Bank Indonesia defines e-money as stored-value or prepaid products in which a record of the funds or value available to a consumer is stored on an electronic device in the consumer’s possession (Hidayati, Nuryanti, Firmansyah, Fadly, & Darmawan, 2006).

According to Detik, e-money usage in Indonesia had increased positively from 2009 to 2012. In 2009, e-money transaction reached 1.4 billion IDR a day. Then in 2010 it reached 1.9 billion IDR. In 2011, the transaction reached 2.7 billion IDR. Then, next, in 2012 it reached 3.9 billion IDR. We can see that on each year, e-money transaction grew 120%.

Based on those facts, JAKPAT tried to conduct a survey concerning e-money usage in Indonesia. We tried to know the reason encouraging Indonesians for using e-money. Next, this survey was followed by 489 respondents.

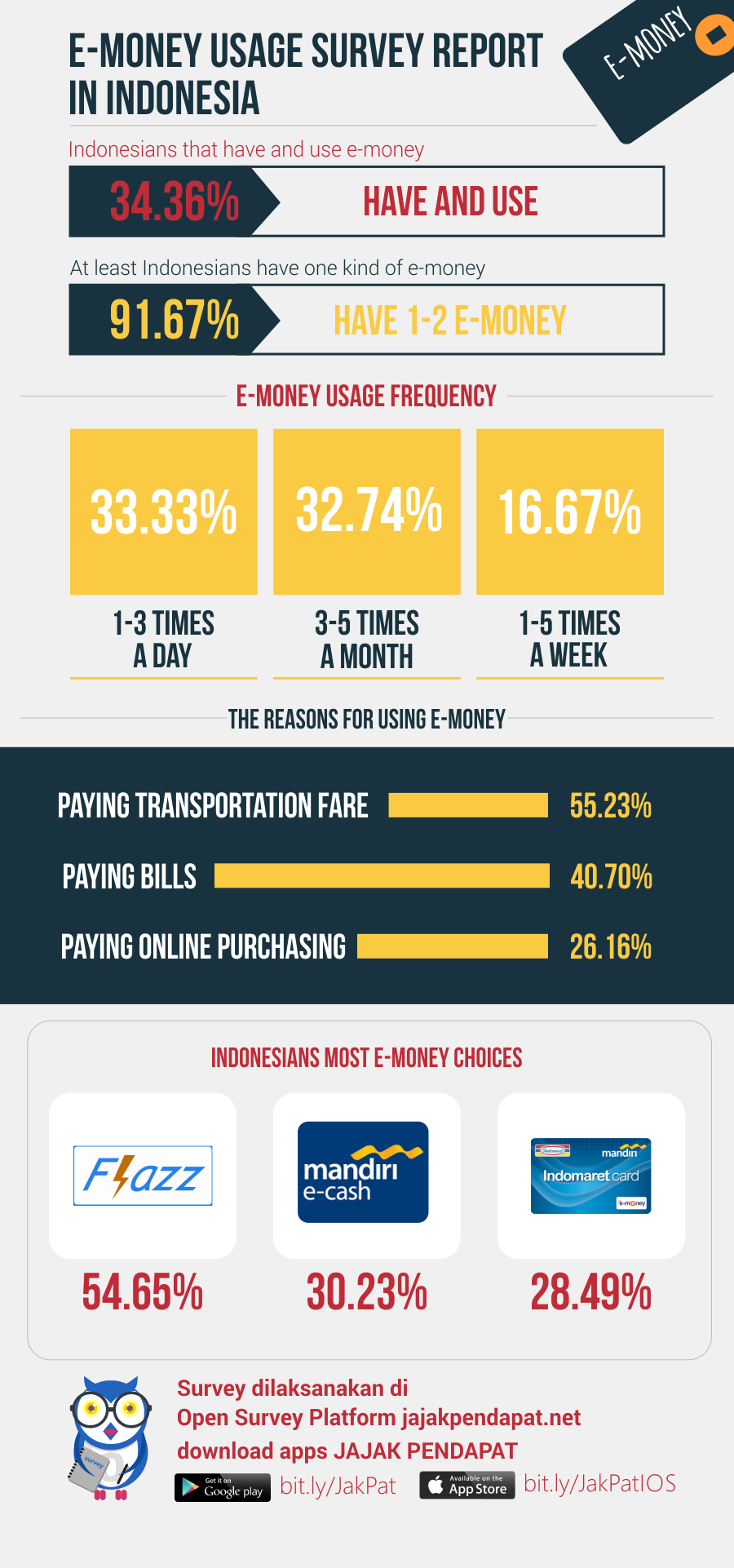

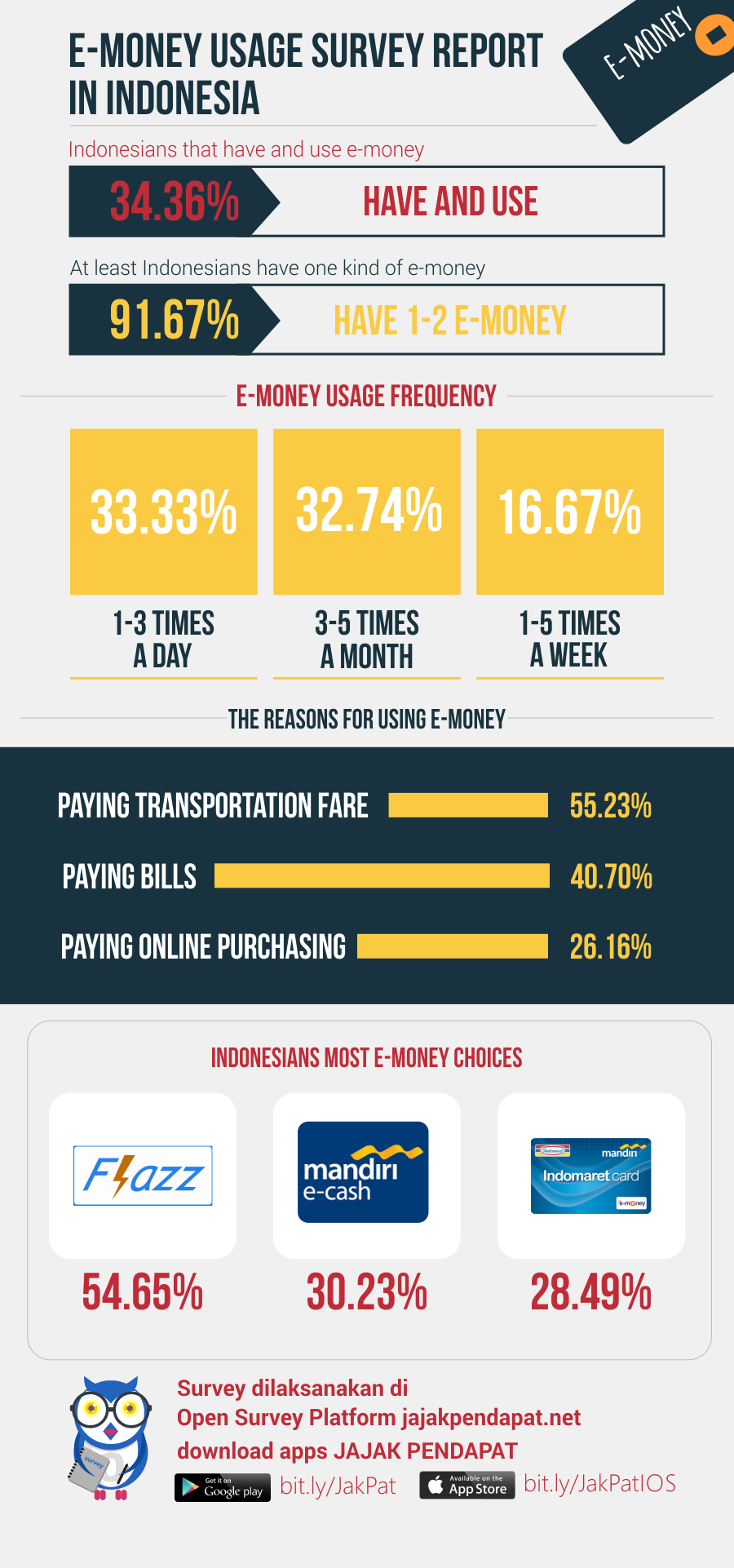

30%+ Use E-Money

At first, we chose respondents having and using e-money among 498 respondents that would be analyzed in this survey. Because from those respondents we found that only 168 respondents have and use e-money (34.36%), thus those respondents answer the following questions in this survey. More respondents not having and using e-money (66.06%).

91.67% Own At Least One

While questioning about how many kinds of e-money that they have, most respondents answered that they have 1-2 kinds each(91.67%). We found most respondents that own at least one e-money here are college students.

Transportation is main driver

Respondents have several reasons for using e-money but mostly they use it to pay their transportation fares (55.23%), and second, to pay their bills (40.70%), such as electricity bill and telephone bill. Below are the comparison between male vs female respondent in using e-money :

|

Q4 (multiple answer) : why do you use e-money as your payment method?

|

Total

|

Gender |

| Male |

Female |

|

Option 1 : i want to pay my bills (ex: purchasing over particular merchant like Indomaret, electricity bill, telephone bill, toll bill and TV cable bill)

|

70 |

37 |

33 |

| 40.70% |

21.51% |

19.19% |

|

Option 2 : i want to pay my transportation fare (ex: train, busway and plane)

|

95 |

46 |

49 |

| 55.23% |

26.74% |

28.49% |

|

Option 3 : i want to pay my online purchasing

|

45 |

25 |

20 |

| 26.16% |

14.53% |

11.63% |

|

Option 4 : i want to pay my voucher game

|

15 |

11 |

4 |

| 8.72% |

6.40% |

2.33% |

|

Total

|

225 |

119 |

106 |

| 130.81% |

69.19% |

61.63% |

Flazz BCA as Most Popular One

We also asked what e-money they own and prefer to use. Results are shown in table below :

| 1 |

Flazz |

96 |

55.81 % |

| 2 |

Mandiri E-Cash |

53 |

30.81 % |

| 3 |

Indomaret Card |

49 |

28.49 % |

| 4 |

BRIZZI |

38 |

22.09 % |

| 5 |

E-Toll Card |

33 |

19.19 % |

| 6 |

Rekening Ponsel |

28 |

16.28 % |

| 7 |

XL Tunai |

16 |

9.3 % |

| 8 |

TCash |

15 |

8.72 % |

| 9 |

JakCard |

13 |

7.56 % |

| 10 |

DokuWallet |

9 |

5.23 % |

| 11 |

Mega Cash |

8 |

4.65 % |

| 12 |

Dompetku |

8 |

4.65 % |

| 13 |

TapCash |

6 |

3.49 % |

| 14 |

Kartuku |

4 |

2.33 % |

| 15 |

GazCard |

3 |

1.74 % |

It turns out that Flazz BCA is the most popular one followed by Mandiri E-Cash.

References:

http://id.techinasia.com/17-pemain-emoney-indonesia-yang-bisa-anda-gunakan-untuk-belanja/

http://www.bi.go.id/id/publikasi/sistem-pembayaran/riset/Documents/4a79ad4a8dbe4ebca2c0f86a5a2f1c69KajianEMoney.pdf

http://inet.detik.com/read/2013/11/12/085423/2410146/328/indonesia-masuki-era-baru-uang-digital?i991102105

For more detail you can download XLS report at the button below. AKPAT report consists of 3 parts which are 1) Respondent Profile, 2) Crosstabulation for each question and 3) Raw Data. Respondent profile shows you demographic profiles ( gendr,age range, locationby province, and monthly spending). Cross tabulation enables you to define different demographic segment preference on each answer.

Click the icon to download XLS report

If you’re interested to do survey on retail and consumer goods field toward our respondents, we have over 23,000 mobile respondents ranged from age 17-50 years old, smartphone active users, and located in all regions of Indonesia that has installed our app and readily answering your survey.

Those 23,000 respondents has been verified, profiled, and continuously tracked to make sure you get the updated profiles of them. Our respondents has been profiled based on their demographic (age,gender,location, spending level, profession,religion), lifestyle habit (smoking/non, gamers/non, wearing glasses/non, frequent flyer/non, online shopper/non), and also brand consumption level ( brand A users, brand B users in FMCG, Retail, E-commerce,etc).

If you want to do research toward our respondent, please signup here and directly create your survey there. Or directly contact our Bizdev - Chrisprastika at +62-878-3908-9833. To non-Indonesian client, we offer free translation from foreign languages includes English, Chinese,Hindi,etc.