There are many ways to maintain skin health, one of them is consuming beauty drinks and skin supplements. Both of these products usually contain collagen or vitamin E which is important for the skin.

Collagen serves to increase skin hydration and elasticity, also helping to reduce wrinkles. Meanwhile, vitamin E has moisturizing benefits and has natural anti-inflammatory properties, so it can and helps soothe the skin.

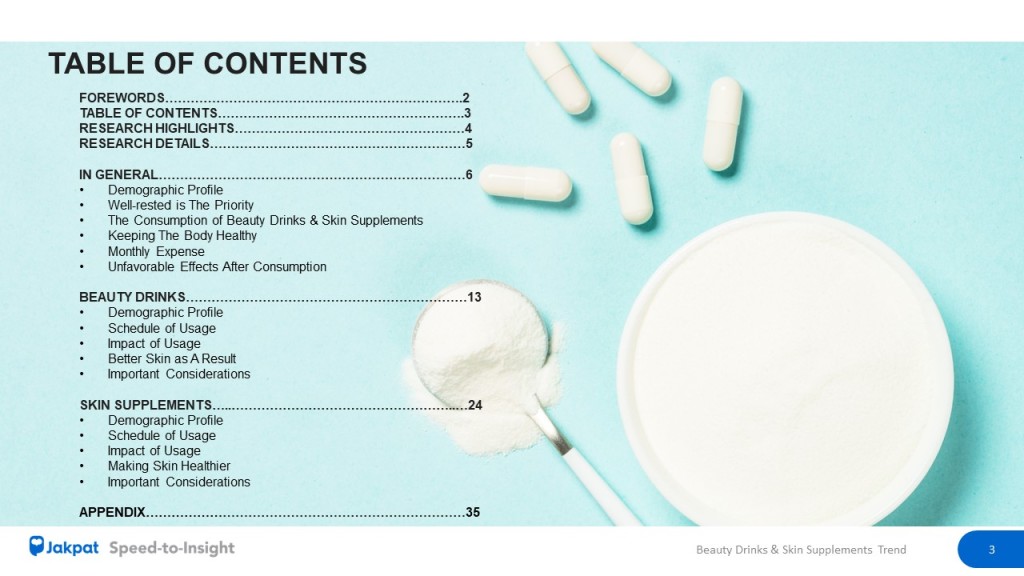

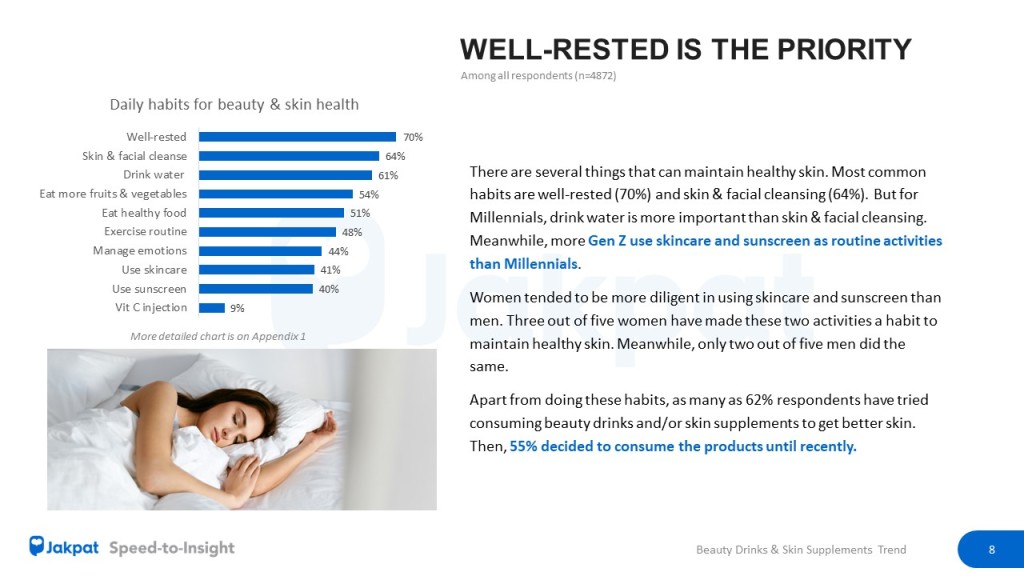

Jakpat conducted a survey of 4872 respondents to see their concern in maintaining healthy skin, especially with the consumption of beauty drinks and skin supplements, as well as the brands used. The most common healthy habits that respondents do is well-rested (70%) and skin & face cleansing (64%). More specifically, Millennials consider drinking water as the priority rather than cleansing the skin & face. Meanwhile, Gen Z use more skin care and sunscreen as routine activities than Millennials.

“The growth of the skincare industry in Indonesia has grown rapidly in recent years. This can be seen from changes in consumer behavior that assess that skin health conditions and appearance are valuable assets, “said Head of Research Jakpat, Aska Primardi.

Motivation to consume

The Jakpat survey stated that half of respondents consumed beauty drinks and/or skin supplements in the last three months. In details, 56% consumed beauty drinks and 54% consumed skin supplements.

“Skincare products from outside the body usually require a longer process, because they are usually divided into several stages ranging from cleansing to moisturizing, and these stages must be done in the order. So it is not surprising that skin care products in the format of drinks and supplements can be increasingly developed today, “said Aska.

The top reason consumers continue to consume beauty drinks and/or skin supplements is to maintain their general health (71%). Other motivations are to maintain healthy skin (64%) and solved skin problems such as acne or dry skin (59%).

Beauty drinks

Most respondents consumed beauty drinks once a day (34%). Then, they also preferred to enjoy this product at night (37%).

“Skincare in the form of drinks is considered simpler and easier to do than the use of skincare from outside the body. Moreover, if the beauty drinks can have a taste that consumers like and can cause a positive mood after consuming it,” said Aska.

As many as 86% of consumers claimed to feel the benefits of consuming beauty drinks. One-third of them claimed their skin was brighter, precisely became glowing and not dull. There are also respondents who felt healthier skin (20%) and fitter body (18%).

Skin Supplements

Most respondents took skin supplements once a day (33%). The consumption time of this product is generally at night (41%).

The most common change experienced after taking skin supplements is that the skin becomes brighter (28%), precisely becomes glowing and not dull. In addition, 16% of respondents claimed to have healthy skin.

Get the details on our report here.