Digital entertainment has become a familiar thing, from watching movies or series to listening to music or podcasts. All forms of entertainment can be accessed from mobile devices or smartphones (hereinafter referred to as mobile entertainment). In addition, social media is also one of the reliable mobile entertainments.

Jakpat conducted a survey to determine the behavior and habits of Indonesians in using mobile entertainment and social media in the second half of 2023. The report involved 2356 mobile entertainment users and 2446 social media users.

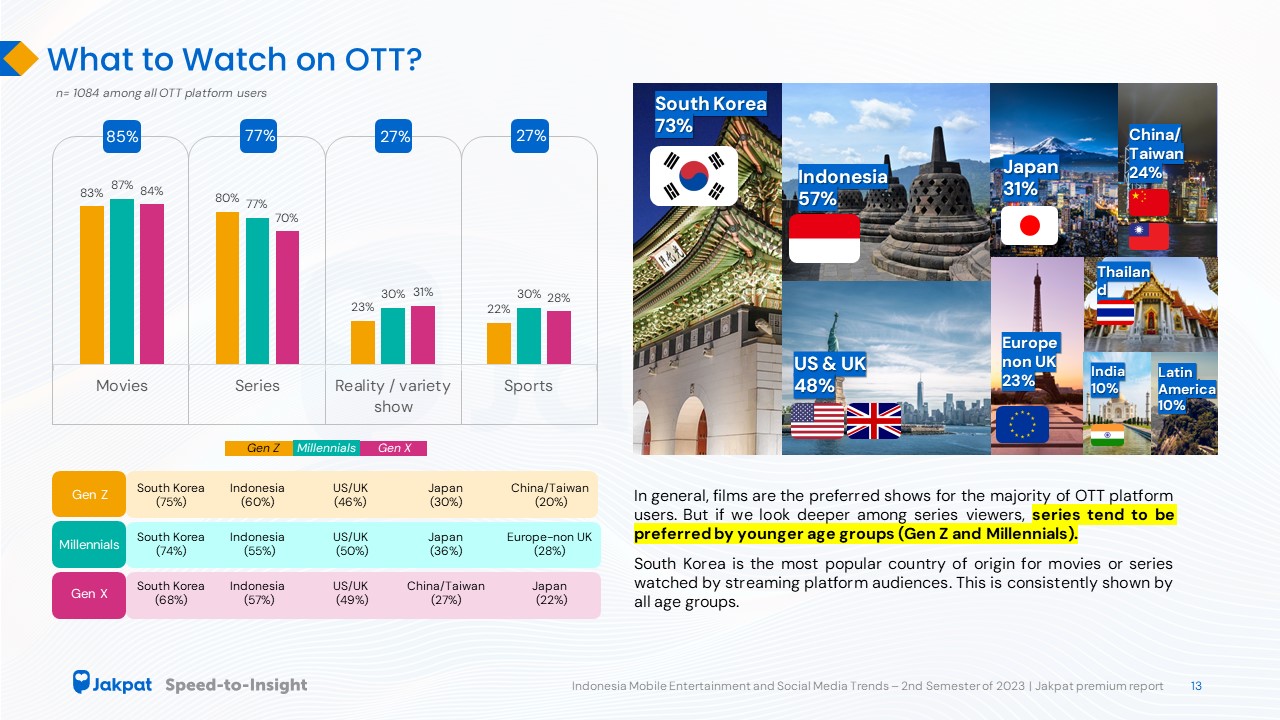

The report highlights the use of over-the-top (OTT) platforms such as Vidio, Netflix, or Disney+ Hotstar. As many as 85% of respondents use OTT to watch movies, 77% to watch series, and 27% to watch reality/variety shows. Based on country of origin, the most watched content is from South Korea (73%), followed by Indonesia (57%), and English-based countries, namely America and the United Kingdom (48%).

Head of Research Jakpat, Aska Primardi, revealed that access to mobile entertainment platforms remains a routine activity carried out every day. However, innovations are needed so that users of an OTT do not leave the platform.

“So now an OTT platform is starting to penetrate other entertainment fields, for example, Netflix with game or news menus, so these two fields can be an entry point for new prospective users, and also become other entertainment alternatives for users,” he said.

In addition to OTT, other entertainment is music streaming and podcasts. Jakpat data shows that 83% of respondents stream music while relaxing. In general, pop is a music genre that is listened to by the majority of music streamers with a percentage of 83%. The second and third positions are K-pop (47%) and dangdut (37%). Based on country of origin, music from Indonesia still dominates playlists (85%), followed by America and the UK (71%), and South Korea (44%).

When it comes to podcasts, comedy (47%) and education (43%) are the topics most liked by listeners, especially Gen Z and Millennials. Meanwhile, Gen X tends to be more interested in political issues or the latest news.

Mobile entertainment subscription fee

To enjoy OTT platform content, users generally need to pay a subscription fee. As many as 39% of respondents admitted that they do not mind paying a subscription fee to be free from annoying ads.

Meanwhile, the interest to subscribe to audio streaming platforms for the sake of no ads is quite large among Gen Z with a percentage of 47%. Although, on the one hand, there are 57% of respondents claim they access free audio streaming platforms for now.

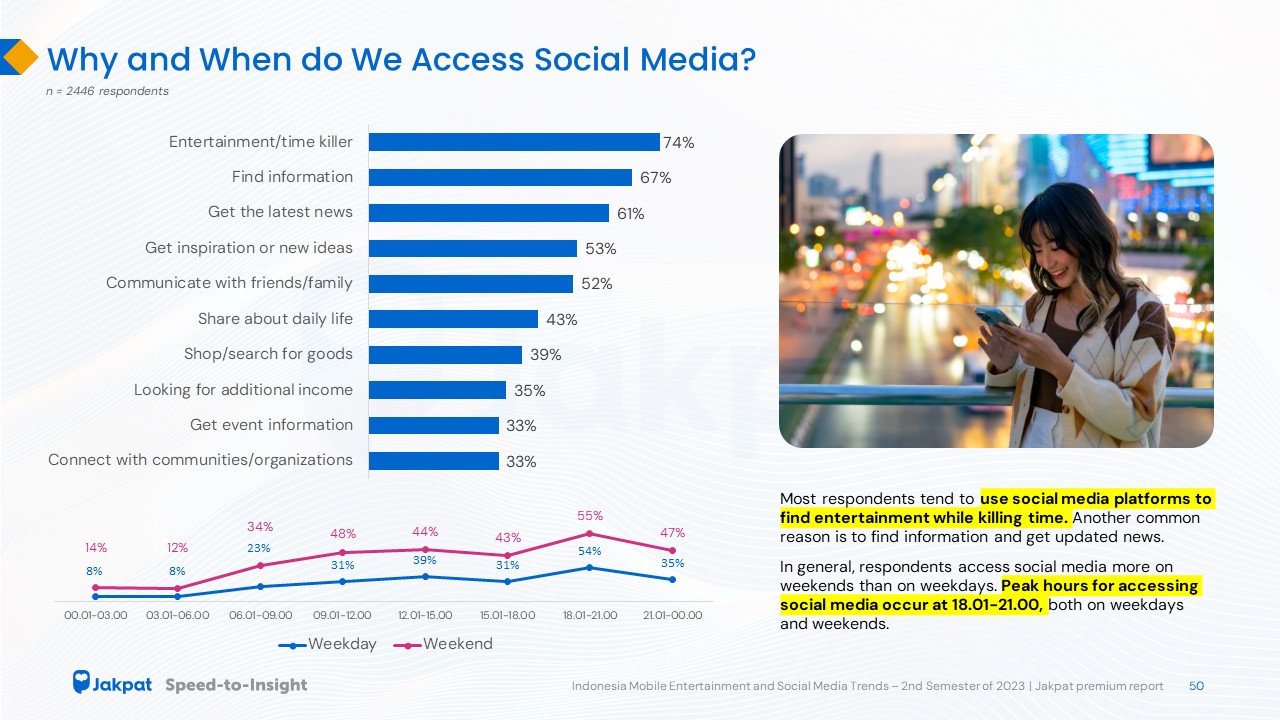

Another entertainment that is no less popular is social media. Instagram is the most loved social media where 78% of respondents using it, followed by YouTube (76%) and Facebook (64%). Regarding the topic, as many as 46% of users claim to like to find information related to music/movies/series on social media. Culinary (43%) and cooking (39%) content are also liked by netizens.

Get the details on our report here.

![[FREE] E-Commerce Trends 2nd Semester 2023-Jakpat Premium Report_241223_10](https://blog.jakpat.net/wp-content/uploads/2023/12/FREE-E-Commerce-Trends-2nd-Semester-2023-Jakpat-Premium-Report_241223_10.jpg)