, or shop instalment.

As we knew, there was high intention among Indonesian women to wear luxurious fashion products. In other hand, they should face the challenge of expensive price as biggest constraint. This condition leads to a new kind of solution, luxurious fashion items rental service.In fashion rental service, we can rent even the latest collection of luxurious fashion products in a relatively cheaper price than buying a new one. This kind of service was relatively new and available only in the big cities. Surprisingly, for a new started business, this service was able to show positive response, showed by 10% of women in 30-35 years old who said ever tried the service.

At the very last, to ensure the potential of Indonesian female luxury market, we asked about their willingness of buying or renting. Surprisingly, although they once said that they want to buy luxurious fashion products when they have the financial power, only 38% of them consider buying or rent the products for special occasions.

For more detail you can download XLS report at the button below (bahasa). JAKPAT report consists of 3 parts which are 1) Respondent Profile, 2) Crosstabulation for each question and 3) Raw Data. Respondent profile shows you demographic profiles ( gender,age range, location by province, and monthly spending). Cross tabulation enables you to define different demographicsegment preference on each answer.

You can also download PDF here:

or Get A Sales Quote by filling this form or Call to +622745015293