After experiencing a correction due to the pandemic in 2020, the motorcycle market has rebounded.In 2022[1], motorcycle sales volume for the domestic market reached 5,221,470 units, or an increase of 3.2% compared to the previous year, which was 5,057,516 units. Meanwhile, until November 2023[2], motorcycle sales volume for the domestic market has reached 5,809,959 units, or an increase of 22.6% compared to the same period last year, which was 4,738,216 units. With such a large market volume, it is not surprising that until now motorcycles are still the most popular mode of transportation in Indonesia.

Jakpat conducted a survey to find out the purchase rate of Indonesian motorcycles and what are the factors that make people choose the vehicle brand. The report involving 1021 respondents shows the use of motorcycles, the level of interest in using motorcycles, the age and brand of motorcycles used, and the impression/brand image of motorcycles in Indonesia. This survey involved respondents aged 17-54 people and was conducted online on November 17-23, 2023.

Motorcycle use in Indonesia

The results of the Jakpat survey stated that 9 out of 10 people use motorcycles as their daily transportation. Meanwhile, 67% of respondents who do not use motorcycles claim to be interested in using this two-wheeled vehicle for daily life.

Of the 930 respondents who used motorcycles, almost 60% stated to drive two-wheeled vehicles under 5 years old. That is, the vehicles they own are produced between 2018 and 2023.

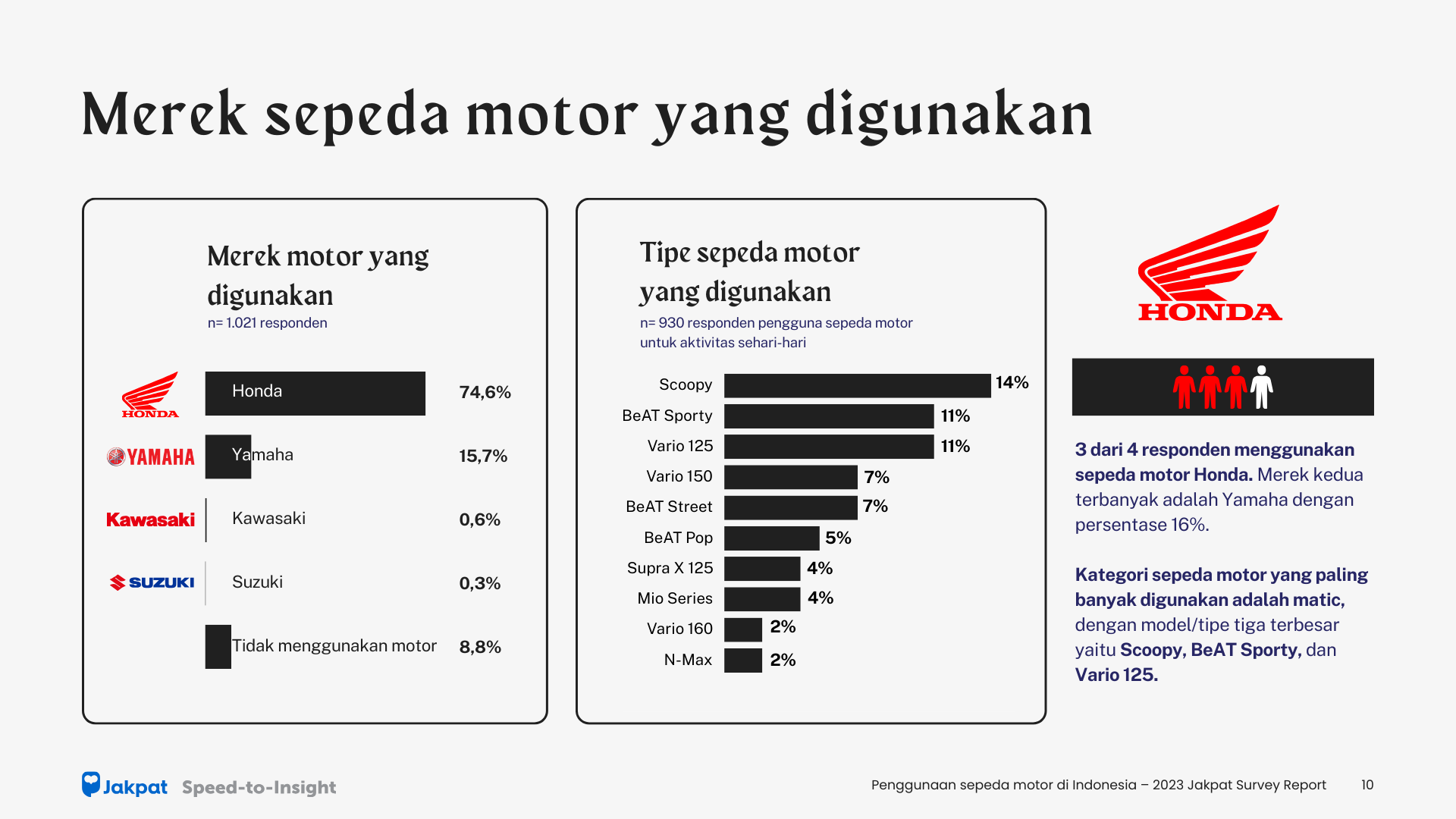

Of all respondents, as many as 75% use Honda motorcycles. The next rank is Yamaha and Kawasaki with percentages of 16% and 1%. In general, the most widely used motorcycle category is matic with the three largest namely Scoopy, BeAT Sporty, and Vario 125.

Impression/brand image of motorcycles in Indonesia

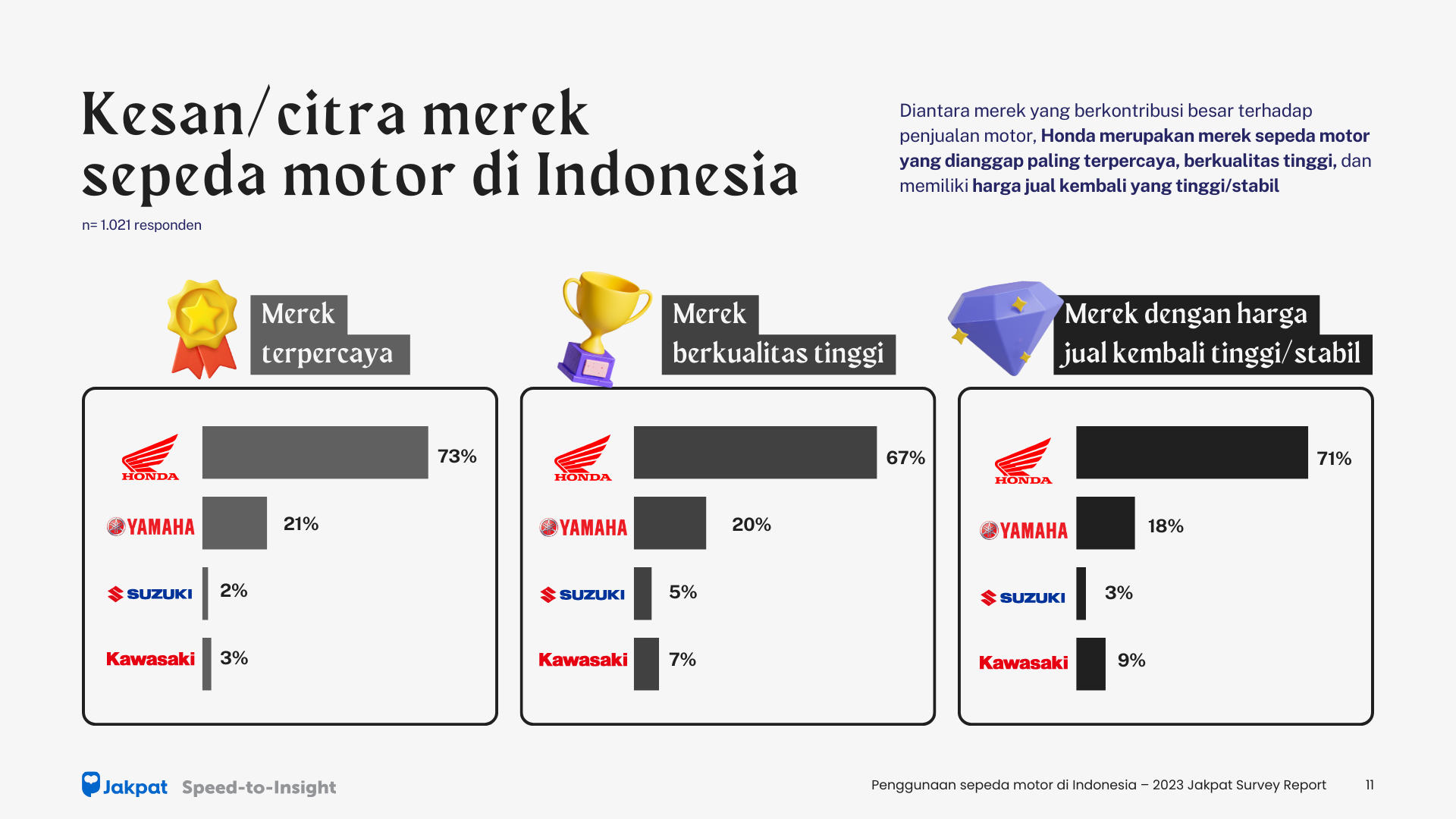

In choosing a motorcycle, many things are considered both rational and emotional. Brand impression/image is one of the factors considered and consists of several aspects including trusted brands, high quality, and high/stable resale prices.

Jakpat respondents assessed that the trusted brand aspect was dominated by Honda at 73%, followed by Yamaha (21%), Kawasaki (3%), and Suzuki (2%). In addition, Honda also excels as a high-quality brand (67%) compared to Yamaha (20%), Kawasaki (7%), and Suzuki (5%). Another aspect is the high/stable resale price with the highest percentage being Honda at 71%, followed by Yamaha (18%), Kawasaki (9%), and Suzuki (3%).

“A high positive image of a brand will be directly proportional to the number of users. This is what Honda brand shows. A positive image can make consumers interested in Honda motorcycles. Then when he uses the motorbike, and it turns out he also gets a positive experience, then he can become a loyal advocate consumer, “said Head of Research Jakpat, Aska Primardi.

Get the details on our report here.

[1]https://www.aisi.or.id/statistic/

[2] Idem