Currently, Indonesian is faced with various campaign activities in various places and media ahead of the upcoming elections. Starting from the election of President and Vice President, members of the House of Representatives, members of district/city Legislative Councils, and members of regional representative councils.

Jakpat surveyed 1276 respondents to find out people’s perspectives on current political campaign activities. In addition, this survey also to find out the political preferences of respondents neutrally without having associations or supporting certain political parties.

The survey results showed that 74% of respondents claimed to follow the progress of the current political campaign. Then, the majority of respondents also expressed interest in ongoing political campaigns, with 68% of Gen Z, 65% of Millennials, and 61% of Gen X showing interest.

Furthermore, 70% of respondents chose to know the quality of the candidates as the first reason for their interest in the current political campaign, followed by 55% who wanted to get insights/references/views to convince the choice, and 53% of respondents who chose as a real action in supporting the growth of the Indonesian nation.

For those who are not interested in campaigns, 41% of respondents choose if they don’t want to bother themselves, then 39% do not like things related to political issues, and 30% of respondents admit that a lot of negative information or news involving government elements is the reason for their disinterest in current political campaigns.

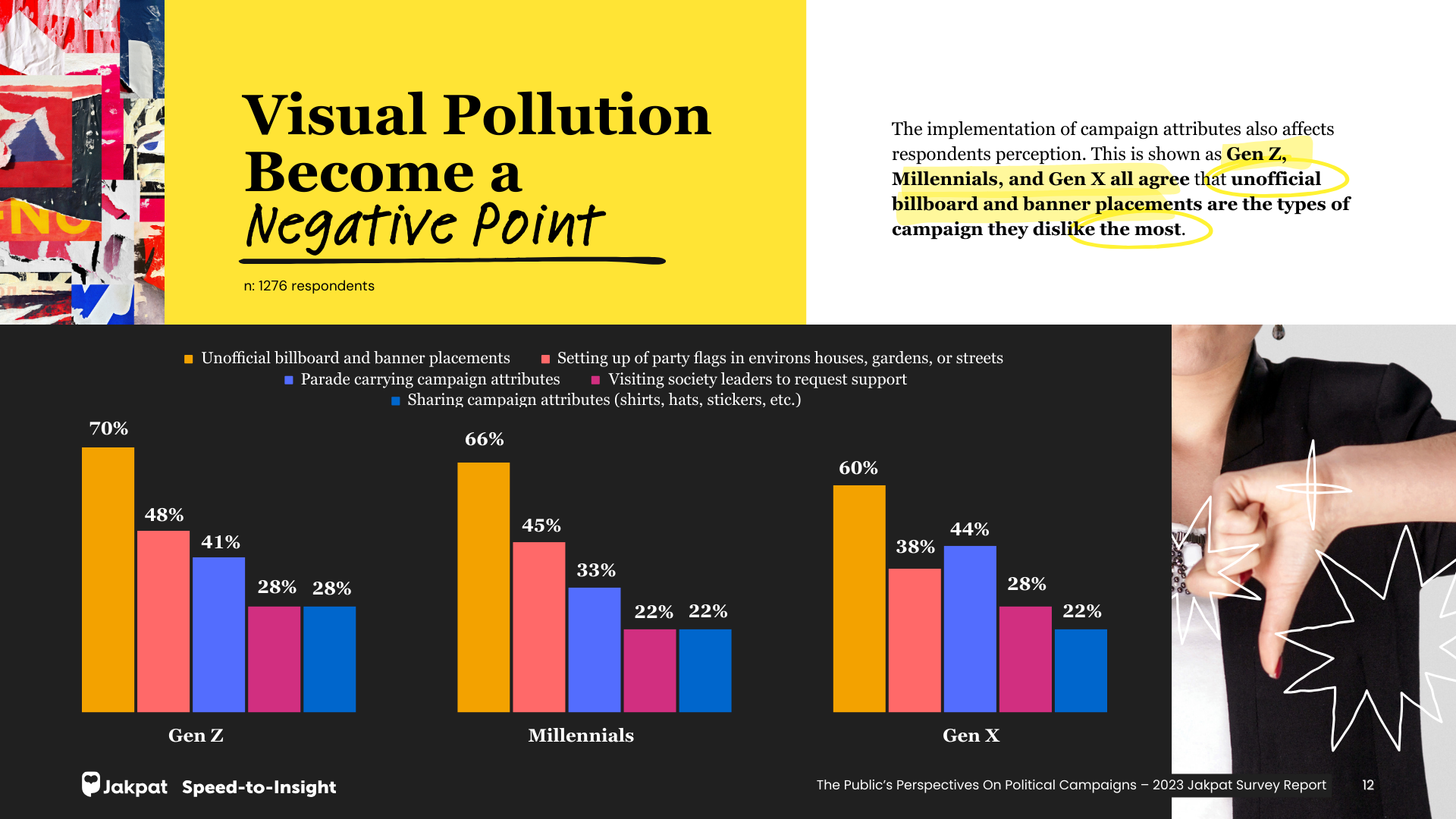

Types of Campaigns Respondents Like and Dislike

Social activities are the first type of campaign preferred by respondents (61%), then the type of direct campaign, which is when candidates are present in front of the public (55%). In addition, conducting debates with other candidates (40%), campaigns with digital publications such as TV, radio, podcasts, YouTube, and others (33%), to candidates having limited discussions with a group of people (24%).

Meanwhile, for the type of campaign they disliked, respondents chose the installation of billboards and banners unofficially to be the type of campaign they disliked the most (66%). Then the installation of party flags in neighborhoods, parks, or streets (44%), marches carrying campaign attributes (38%), going to community leaders to ask for support (25%), to distributing campaign attributes such as t-shirts, hats, stickers, and others (24%).

Resources & Choosing Decisions

Respondents get information about ongoing campaign activities from different sources. TV and radio (53%) are the most preferred sources by Gen X, while for Gen Z and Millennials who use digital media and social media the most, information comes from Instagram and TikTok.

Head of Research Jakpat, Aska Primardi explained that the current campaign situation is assessed differently by each group of voters. For Gen Z, this 2024 election is their first experience of being involved and exercising their right to vote, so, naturally, the majority of Gen Z does not yet have a final say on who to vote for. What’s more, the majority of Gen Z prefer TikTok (51%) as a means of getting to know presidential candidates and legislative candidates, where there are many debates they pay attention to. This is why the majority of them are still confused in making their choices.

“Unlike the case with Gen X, the majority of whom have decided who to choose, because indeed Gen X has learned from previous experience and knowledge about presidential candidates or legislative candidates. The majority of Gen X prefer conventional media such as TV and radio as sources of campaign information, and they consider that the current campaign situation is still peaceful and conducive. Thus, it is natural that Gen Z is the main target of candidates and political parties because in addition to the proportion in the population being one of the largest after Gen Y, the majority of Gen Z is also still very open to all choices, and may still change until the last moment before entering the voting booth on election day,” continued Aska.

Regarding the decision to choose, this is indicated by 52% of respondents considering the possibility of changing their mind or changing choices after the campaign or ahead of the election, especially for Gen Z with 61%, followed by Millennials 54%, and Gen X 41%.

Get the details on our report here.

![[FREE] E-Commerce Trends 2nd Semester 2023-Jakpat Premium Report_241223_10](https://blog.jakpat.net/wp-content/uploads/2023/12/FREE-E-Commerce-Trends-2nd-Semester-2023-Jakpat-Premium-Report_241223_10.jpg)